a) Should banks have to hold 100% of their deposits? Why or why not? b) Humongous Bank is the only bank in the economy. The people in this economy have $20 million in money, and they deposit all their money in Humongous Bank. Humongous Bank is required to hold 5% of its existing $20 million as reserves, and to loan out the rest. How the total deposits are going to increase in multiple rounds? c) What will happen to the money multiplier process during the time of recession with inflationary spiral. Explain using a hypothetical values?

Answers

The choice of whether banks should hold 100% reserves is difficult since it must balance worries about stability and liquidity with the desire to expand credit and the economy

There are a number of variables and policy concerns that determine whether banks should be compelled to keep 100% of their deposits. By granting loans for consumption and investment, this system enables banks to generate credit and promote economic growth. Additionally, it enables effective capital allocation throughout the economy.

It can increase banking system stability and avert financial catastrophes. Banks would be fully liquid and able to accommodate all requests for withdrawals of deposits if they had 100% reserves. This reduces the possibility of bank runs or panics, in which depositors rush to withdraw their money and possibly bring down a bank or the entire financial system.

However, making banks keep 100% of their reserves could restrict their ability to lend and promote economic growth. It might make loans less accessible, which could be bad for economic expansion. Additionally, maintaining 100% reserves may not be feasible or cost-effective for banks because it could result in a large loss of opportunity.

Each round expands the total deposits in the economy, creating a multiplier effect.

Humongous Bank is required to hold 5% of its existing $20 million as reserves, and to loan out the rest.

Money multiplier process:

Initial Deposit = $20 million

Reserve Requirement = 5% of $20 million = $1 million

Loan Creation = $19 million

Total deposits = Initial deposit + Loan creation = $20 million + $19 million = $39 million

Deposit Expansion = Initial deposit + Loan creation + Deposit expansion = $20 million + $19 million + $19 million = $58 million

Following rounds of this procedure, banks can continue to accept deposits, maintain reserves, and lend out the leftover funds. The total deposits in the economy increase with each round, having a multiplier effect.

The money multiplier process can be affected by an inflationary spiral that is present during a recession. To better comprehend this, let's take a fictitious example:

Let's assume that the economy is in a recession with high unemployment and poor economic activity. The central bank reduces interest rates and adopts an expansionary monetary policy to fight the recession. However, the central bank may need to tighten monetary policy to contain inflation if the economy enters an inflationary spiral in which prices are growing quickly.

The central bank aims to restrict the expansion of the money supply and lessen inflationary pressures by diminishing the money multiplier effect. This reduction in the money multiplier process would act as a disinflationary measure, helping to counter the inflationary spiral during a recession.

To know more about Money Multiplier, refer

https://brainly.com/question/32552823

#SPJ4

Related Questions

What role does product/service management play in marketing?.

Answers

Answer:

El Marketing de Servicios es un conjunto de tácticas que tienen como objetivo agregarle valor al servicio ofrecido, con el fin de persuadir al cliente para que opte por una determinada empresa. A través de una estrategia de Marketing de Servicios, es posible garantizar la máxima satisfacción de consumidores y usuarios

Explanation:

Answer:

✒️Answer:Product/service management is a marketing function that involves obtaining, developing, maintaining, and improving a product or service mix in response to market opportunities.

Explanation:

#CarryOnLearning\(watch.some.anime\)

Which is the first step in setting a financial goal?

a. setting aside leftover income

b. reducing your spending

c. tracking your spending

d. starting a second source of income

Answers

Answer:

All four actually.

Explanation:

In order to reach a financial goal you need to:

1. Save Money

2. Set and manage a budget (usually a monthly budget listing all your known expenses works)

3. Track your spending, and keep managing your budget.

4. Reduce your spending. If you are trying to reach a goal, a great line of thinking is “Only buy what you Need, Not what you Want”

5. If you are trying to reach a set financial goal quickly, then yes, it makes sense to find a secondary source of income, such as a part time job, or start a selling site on EBay, for items you don’t use anymore, etc.

Answer: B. reduce your spending.

Explanation: by not spending money this will allow you to save money for your financial goal.

A country has a trade deficit of $20 billion with its trading partners (

year. Which change would cause the country to have a trade surplus the

following year, assuming everything else remains the same?

A. The country increases its exports by $30 billion.

B. The country increases its imports by $30 billion.

C. The country decreases its exports by $10 billion.

D. The country decreases its imports by $10 billion.

Answers

D) The nation reduces its exports by $30 billion, the change would result in a trade deficit the following year for the country that had a trade surplus of $20 billion in one year.

