Answers

Answer:

Equitable distribution of resources provides equal rights to all sections of society (rich and poor) to access these resources. It prevents the division of society and accumulation of resources in the hands of a few persons. It helps to maintain the continuous flow of resources so that everyone can get their share.

Explanation:

Mathematics permits economists to construct precisely defined models from which exact conclusions can be derived with mathematical logic, which can then be tested using statistical data and used to make quantifiable predictions about future economic activity.

Im not fully sure what you mean but this is what i presume.

Related Questions

How does the slope of a supply or demand curve differ from elasticity of supply or demand?

Answers

The slope of a supply or demand curve differ from elasticity of supply or demand are to represent quantities to prices because of changes in the level of prices to changes in the level of quantity supply or demand.

What is demand?The term “demand” is believing on people wants and desires to the amount of money of goods and services. Demand is an economic notion that deals with the relation between user demand for goods and services and their market prices.

The slope of a supply curve is upward basis and the demand curve basis on downward to the right was the straight line. It was the change of prices in the level of quantity supply or demand. Elasticity of supply or demand was the quantity to price demanded or supplied.

As a result, the conclusion of the difference between are the aforementioned.

Learn more about on demand, here:

https://brainly.com/question/29761926

#SPJ9

A bank offers two interest account plans. Plan A gives you 6% interest compounded annually.

Plan B gives you 13% annual simple interest. You plan to invest $2,000 for the next 4 years.

Which account earns you the most interest (in dollars) after 4 years? How much will you have

earned?

(1 pol

Answers

We can use the formula A = P(1 + r/n)^(nt) to calculate the future value (A) of the investment, where P is the principal amount, r is the annual interest rate, n is the number of times the interest is compounded per year, and t is the number of years.

For Plan A, P = $2,000, r = 6%, n = 1 (compounded annually), and t = 4. Substituting these values into the formula, we get:

A = 2000(1 + 0.06/1)^(1*4) = $2,494.47

The interest earned is the difference between the future value and the principal amount:

Interest earned = $2,494.47 - $2,000 = $494.47

Plan B:

For Plan B, we can use the formula I = Prt to calculate the interest earned, where P is the principal amount, r is the annual interest rate, t is the number of years, and I is the interest earned.

For Plan B, P = $2,000, r = 13%, and t = 4. Substituting these values into the formula, we get:

I = 2000 * 0.13 * 4 = $1,040

Therefore, the amount earned after 4 years is:

Plan A: $2,494.47

Plan B: $3,040

So, Plan B earns the most interest after 4 years. The amount earned with Plan B is $3,040 - $2,000 = $1,040.