When imports rise faster than exports, a trade deficit occurs. If the country increases its exports by $30 billion, decreases its imports by $10 billion, or increases its imports by $10 billion, it cannot have a trade deficit.

As a result, the country will only experience a trade deficit if its exports decrease by $30 billion while the rest of its exports remain unchanged.

With an example, what is a trade deficit?A country has a trade deficit when its imports exceed its exports over a given time period. A negative balance of trade (BOT) is another name for this situation. There are several ways to determine the balance, including: goods (also called " merchandise”), goods and services, and services and goods.

To learn more about trade deficit here

https://brainly.com/question/25313034

#SPJ1

Full Question = A country has a trade surplus of $20 billion with its trading partners over a

year. Which change would cause the country to have a trade deficit the

following year, assuming everything else remains the same?

A. The country increases its exports by $30 billion.

B. The country decreases its imports by $10 billion.

O C. The country increases its imports by $10 billion.

O D. The country decreases its exports by $30 billion.

An active primary market for the creation of new securities and the presence of plenty of buyers and sellers are all most indicative of _____.

an efficient monetary policy

a national economy

a competitive marketplace

sound financial management

Answers

An active primary market for the creation of new securities and the presence of plenty of buyers and sellers are all most indicative of a competitive marketplace. Thus, option C is correct.

What is the market?Markets are places where individuals, businesses, and industries transact, whether it be for the purpose of purchasing, producing, or providing services. they use it n order earning profits.

As there are various suppliers in the market, there is a face lot of people have various options from which the person could buy.

Customer competition is fueled by a competitive market. This implies that consumers struggle among others to purchase a commodity, particularly when inventory is low. Therefore, option C is the correct option.

Learn more about the market, here:

https://brainly.com/question/13414268

#SPJ1

What is defined as a budget surplus? (1 point)

O Spending exceeds income.

OA spending necessity.

OA spending desire or luxury.

O Take-home pay exceeds spending.

Answers

Take-home pay or income exceeds spending is defined as a budget surplus.

When income surpasses expenditure, there is a budget surplus. Since people often have "savings" rather than a "budget surplus," which is a sign that a government's finances are being handled well, the word is frequently used to describe the financial situation of the government.

A budget excess might be put to use for a purchase, debt repayment, or retirement planning. If a community has a budget surplus, it could utilize that money to make renovations, such reviving a run-down park or downtown. There is a budget imbalance when expenses go beyond revenues. Similar to when someone spends more than they make and pays interest on a credit card debt, deficits require borrowing money and paying interest. When spending and revenue are equal, a budget is balanced.

Learn more about Income here:

https://brainly.com/question/1810376

#SPJ1

1. how many members participate in h&m’s loyalty program worldwide?

Answers

Answer:

H&M now has over 100 million members.

Explanation:

hope it can help

What does selling on consignment mean?

Answers

The CEO does not fully understand which are the options enabled by the dynamic allocation of resources. Which of the following paragraphs best describes them: O When you need computing power you access the cloud and use some of the resources. When you do not need computing power. other companies will use it. In case you need more (or less) computing power, the system adapts the resources of your virtual computer(s). It can also switch your virtual computer(s) to different computer centers in other locations. O When you need computing power you access the cloud and use some of the resources. When you do not need computing power. other companies will use it. O When you need computing power you access the cloud and use some of the resources. When you do not need computing power. other companies will use it. In case you need more (or less) computing power, the system adapts the resources of your virtual computer(s). O When you need computing power you access the cloud and use some of the resources. When you do not need computing power. other companies will use it. In case you need more (or less) computing power, the system adapts the resources of your virtual computer(s). It can also switch your virtual computer(s) to different computer centers in other locations. Beside, it allows you to use different operating systems.

Answers

The paragraph that best describes the options enabled by dynamic allocation of resources is: "When you need computing power, you access the cloud and use some of the resources. When you do not need computing power, other companies will use it."

The selected paragraph accurately describes the options enabled by dynamic allocation of resources. It states that when computing power is required, users can access the cloud and utilize a portion of the available resources. However, when the computing power is not needed, those resources are made available to other companies or users. This concept highlights the flexibility and efficiency of resource allocation in the cloud. It ensures optimal utilization of resources, as they are dynamically allocated based on demand. The paragraph does not mention additional features like adapting resources, switching computer centers, or using different operating systems, so it focuses solely on the core concept of sharing and utilizing computing power as needed.