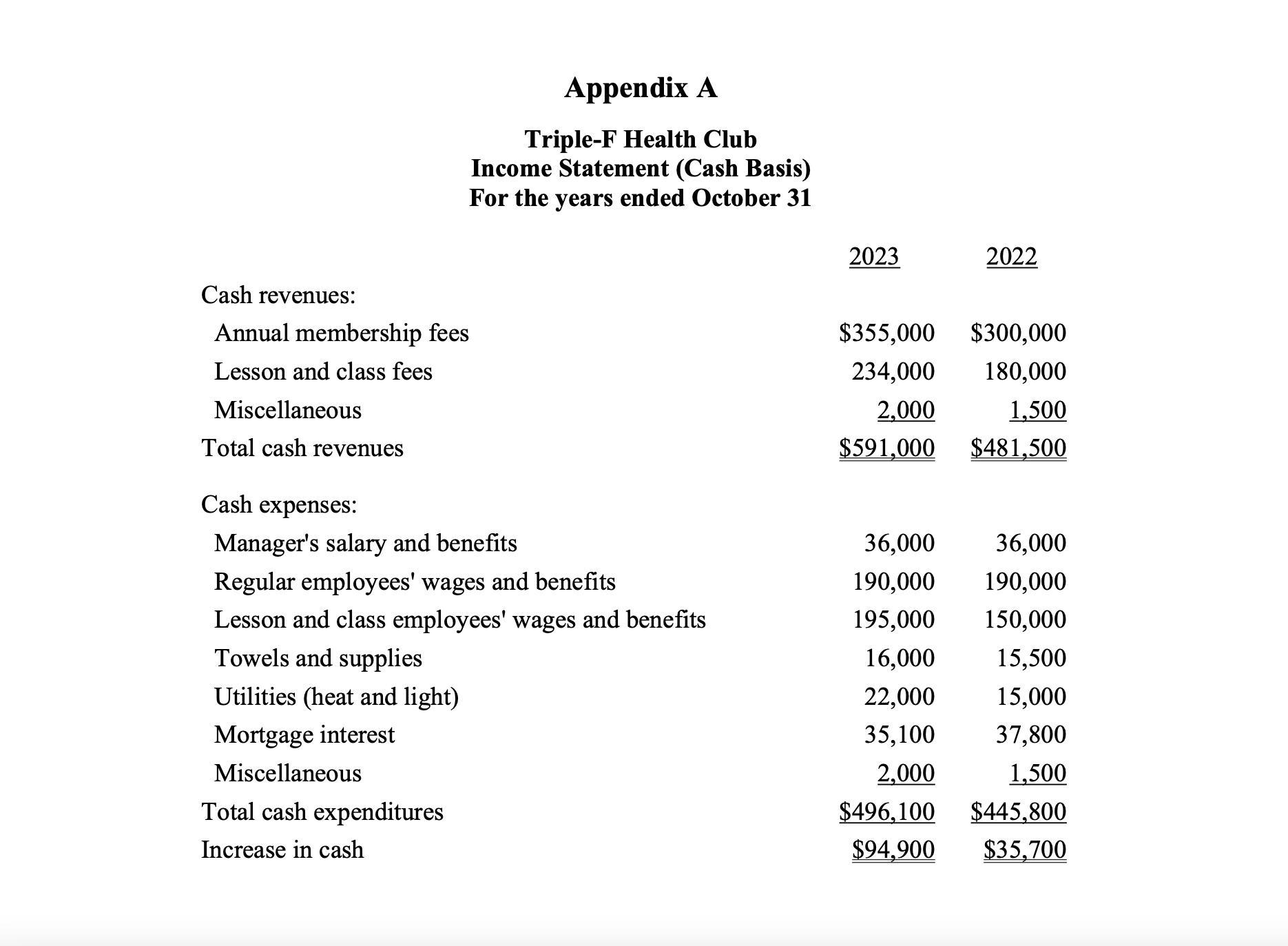

Triple-F Health Club (Family, Fitness, and Fun) is a not-for-profit family-oriented health club. The club's board of directors is developing plans to acquire more equipment and to expand club facilities. The board plans to purchase about $25,000 of new equipment each year and wants to establish a fund to purchase the adjoining property in four or five years. The adjoining property has a market value of about $300,000.

The club manager, Jane Crowe, is concerned that the board has unrealistic goals in light of the club's recent financial performance. She has sought the help of a club member with an accounting background to assist her in preparing a report to the board supporting her concerns.

Jane would like you to prepare a cash budget for 2024 for the Triple-H Health Club and explain any operating problems that this budget discloses for the Triple-H Health Club. Is Jane Crowe's concern that the board's goals are unrealistic justified?

Answers

The Triple-H Health Club may face operational issues in 2024, based on the cash budget. There is a $5,000 cash shortfall as a result of the anticipated cash outflows exceeding the anticipated cash inflows.

What is Cash Outflow?Any cash payments or expenditures made by a person or organization, such as purchasing inventory, paying salaries, or purchasing equipment, are referred to as cash outflow.

To prepare a cash budget for 2024, we need to estimate the club's cash inflows and outflows for that year. Here is a potential cash budget for Triple-H Health Club for 2024:

Cash Inflows:

Membership fees: $200,000

Donations: $20,000

Total Cash Inflows: $220,000

Cash Outflows:

Equipment purchases: $25,000

Rent: $60,000

Salaries and wages: $100,000

Utilities: $12,000

Insurance: $10,000

Maintenance and repairs: $8,000

Total Cash Outflows: $215,000

Net Cash Inflows: $5,000

This cash budget indicates that the club is expecting a net cash inflow of $5,000 in 2024, which is a positive sign. However, the budget also shows that the club has relatively high fixed costs in the form of rent, salaries, and wages, which could pose challenges if the club's revenue falls short of expectations.

To know more about Cash Outflow, visit:

brainly.com/question/23453537

#SPJ1

Which of the following decreases when credited?

Revenue

Inventory

Wages payable

Loans payable

Answers

Inventory decreases with Cr.

Wages Payable decreases with Dr

Loans Payable decreases with Dr

So only inventory decreases with Cr

Asset has a normal balance of a Dr

Liabilities have a normal balance of a Cr

Revenue has a normal balance of a Cr

15. Assume that Cane’s customers would buy a maximum of 87,000 units of Alpha and 67,000 units of Beta. Also assume that the company’s raw material available for production is limited to 168,000 pounds. If Cane uses its 168,000 pounds of raw materials, up to how much should it be willing to pay per pound for additional raw materials? (Round your answer to 2 decimal places.)

Answers

Cane's should be willing to pay up to $43,890 per pound of raw material if they decide to produce more Beta.

To produce more units than the given production limits, Cane needs to purchase additional raw materials. The maximum price they should pay per pound for additional raw materials depends on which product they choose to produce more of. For Alpha, the contribution margin per pound of raw material is $2, and for Beta, it is $1.33.

Cane's can use up to 6,000 more pounds of raw material for Alpha, so they can pay up to $12,000 for additional raw material. Beta, they can use up to 33,000 more pounds of raw material, so they can pay up to $43,890 for additional raw material.

To learn more about material follow the link:

https://brainly.com/question/13376768

#SPJ1

To maintain financial stability in the country with reduction in deficit, Govt gets help from different international financial institutions. Discuss the different pragmas introduced by IMF, World bank, Asian development bank and Islamic development bank for Pakistan.

Answers

Answer:

Pakistan is an under developed country. The resources here are sufficient but the main constraint which hinders the country progress is heavy debt burden on it. The country is struggling to become developed as other nations in the world. Pakistan is insufficient in financial resources and all the money which country generates is offset by the interest on the debt.

Explanation:

There are times when the country has to approach different financial aid institutions in the world for the money. IMF is one of the major financial aid institution which provides finance for developing country. Pakistan has approached IMF many times and it has imposed certain covenants on the country to provide financial aid. The tax imposition, restrictions on usage of fund, military and defense restrictions are imposed on Pakistan.

00 For Market failures means that the market has not achieved its optimum production outcome. This means that it has not produced the correct quantity of goods and services. QUESTION 1 Conduct a research to any small business that is manufacturing goods in your community. Make an appointment to interview the owner for the purpose of collecting the information using the questionnaire below. 1.1 General information: ● Name of the firm / business Specify the type of goods or service ● ● Position of the person interviewed ● Date of the interview 1,2 Explain briefly the negative impact the following factors have in your business. (10) Lack of information: ● Price discrimination Immobility of factors of production with special reference to: Physical capital Structural changes ● ● (1) ● (1) (1) (1) [14] QUESTION 2: Interview 3-4 community members that reside near the business you have visited. 2.1 Ask them to name any TWO negative externalities and TWO positive externalities caused by the local business, (2 x 2) (4) 2.2 Request them to list any TWO characteristics of public goods. (2 x 1) (2) 2.3 Use the negative externality and positive externality graphs to explain the impact this business have to the society (10) [16]

Answers

The first step in researching a small business in your neighborhood is to find a suitable nearby manufacturing company.

Once you do, contact the manager or owner to arrange an interview. Gather general information during the interview, such as the name of the company or business, what types of products or services they provide, the interviewer's position, and the time and date of the interview.

Then, focus on the detrimental effects different situations can have on the company. Briefly describe the impact on business of informational gaps, price discrimination, immobility of production variables (with a focus on physical capital), and structural changes.

Interview three to four locals who live close to the establishment you just visited. Ask them to list two unfavorable and two beneficial externalities brought about by the neighborhood business. Ask them to add two properties of public goods to the list as well.

Finally, use the data from the interviews to create graphs showing the positive and negative externalities of business on society. These infographics will graphically describe the costs and benefits that the company's neighborhood has.

Learn more about business, here:

https://brainly.com/question/15826604

#SPJ1

I. A clinic encourages its customers to have their bond checked with the claim that one out

of four 60-year-old men need to be supplemented with glucosamine. If this is true, what is

the probability of the following events:

a. Two out of the next eight 60 year-old men need to be supplemented with glucosamine

b. Three out of the next 12 60 year-old men need to be supplemented with glucosamine

Answers

A clinic encourages its customers to have their bond checked with the claim that one out of four 60-year-old men need to be supplemented with glucosamine. If this is true, then the probability of the following events is Two out of the next eight 60 year old men need to be supplemented with glucosamine.

Glucosamine is a naturally occurring compound in the body. It is required for the formation and repair of cartilage as well as other body tissues.