Learn more about companies here:

https://brainly.com/question/32531667

#SPJ11

What does ROA quantify and measure?

A. Reductions in the operating budget of the materials department.

B. The indirect contribution of material / supply management to profitatiblity.

C. The rate in which sales increases over the cost of assets.

D. Impact of reduced spend on profitability measure relative to sales increases.

E. Impact of actions on the inventory and the balance sheet.

Answers

ROA measures the efficiency of a company in using its assets to generate profit. The answer is C. The rate in which sales increases over the cost of assets.

ROA stands for Return on Assets. It is a profitability ratio that measures how efficient a company is in using its assets to generate profit. ROA is calculated by dividing net income by total assets.

So, ROA quantifies and measures the rate in which sales increases over the cost of assets. A higher ROA means that a company is using its assets more efficiently to generate profit.

The other options are incorrect. Option A is about reductions in the operating budget of the materials department. Option B is about the indirect contribution of material / supply management to profitability. Option D is about the impact of reduced spend on profitability measure relative to sales increases. Option E is about the impact of actions on the inventory and the balance sheet.

To learn more about Return on Assets: https://brainly.com/question/31080458

#SPJ11

thermogenesis has been studied the plants in the genus arum, including skunk cabbage and the corpse flower. in these plants, what hypotheses have been provided to explain the reason behind thermogenesis? select all that apply

Answers

All organs produce obligatory thermogenesis, which is a necessary complement to all metabolic processes necessary to keep the body alive.

It includes the amount of energy required to consume, digest, and process food (thermic effect of food).

The thermogenic theory: what is it?Your metabolism is boosted by certain foods, which cause your body to burn more calories and produce more heat. Thermogenic foods or compounds are those that stimulate metabolism and, as a result, generate more heat. Theoretically, the quicker you lose weight, the more calories burned.

What factors influence thermogenesis?Fatal cycles, such as the simultaneous occurrence of lipogenesis and lipolysis or glycolysis and gluconeogenesis, contribute to thermogenesis. In a broader sense, activity/rest cycles like the summer matter cycle can have an impact on futile cycles. Muscle metabolism is accelerated by acetylcholine stimulation.

To learn more about thermogenesis here

https://brainly.com/question/17209835

#SPJ4

Full Question = Thermogenesis has been studied the plants in the genus Arum, including skunk cabbage and the corpse flower. In these plants, what biological process is most strongly associated with heat production?

Warner Company’s year-end unadjusted trial balance shows accounts receivable of $116,000, allowance for doubtful accounts of $770 (credit), and sales of $450,000. Uncollectibles are estimated to be 1% of sales. Prepare the December 31 year-end adjusting entry for uncollectibles

Answers

On December 31, Warner Company must make an adjusting entry to account for uncollectibles.

Prepare the December 31 year-end adjusting entry for uncollectibles?Debit Allowance for Doubtful Accounts for $4,500Credit Accounts Receivable for $4,500On December 31, Warner Company must make an adjusting entry to account for uncollectibles.Uncollectibles are estimated to be 1% of sales, or $4,500 ($450,000 x 0.01). The adjusting entry would be to debit Uncollectible Accounts Expense for $4,500 and credit Allowance for Doubtful Accounts for $4,500.This will increase Uncollectible Accounts Expense and reduce Allowance for Doubtful Accounts, thus decreasing Accounts Receivable by the same amount.After making this adjusting entry, the Accounts Receivable balance would be $111,500 ($116,000 - $4,500), the Allowance for Doubtful Accounts balance would be $4,270 ($770 + $4,500), and the Uncollectible Accounts Expense balance would be $4,500.To learn more about Debit Allowance for Doubtful Accounts refer to:

https://brainly.com/question/26498002

#SPJ4

use the price-demand function below, to answer parts (a), (b), and (c).

Answers

In a price-demand function, the relationship between the price of a product and the quantity demanded can be expressed mathematically.

The specific form of the price-demand function can vary depending on the nature of the product and the market.

a) If given a price-demand function, you can determine the quantity demanded at a specific price by substituting the price value into the function and solving for the quantity. For example, if the price-demand function is Q = 100 - 2P, and the price is $20, you can substitute P = 20 into the function and calculate the corresponding quantity demanded (Q).

b) The inverse of the price-demand function represents the demand curve. By manipulating the function, you can express it in the form of P = f(Q), where P is the price and Q is the quantity demanded. This form allows you to calculate the price corresponding to a given quantity demanded.

c) The price elasticity of demand measures the responsiveness of quantity demanded to changes in price. It can be calculated by taking the derivative of the price-demand function and dividing it by the ratio of price to quantity demanded. The resulting value indicates the sensitivity of demand to price changes.

To answer parts (a), (b), and (c) of a specific question, you would need to provide the actual price-demand function and any additional information or parameters involved in the problem.

Learn more about quantity here

https://brainly.com/question/30010562

#SPJ11

a. associates degree

b. doctoral degree

c. high school degree

d. professional degree

Answers

When banks borrow money from the federal reserve, these funds are called

a. treasury funds.

b. federal loans.

c. discount loans.

d. federal funds.

Answers

The correct answer is option c, "discount loans." When banks borrow money from the Federal Reserve, these funds are called "discount loans."

When banks need to borrow money from the Federal Reserve, they have the option to obtain funds through discount loans. Discount loans refer to loans provided by the Federal Reserve to banks at a discount rate, which is typically below the prevailing market interest rate.

These loans serve as a source of short-term liquidity for banks to meet their immediate funding needs. The Federal Reserve sets the discount rate, which is the interest rate charged on these loans. Banks can borrow funds from the Federal Reserve's discount window, which acts as a lending facility.

The purpose of discount loans is to support and stabilize the banking system by providing a means for banks to access additional funds when they experience a temporary shortage of liquidity.

By borrowing funds through discount loans, banks can address short-term cash flow imbalances, manage reserve requirements, and fulfill their obligations to depositors and other creditors. These loans provide a mechanism for banks to manage their liquidity and ensure the smooth functioning of the financial system.

In conclusion, when banks borrow money from the Federal Reserve, the funds they obtain are referred to as option c. "discount loans." These loans are an important tool for banks to manage their liquidity needs and maintain stability within the banking system.