Because glucosamine production slows in age, some people take glucosamine supplements to help them fight aging-related health issues like osteoarthritis. The majority of supplements are made from the shells of marine life, such as prawns and crabs.

Learn more about Glucosamine, here:

https://brainly.com/question/32219634

#SPJ1

What do you think the curves would look like in the next 100 years?

Answers

Answer:The last 100 years have seen a massive fourfold increase in the population, due to medical advances, lower mortality rates, and an increase in agricultural productivity made possible by the Green Revolution.

What are some solutions for schools to fix the problem of too much work/homework given by teachers

Answers

they could give out less homework

give out weekly packets instead of a lot of daily work

only do necessary work

do more work in class

give homework every 2 weeks

or stop giving homework all together

Leimersheim GmbH has adopted the following policies regarding merchandise purchases and inven-

tory. At the end of any month, the inventory should be €15,000 plus 90% of the cost of goods to be

sold during the following month. The cost of merchandise sold averages 60% of sales. Purchase terms

are generally net, 30 days. A given month’s purchases are paid as follows: 20% during that month and

80% during the following month.

Purchases in May had been €150,000 and the inventory on May 31 was higher than planned

at €230,000. The manager was upset because the inventory was too high. Sales are expected to be

June, €300,000; July, €290,000; August, €340,000; and September, €400,000.

1. Compute the amount by which the inventory on May 31 exceeded the company’s policies.

2. Prepare budget schedules for June, July, and August for purchases and for disbursements for

purchases.

Answers

1. The amount by which the inventory on May 31 exceeded the company’s policies is €53,000.

2. The preparation of the budget schedules for June, July, and August for purchases and for disbursements for purchases is as follows:

a) Purchases:May June July August

Cost of goods sold 180,000 174,000 204,000

Ending Inventory €230,000 171,600 198,600 231,000

Goods available for sale 351,600 372,600 435,000

Beginning Inventory 230,000 171,600 198,600

Purchases €150,000 121,600 201,000 236,400

b) Disbursement for purchases:May June July August

20% during the month 24,320 40,200 47,280

80% following month 120,000 97,280 160,800

Total disbursements €144,320 €137,480 €208,080

How is the difference between actual inventory and inventory per company policy determined?Expected ending inventory = €15,000 plus 90% of the next month's cost of goods.

Cost of goods sold = 60% of sales

Purchase terms = net 30 days

Purchase payments:

20% during the month

80% following month

May June July August September

Expected Sales €300,000 €290,000 €340,000 €400,000

Cost of goods sold 180,000 174,000 204,000 240,000

Purchases €150,000

Ending Inventory €230,000

= €15,000 plus 90% of €180,000 = €177,000

Excess ending inventory for May = €53,000 ( €230,000 - €177,000)

Data and Calculations:Purchases:May June July August September

Expected Sales €300,000 €290,000 €340,000 €400,000

Cost of goods sold 180,000 174,000 204,000 240,000

Ending Inventory €230,000 171,600 198,600 231,000

Goods available for sale 351,600 372,600 435,000

Beginning Inventory 230,000 171,600 198,600 231,000

Purchases €150,000 121,600 201,000 236,400

Disbursement for purchases:20% during the month 24,320 40,200 47,280

80% following month 120,000 97,280 160,800

Total disbursements €144,320 €137,480 €208,080

Learn more about Purchases Budgets at https://brainly.com/question/17076342

#SPJ1

Given $100,000 to invest, construct a value-weighted portfolio of the four stocks listed below.

Stock Price/Share ($) Number of Shares Outstanding (millions)

Golden Seas 14 1.43

Jacobs and Jacobs 24 1.44

MAG 43 29.52

PDJB 9 11.48

Required:

Write down the the portfolio weight.

Answers

Answer:

Weight of Golden Seas in the portfolio = 1.40%

Weight of Jacobs and Jacobs in the portfolio = 2.42%

Weight of MAG in the portfolio = 88.94%

Weight of PDJB in the portfolio = 7.24%

Explanation:

This can be done as follows:

Step 1: Calculation of value of each stock

Value of stock can be calculated using the following formula:

Value of a stock = Price per share * Number of shares outstanding................ (1)

Using equation (1), we have:

Value of Golden Seas = $14 * 1.43 millions = $20.02 millions

Values of Jacobs and Jacobs = $24 * 1.44 millions = $34.56 millions

Value of MAG = $43 * 29.52 millions = $1,269.36 millions

Values of PDJB = $9 * 11.48 millions = $103.32 millions

Step 2: Calculation of value of the portfolio

This can be obtained by adding the values of all the stocks in step 1 as follows:

Value of the portfolio = Value of Golden Seas + Values of Jacobs and Jacobs + Value of MAG + Values of PDJB = $20.02 millions + $34.56 millions + $1,269.36 millions + $103.32 millions = $1,427.26 millions

Step 3: Calculation of weight of each stock in the portfolio

The weight of each stock in the portfolio is obtained as the values of each stock divided by the value of the portfolio. This can be calculated as follows:

Weight of Golden Seas in the portfolio = $20.02 millions / $1,427.26 millions = 0.0140, or 1.40%

Weight of Jacobs and Jacobs in the portfolio = $34.56 millions / $1,427.26 millions = 0.0242, or 2.42%

Weight of MAG in the portfolio = $1,269.36 millions / $1,427.26 millions = 0.8894, or 88.94%

Weight of PDJB in the portfolio = $103.32 millions / $1,427.26 millions = 0.0724, or 7.24%

The sale of machinery at a loss that was used in a trade or business and held for more than one year

results in the following type of loss?

A. Capital.

B. §291.

C. §1231.

D. §1245.

E. None of these.

Answers

C. The sale of machinery at a loss that was used in a trade or business and held for more than one year results in §1231 (Section 1231) type of loss

Any loss that has been realised as a result of a sale, exchange, or conversion mentioned in subsection is referred to as a "section 1231 loss" (A). Apart from that section 1211 does not apply, section 1231 losses must only be included if and to the extent that they are taken into consideration in calculating taxable income. When a property is sold, a section 1231 gain is taxable at the reduced rate of taxation as opposed to the percent for ordinary income. That 1231 gain doesn't really apply if the sold asset was owned for less than a year.

To learn more about section 1231 refer here:

https://brainly.com/question/17157656

#SPJ4

How can organizations use flexibility to utilize human talent in the pursuit of achieving strategic goals?

Answers

Flexibility in the workplace may assist long-term strategic corporate goals, such as cost savings from decreased turnover, absenteeism, and workplace accidents. Some forms of flexibility, like telework, allow for continuous work to continue through inclement weather, the flu season, or other obstacles.

People perform better because flexibility grants them autonomy, freedom, and balance. Higher productivity, loyalty, and satisfied workers are the results. Employees strategic may choose to have a compacted workweek or choose their own hours, shifts, and break periods (i.e., working full-time in four days instead of five). Adaptable hours. When necessary, employees might reduce hours or convert to a part-time schedule.

To learn more about flexibility, click here.

https://brainly.com/question/10881309

#SPJ1

***I WILL GIVE BRAINLIEST*****

Jose can't wait to buy his first car next month. He imagines that he will make several new friends at school since everyone will want to ride in his car. He is even having a hard time concentrating on filling orders at the restaurant where he works. Does Jose's thinking have an ethical component? Who is most affected by Jose's conduct? *

Answers

Answer:

His thinking does NOT have a ethical componet.

HISELF is most affected by his conduct.

Answer:

C

Explanation:

im him

A retail store does not segregate sales and the amount of sales tax on sales. If the sales tax rate is 4% and the register total amounted to $295100, what is the amount of the sales taxes owed to the taxing agency?

Answers

295,100/0.04 is 11,804

$10,850 is the amount of the sales taxes owed to the taxing agency. Option (a) is correct.

What do you mean by Tax?Taxes are compulsory payments made by a government organization, whether local, regional, or federal, to people or businesses. Tax revenues are used to fund a variety of government initiatives, such as Social Security and Medicare as well as public infrastructure and services like roads and schools.

Amount given in the question of $282,100 included 4% sales tax on sales.

If the total sales is $100, then sales tax on sale will be $4 (100*4%) and total amount will be equal to $104 ($100 sales+$4 sales tax on sale).

So from the above explanation, sales tax is segregated from total amount which is shown as follows:-

Sales Tax on Sales = (Total Amount/104)*4

= ($282,100/104)*4 = $10,850

Sales = Total amount - Sales tax

= $282,100 - $10,850 = $271,250

Therefore, Option (a) is correct, The amount of the sales taxes owed to the taxing agency is $10,850.