Learn more about Federal Reserve here; brainly.com/question/25817380

#SPJ11

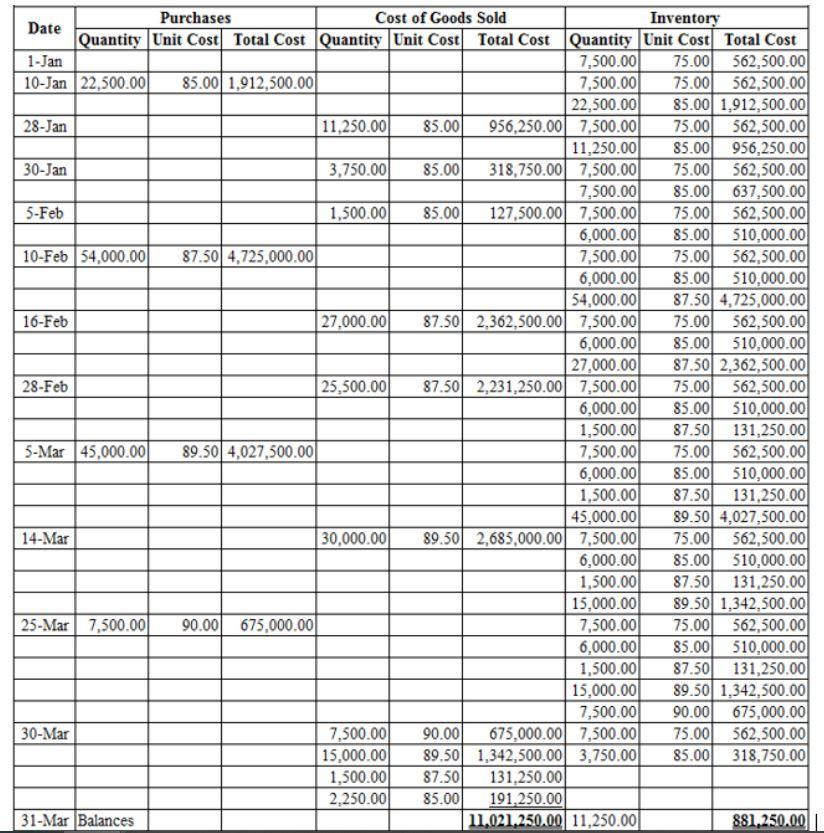

The beginning inventory at Midnight Supplies and data on purchases and sales for a three-month period ending March 31, are as follows: Date Transaction Number of Units Per Unit Total Jan. 1 Inventory 7,500 $75.00 $562,500 10 Purchase 22,500 85.00 1,912,500 28 Sale 11,250 150.00 1,687,500 30 Sale 3,750 150.00 562,500 Feb. 5 Sale 1,500 150.00 225,000 10 Purchase 54,000 87.50 4,725,000 16 Sale 27,000 160.00 4,320,000 28 Sale 25,500 160.00 4,080,000 Mar. 5 Purchase 45,000 89.50 4,027,500 14 Sale 30,000 160.00 4,800,000 25 Purchase 7,500 90.00 675,000 30 Sale 26,250 160.00 4,200,000

Answers

Solution :

The answer is in the chart provided below.

The record of the cost of the goods sold, purchase, inventories and ending inventory that uses LIFO for the three months that ended on 31st of March month ---

The total cost of goods sold is $ 1,021,250.00 and total inventory cost is $ 881,250.00

The Affordable Care Act provides that individuals and families may take a tax credit called the ______ to help them purchase health insurance through a health insurance exchange. A. Health insurance tax deduction B. Modified Adjusted Gross Income (MAGI) Credit C. Health Insurance Premium Tax Credit D. American Opportunity Tax Credit

Answers

The Affordable Care Act provides that individuals and families may take a tax credit called the Health Insurance Premium Tax Credit to help them purchase health insurance.

What is Affordable Care Act?The Affordable Care Act was enacted to reduce the cost of health insurance coverage for people who qualify for it.

The law of the Affordable Care Act make provision for premium tax credits and cost-sharing reductions to help the lower-income group.

Hence, the Act provides that individuals and families may take a tax credit called the Health Insurance Premium Tax Credit to help them purchase health insurance through a health insurance exchange.

Therefore, the Option C is correct.

Read more about Affordable Care Act

brainly.com/question/15003073

smith company receives $500,000 of subscription revenue in advance during year 1. the subscription revenue is not included on the income statement, but is reported for tax purposes in year 1. $250,000 will be recognized in year 2 and $250,000 in year 3. smith company is subject to a 40% tax rate. what is the amount of the deferred tax asset at the end of year 2?

Answers

The deferred tax asset at the end of year 2 will be $100,000.

How to calculate the deferred tax assetSmith Company has received $500,000 of subscription revenue in advance during year 1, but only $250,000 will be recognized in year 2 and year 3 each.

The subscription revenue is not included in the income statement but reported for tax purposes in year 1.

Since the company is subject to a 40% tax rate, it will have to pay taxes on the entire $500,000 in year 1.

However, in year 2 and year 3, it will only recognize $250,000 each year, resulting in lower taxable income and tax liability. This creates a deferred tax asset because the company has already paid taxes on the entire amount but will recognize revenue in future years.

To calculate the amount of deferred tax asset at the end of year 2, we need to determine the tax savings from the lower taxable income in year 2.

The tax savings will be 40% of the $250,000 recognized in year 2, which is $100,000.

Learn more about tax assets at

https://brainly.com/question/15394738

#SPJ11

What is the first step to creating a winning value proposition?.

Answers

Answer:

Tactics to Develop an Effective Value Proposition. Conduct research to determine the value proposition of your competitors. Explain the value of your products and services. Describe the benefits your ideal customer will experience when they choose your product or service over the competition.

What is one method that helps control online fraud? O A. Deleting odd emails before reading B. Reporting odd emails to police • C. Reporting odd emails as spam • D. Signing into email in many locations

Answers

Answer: C. Reporting odd emails as spam

Explanation:

What is the danger of having a lot of debt?

(brainlyest)

Answers

Answer:

probably not paying it off in time or something

Explanation:

The production function gets flatter, while the total cost curve gets steeper due to the fact that Group of answer choices at lower levels of production firms require more inputs to increase production by the same amount as compared to higher levels of production. at higher levels of production firms require more inputs to increase production by the same amount as compared to lower levels of production. at higher levels of production firms require less inputs to increase production by the same amount as compared to lower levels of production.

Answers

The production function gets flatter, while the total cost curve gets steeper due to the fact that C. at higher levels of production firms require less inputs to increase production by the same amount as compared to lower levels of production.

The production function shows the relationship that exists between the inputs and the outputs during the production of a product.