Learn more about Tax, here;

https://brainly.com/question/16423331

#SPJ6

Your question is incomplete, your question will be;

A retail store does not segregate sales from the amount of sales tax on sales. If the sales tax rate is 4% and the register total amounted to $282100, what is the amount of the sales taxes owed to the taxing agency?

(a) $10850

(b) $282100

(c) $271250

(d) $11284

Mitchell Bicycle Shop has the following transactions related to its top-selling Mongoose mountain bike for the month of March. Mitchell Bicycle Shop uses a periodic inventory system. Date Transactions Units Unit Cost Total Cost March 1 Beginning inventory 20 $185 $3,700 March 5 Sale ($270 each) 15 March 9 Purchase 10 205 2,050 March 17 Sale ($320 each) 8 March 22 Purchase 10 215 2,150 March 27 Sale ($345 each) 12 March 30 Purchase 9 235 2,115 $10,015 For the specific identification method, the March 5 sale consists of bikes from beginning inventory, the March 17 sale consists of bikes from the March 9 purchase, and the March 27 sale consists of four bikes from beginning inventory and eight bikes from the March 22 purchase. Required: 1. Calculate ending inventory and cost of goods sold at March 31, using the specific identification method. 2. Using FIFO, calculate ending inventory and cost of goods sold at March 31. 3. Using LIFO, calculate ending inventory and cost of goods sold at March 31. 4. Using weighted-average cost, calculate ending inventory and cost of goods sold at March 31. 5. Calculate sales revenue and gross profit under each of the four methods. 6. Comparing FIFO and LIFO, which one provides the more meaningful measure of ending inventory? 7. If Mitchell Bicycle Shop chooses to report inventory using LIFO instead of FIFO, record the LIFO adjustment.

Answers

Bikes from initial inventory are included March 5 sale, a March 17 outsourcers bikes from March 9 sale, or Mar 27 sale includes four bikes from the initial balance & eight bikes from March 22 purchase. 1/2 is need.

Now what you mean by inventory?All the products, materials, and things that a company keeps on hand in anticipation of selling them to customers for a profit are referred to as inventory. Example: If a newspaper seller utilizes a vehicle to distribute newspapers to clients, just the newspapers will be deemed inventory.

What are the four different categories of inventory?Raw materials/components, WIP, final products, and MRO are the four main categories of inventory.

To know more about inventory visit:

https://brainly.com/question/14184995

#SPJ1

The structure of an industry is changed over time by firms both entering and exiting it. For example, when Apple introduced its iPod, it had a monopoly in this product space since no other manufacturers sold any devices like it. But over time, competitors being lured by profit potentials, introduced their own products such that the industry structure for mp3 players changed from being a monopoly into one that became more competitive as more similar products began appearing in the mp3 player product space.

Smartphones have largely displaced stand-alone mp3 players. Describe the effects of this on the mp3 player industry focusing more on how this industry has changed. Include some discussion of Apple's response to the changing industries conditions over time to as far as what they are more-recently.

Answers

The effects of the smartphone industry on mp3 players was that decline in the music player industry has been noticed.

What are smartphones?Smartphones are referred to as electronic devices mainly used to communicate with people. Smartphones make the life of an individual easier by providing facilities with one click.

The majority of companies that produce MP3 players have entered the smartphone market due to the decline in mp3 players. A number of businesses well-known for producing electronic products, such as MP3 players, have now changed their attention to producing smartphones.

As the market conditions changed over time, Apple responded in a way that helped it become one of the top brands known for its innovation. Apple focuses on providing outstanding customer value. Apple shifted its attention to the design and the display to increase customer satisfaction.

Learn more about smartphones, here:

brainly.com/question/14774245

#SPJ1

Which list is the best way to highlight relevant items in the "Activities and Award" category of the résumé?

Answers

Answer:

How to Highlight Your Skills on Your Resume

One of the trickiest aspects of writing a resume is highlighting your skills. You don't want to sound like you are bragging, yet you want to clearly demonstrate that you have the jobs skills the employer is looking for. How do you know what skills to highlight? How do you do it effectively?

Identifying Which Skills to Highlight on your Resume

Assessing the Employer's Needs

The best way to identify which skills you need to highlight on your resume is to put yourself in the employer's shoes. What are the employer's needs? How can you fulfill those needs? To accomplish this, look at the employer's job description. Everything you need to know should be there. If it isn't, you may want to contact the company for more information about the job. You can do this by requesting an informational interview. Many employers are willing to do this.