It should be noted that diminishing marginal product is vital for explaining why the increase in the output of a firm results in the production function getting flatter. Also, the total curve becomes steeper.

Therefore, at higher levels of production, firms require fewer inputs to increase production by the same amount.

Read related link on:

https://brainly.com/question/25162387

If unemployed workers become discouraged and give up trying to find work, the number of workers employed and the unemployment rate would change in which of the following ways?

Workers employed, no change. Unemployment rate, decrease.

Answers

If unemployed workers become discouraged and give up trying to find work, the number of workers employed and the unemployment rate would decrease.

Someone's employment status will rely upon whether their agreement is: a settlement of service, ie employment (employee) a settlement for the personal performance of work (employee) a agreement for offerings (self-hired).

A worker is defined as both an employee operating underneath a settlement for Employment or a person who works beneath a contract apart from a settlement of Employment and is offering his private carrier in go back for remuneration to the company who isn't always his/her consumer or purchaser.

Learn more about workers here:https://brainly.com/question/25748643

#SPJ4

The world as we know it is at a halt. This fast-pacing planet and its success hungry people have been put on hold. With so much advancement in all sectors of science, we are still struggling to find an actual cure for this worldwide pandemic. People are stuck at home doing all the work that they would have to do in the outside world. Amidst all these negatives, a positive in this pandemic is the evolution of online platform. One of the stores that popped up in the crowd is Hot Pan, a groundbreaking cloud kitchen that sells pizza at doorstep until 4 am. Now answer the following,

f. How will you manage the wailing line? (1.5 Marks)

g. Figure out the required number of servers.

Answers

f. To manage the wailing line of Hot Pan, the following things can be done:1. The restaurant can send notifications to customers when their orders are ready.2. Hot Pan can offer online ordering services to reduce the time spent in queues.3. Hot Pan can provide self-order kiosks that can assist customers in placing orders and making payments quickly.

g. To figure out the required number of servers for Hot Pan, the following steps should be taken:Step 1: Determine the sales rate of pizzas per hour during peak hours. For example, if they sell 100 pizzas per hour during peak hours, this is the minimum number of servers they will need to have.Step 2: Determine the time it takes to make and deliver each pizza. For example, if it takes 10 minutes to make and deliver one pizza, then they will need at least 6 servers to handle 100 pizzas in an hour.Step 3: Adjust the number of servers based on the number of orders received during peak hours. If there is an increase in demand, more servers will be required to handle the orders efficiently.

Know more about manage the wailing line of Hot Pan here:

https://brainly.com/question/4207596

#SPJ11

This is Information Technology question:

Module 2 Discussion: Five Moral Dimensions of the Information Age

Our textbook discusses the "Five Moral Dimensions of the Information Age" and how they are of concern for modern business. Post compelling, well-developed questions regarding these five dimensions for discussion by your peers and participate in the discussion of others' postings.

PLEASE READ BELOW

THE RELATIONSHIP BETWEEN ETHICAL, SOCIAL, AND

POLITICAL ISSUES IN AN INFORMATION SOCIETY

The introduction of new information technology has a ripple effect, raising new ethical, social, and political issues that must be dealt with on the individual, social, and political levels. These issues have five moral dimensions: information rights and obligations, property rights and obligations, system quality, quality of life, and accountability and control. a delicate ecosystem in partial equilibrium with individuals and with social and political institutions. Individuals know how to act in this pond because social institutions (family, education, organizations) have developed well- honed rules of behavior, and these are supported by laws developed in the political sector that prescribe behavior and promise sanctions for violations. Now toss a rock into the center of the pond. What happens? Ripples, of course.

Imagine instead that the disturbing force is a powerful shock of new information technology and systems hitting a society more or less at rest. Suddenly, in- dividual actors are confronted with new situations often not covered by the old rules. Social institutions cannot respond overnight to these ripples—it may take years to develop etiquette, expectations, social responsibility, politically correct attitudes, or approved rules. Political institutions also require time before developing new laws and often require the demonstration of real harm before they act. In the meantime, you may have to act. You may be forced to act in a legal gray area.

We can use this model to illustrate the dynamics that connect ethical, social, and political issues. This model is also useful for identifying the main moral dimensions of the information society, which cut across various levels of action—individual, social, and political.

Five Moral Dimensions of the Information Age

The major ethical, social, and political issues that information systems raise include the following moral dimensions.

Information rights and obligations: What information rights do individuals and organizations possess with respect to themselves? What can they protect?