Read the job description carefully. It will give you clues into what the employer is looking for. It will also give you the keywords you need to use, so your resume will get past the initial computer screening that so many companies are using today. Even a short four-line job description could contain all the keywords you need to compile a relevant assessment of your skills.

For example the following listing is quite short.

In need of someone who knows how to screen print and is able to do graphic art work. If you don't have good experience and just want to learn that isn't for me. We have a small growing shop and we need someone part time to help get our orders completed, handle customers and so on. Must be able to print and do graphic art work.

The key skills are the ability to screen print and create graphic art work (notice they mentioned it twice). They also mention an ability to handle orders, and that they are a growing company. The skills you to highlight for this position are screen printing experience and graphic art experience

The job skills the employer has listed are the ones you want to highlight on your resume. Don't worry if you can't use every skill listed. If you have experience in the industry, you will know which ones are the most important. If you are trying to break in, choose the skills that you know you have and go with that. Honesty on a resume is vital.

You also want to identify the needs a job posting only hints at. In the above brief listing, the employer is hinting at their needs to handle growth in the business, to meet challenges in completing their orders, and to have someone who can handle customers. Once you identify an employer's "hidden" needs, you can highlight those skills on your resume.

How to Highlight Your Skills Effectively

The best way to highlight your skills effectively is to imagine yourself already in the job. Then look at your past work experiences. Think of specific duties you performed and the benefits you provided.

Use Power Words

Now, use power words to describe your skills in action. Don't say, "Printed t-shirts." Say, "Prepared screens for four-color art work. Exposed and developed screens." Describe some of the steps. Give life to the actions you performed on the job. Express your skills in a manner that is impactful, forceful and persuasive - whatever your job may have been - by using action-oriented verbs, such as:

reduced | pioneered | targeted | designed | managed | streamlined | secured | expedited collaborated | authored | coached |increased |monitored | systemized | conceptualized

Show Your Benefit

Quantify the benefits your work provided to your employer. Things like, "Increased profits by 10%," or "Reduced waste by 10%" demonstrate that your skills will benefit your future employer as well.

As you develop your list of skills, share them in a way that demonstrates that you have become more responsible and valuable as time has progressed. If at all possible, make sure the most valuable skills are highlighted under the most recent employment.

You also want to avoid repeating the same information. If you can't demonstrate growth in your skills from one job to the next, focus all your skills in one section. Rather than list skills under each employer, consider listing specific projects and their results. This is another subtle way of highlighting your ability to benefit an employer.

Your resume is your opportunity not only to highlight your skills, but also to sell the benefits those skills offer a potential employer. Successful resumes assess the employer's needs, make a powerful impression by using action-oriented verbs and prove a candidate's benefit to the employer by quantifying skills, accomplishments and professional growth. When successfully executed, these strategies will effectively highlight your skills within the space constraints of a resume and give you a competitive edge within the job market.

a. Suppose we have a three year fixed-payment loan with $300 payments made at the end of each year. Given a market interest rate of 6 percent, how much was initially borrowed?

Answers

The amount that has been initially borrowed is $802, having an annuity payment of $300 at the end of each year and a market interest rate of 6%.

What is annuity?An annuity is a series of payments made at regular intervals in the financial world. Regular savings account deposits, monthly home mortgage payments, monthly insurance payments, and pension payments are all examples of annuities. The frequency of payment dates distinguishes annuities.

The formula for calculating the present value of an annuity which is actually the sum borrowed is :

V= A/i {1-(1+i)^-n} , where,

A= fixed payment of annuity,

i= market rate of interest, and

n = number of years

V= 300/0.06{1-(1+0.06)^-3}

= 300/0.06{1-0.8396}

= 300/0.06 × 0.1604

= $802

Therefore, $802 was initially borrowed.

To learn more about annuity, click here:

https://brainly.com/question/23554766

#SPJ1

What historical management

perspective supports this idea

Answers

From a historical management perspective, the idea that beta depends on investors' expectations of the correlation and volatilities of a security's and market's returns aligns with the principles of modern portfolio theory (MPT) and the efficient market hypothesis (EMH).

Modern portfolio theory, developed by Harry Markowitz in the 1950s, emphasizes the importance of diversification and risk management in constructing investment portfolios. According to MPT, investors should consider the correlation between different assets when constructing a portfolio.

The idea is to select assets that have low or negative correlations, as this helps to reduce the overall portfolio risk. In the context of beta estimation, if a security's returns have a high positive correlation with the market, it indicates a higher systematic risk, resulting in a higher beta value.