Answers

information rights and obligations are an essential aspect of the moral dimensions of the information age, as they raise ethical, social, and political concerns about who has the right to access and control information, who can claim ownership of that information, and who is responsible for the accuracy and privacy of that information.

The "information rights and obligations" moral dimension is one of the five moral dimensions of the information age that is discussed in the textbook. This moral dimension raises ethical, social, and political issues concerning what information rights individuals and organizations possess with regard to themselves and what they can protect. This moral dimension deals with who has the right to access and control information, who can claim ownership of that information, and who is responsible for the accuracy and privacy of that information.

It also discusses the issue of data privacy and the right to privacy of individuals and organizations.Information rights and obligations is a delicate ecosystem that is in partial equilibrium with individuals and social and political institutions. Social institutions such as families, education, and organizations have well-honed rules of behavior that guide individual behavior, and these are supported by laws created by the political sector that prescribe behavior and impose penalties for violations.

When new information technology and systems are introduced, they disrupt the balance and create ripples that need to be addressed on the individual, social, and political levels. It may take time for social institutions and political institutions to develop new etiquette, expectations, social responsibility, politically correct attitudes, or approved rules to address these ripples in the meantime, individuals may have to act in a legal gray area

.In conclusion, information rights and obligations are an essential aspect of the moral dimensions of the information age, as they raise ethical, social, and political concerns about who has the right to access and control information, who can claim ownership of that information, and who is responsible for the accuracy and privacy of that information.

To know more about information visit;

brainly.com/question/30350623

#SPJ11

Which roles do franchisees play in case of a product distribution franchise?

Answers

Answer:

For the most part, Franchisees own the land and run the day to day operations of the stores that they finance.

Explanation:

Two benefits of self employment

Answers

Self-employment provides strong earning potential as people have more control over their own progression. Going hand-in-hand with the flexible lifestyle, individuals who work for themselves can go over and above to work long hours on some days, network, and reap the benefits of their hard work.

Which of the following statements are not true of satisfied customers?

A. Satisfied customers tend to stay loyal.

B. Customers will spend more money with a company for great customer service.

C. Satisfied customers do not share their experiences with other people.

D. All of the above

Answers

OPTION (C) Satisfied customers do not share their experiences with other people. When customers feel satisfied from the services or products from a particular company, they are tend to share their experience with their friends and families. So that they can too get benefitted from the same.

Who are Customers?In sales, commerce, and economics, a customer is the recipient of a good, service, product or an idea - obtained from a seller, vendor, or supplier via a financial transaction or exchange for money or some other valuable consideration.

What is meant by 'Services'?A service is any activity or benefit that one party can offer to another, which is essentially intangible and does not result in the ownership of anything. Its production may or may not be tied to a physical product.

What is a Company?A company, abbreviated as co., is a legal entity representing an association of people, whether legal, natural, or a mixture of both, with a specific task or objective. Company members share a common purpose and unite to achieve specific, declared goals.

To learn more about Services here:

https://brainly.com/question/21741587

#SPJ3

which activity is most likely to be outsourced by an automotive company such as Ford Motor Co.?

a) the concept design for future cars

b) final car assembly

c) design of the engine

d) production of tires

Answers

The correct option is D, production of tires is most likely to be outsourced by an automotive company such as Ford Motor Corporation.

A corporation is a legal entity that is separate and distinct from its owners, known as shareholders. It is created under the laws of a particular state or country and has the ability to enter into contracts, borrow money, sue and be sued, and conduct business operations.

The shareholders of a corporation provide capital in exchange for ownership through shares of stock. The corporation is managed by a board of directors who are elected by the shareholders and are responsible for setting policy and making major business decisions. One of the key benefits of incorporating is limited liability. This means that the shareholders are generally not personally liable for the debts and obligations of the corporation.

To learn more about Corporation visit here:

brainly.com/question/11745931

#SPJ4

Here is selected financial statement data regarding a company's property, plant, and equipment. Balance Sheet: Dec. 31, 2018 Dec. 31, 2017 Property, plant, and equipment $ 563,000 $ 294,000 Accumulated depreciation 286,000 237,000 Income Statement: 2018 Depreciation expense $ 105,000 Gain on sale of property, plant, and equipment 26,000 During the year, PPE with a book value of $23,000 were sold. In the statement of cash flows, the investing activities section should show a cash disbursement for "purchases of property, plant, and equipment" for $ _________.

Answers

Answer:

$292,000

Explanation:

price of old equipment sold = $26,000 + $23,000 = $49,000 (cash inflow)

new equipment purchased = $563,000 - $294,000 + $23,000 = $292,000 (cash outflow)

cash flow from investing activities:

cash disbursed for purchasing new equipment = ($292,000)

cash received from sale of old equipment = $49,000

net cash flow from investing activities = ($243,000)

Taxes Unit Test Answers

Answers

Answer: The Question Doesn't Make Sense So I'll Try My Best

Which of the following are the 3 largest categories of federal government spending

Health, Military, and Interest on Debt

What does the term "withholding" mean about your paycheck?

It is how much is taken out of your paycheck in taxes

When do you start paying taxes?

When you make more than the minimum income requirement

Why is it important to be extremely careful when completing your 1040 form?

The 1040 form determines whether you owe additional taxes or are entitled to receive a refund from the government.

Which of the statements is true about filing your taxes, assuming your only income comes from the salary you earn at BigTech Company?

You must file your tax return by April 15th of the following year or request an extension by that date.

You are starting your first job and you are asked to complete some paperwork on your first day. Which form will determine how much money is withheld from your paycheck for federal and state income taxes?

W-4

Which of the following paycheck withholdings puts money into a retirement fund that you manage?

401(k) contribution

When determining whether you NEED to file a federal tax return, each of these questions matters EXCEPT...

What state you are in

Juanita has a part-time job that pays $12/hour and works about 50 hours every month. Her withholdings are Social Security (6.2%), Medicare (1.45%), and federal income tax (10%). What is her approximate net pay?

$500

Which of the following statements about this W-4 is TRUE?

Mr. Khan's paycheck will have less money withheld from his paycheck since he is claiming a dependent.

What form am I? I am received when you start a job. You use me to prove that you are eligible to work in the U.S., and you must provide forms of identification when submitting me.

I-9

Which of the following statements is true?

Lily paid state income taxes of 1,189.90

What was the net or take-home pay for this pay period

1,102.98

How much did this person pay towards medication in this pay period only

19.62

How frequently is this employee paid

monthly

Your friend Laila is talking to you about the benefits of tax filing software. Which of the following is true?

You can avoid the costs of having to pay for a professional, though you may have to pay for the software

Which of the following describes what a dependent is for tax purposes

Someone under the age of 19 who you financially support

Upon creating your 1040, you realize that you owe the IRS $427. Each of the following is a possible way to pay the taxes you owe EXCEPT...

Tell the IRS to take out more taxes next year to pay back the $427

Elaine is an employee. Which of the following steps is she responsible for?

Complete a W-4

Which of the following statements about the W-2 form is TRUE?

You need a separate W-2 form from EACH of your employers to file your taxes.

When you complete your 1040 form, if you overpaid your taxes and the government owes you money, that is called

A refund

Akshay worked at a cafe while he was a college senior in Boston, Massachusetts. After graduating in June, he moved back to his home in California and started a full-time job in September. Which of the following statements is true?

Akshay will need to file a federal tax return and a state tax return for both Massachusetts and California.

Out of the following group, who does NOT have to file a tax return?

Max, whose total income from three separate part-time jobs was $9,500.

You will need to pay a 15.3% self-employment tax if you earn $1,100 in a year

Screen printing and selling custom-made t-shirts

Marquis is starting a fast food job during his senior year of high school. He lives with his parents and they will claim him as a dependent on their taxes this year. He earns $2000. Based on how he completed his W-4, his employer withheld $200 in federal income taxes from his paychecks. What will happen if Marquis doesn't file taxes in April?

Nothing will happen, but Marquis will miss out on his potential refund.

Identify two different forms of income that are taxable

Wages, salaries, tips, investment income, and meaned income.

What is the deadline to file your tax return?

April 15th

Give two reasons why someone would go to a tax professional (rather than using tax filing software or using paper forms) to file their tax return.

Could've had a major life change, might not feel comfortable doing them, may not have had the time doing it, or might have questions.

Jill is 16 years old and worked at her local grocery store over the summer earning $5,600. Is Jill legally required to file a tax return? If not, why should she?

a No, because she didn't make $5,900, however, she should file for a tax return so she can get the money back.

List two things the federal government spends your tax dollars on that you benefit from.

the Schools, roads, national parks, libraries, clean water, and air, and, the military.

Hope This Helps!