The efficient market hypothesis, proposed by Eugene Fama in the 1960s, suggests that financial markets are efficient and reflect all available information. According to the EMH, investors cannot consistently outperform the market by exploiting information or patterns in stock prices.

If the market is efficient, beta reflects the collective expectations of all market participants regarding the correlation and volatilities of a security's returns with respect to the market returns. Both MPT and EMH emphasize the importance of considering market factors and expectations when estimating beta.

These perspectives recognize that investors' expectations of the correlation and volatilities of a security and the market are essential in understanding and assessing the security's risk profile. By incorporating these factors into beta estimation, investors can make more informed decisions about portfolio construction and risk management.

For more such questions on management

https://brainly.com/question/1276995

#SPJ8

If the amount of gasoline purchased per car at a large service station has a population of $15 and a population standard deviation of$4 then 99.73% of all cars will purchase between $3 and $27

Answers

The range between $3 and $27 is three standard deviations away from the mean.

Since we know that 99.73% of the data falls within three standard deviations of the mean, we can estimate that 99.73% of all cars will purchase gasoline between $3 and $27.

According to the given information, the population mean is $15, and the population standard deviation is $4.

This means that 99.73% of all cars will purchase gasoline within three standard deviations of the mean, using the empirical rule.

Therefore, we can use the empirical rule to estimate the percentage of cars that will purchase gasoline between $3 and $27.

The empirical rule is also known as the 68-95-99.7 rule, which states that:Approximately 68% of the data falls within one standard deviation of the meanApproximately 95% of the data falls within two standard deviations of the meanApproximately 99.7% of the data falls within three standard deviations of the mean.

To find the number of standard deviations that correspond to $3 and $27, we need to calculate the z-scores.

The z-score formula is given as:z = (x - μ) / σwhere z is the standard score, x is the value of the variable, μ is the population mean, and σ is the population standard deviation.

To find the z-score for $3, we plug in the values:z = (3 - 15) / 4z = -3To find the z-score for $27, we plug in the values:z = (27 - 15) / 4z = 3.

For more such questions on standard deviation

https://brainly.com/question/29435572

#SPJ8

A study of the external environment allows a manager to understand the ________ and________ for the organization.

A) threats; weaknesses B) strengths; weaknesses

C) strengths; opportunities D) opportunities; strengths

Answers

The correct response is D) opportunities; threats. A study of the external environment allows a manager to understand the opportunities and threats for the organization.

An organization or organization is a thing that consists of one or more people and serves a certain purpose, such as a company, institution, or association (Commonwealth English; see spelling variations). The term is derived from the Greek word organon, which can also be used to describe a variety of equipment, instruments, and organs. An organization is made up of a group of people who work together, such as in a union, firm, charity, or neighborhood association.The term "organization" can refer to an individual, a team, a business, or the act of creating something. However, being organized can enhance your well-being and lead to greater happiness and comfort. Your life can suffer greatly from disorganization. It could lead to despondency and increased tension. In addition to being a cause of dust buildup and mould growth, disorganization can be a fire danger.

Learn more about organization here

https://brainly.com/question/25922351

#SPJ4

A study of the external environment allows a manager to understand the ________ and________ for the organization.

A) threats; weaknesses B) strengths; weaknesses

C) strengths; opportunities D) opportunities; threats

d) 3(x - 2y) - (2x - 5y) si x = -4, y = 5

Answers

(3x - 6y) - (2x - 5y)

3(-4) - 6(5) - 2(-4) - 5(5)

-12 - 30 + 8 - 25

-42 + 8 - 25

-34 - 25

= -59

Henrich is a single taxpayer. In 2021, his taxable income is $455,000. What is his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. (Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable. Round your final answers to 2 decimal places.)

a. All of his income is salary from his employer.

Income tax _______

Net investment income tax ______

Total tax liability __________

b. His $455,000 of taxable income includes $2,000 of long-term capital gain that is taxed at preferential rates.

Income tax _______

Net investment income tax ______

Total tax liability __________

c. His $455,000 of taxable income includes $49,000 of long-term capital gain that is taxed at preferential rates.

Income tax _______

Net investment income tax ______

Total tax liability __________

d. Henrich has $197,500 of taxable income, which includes $51,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $210,000.

Income tax _______

Net investment income tax ______

Total tax liability __________

Answers

a. Henrich, a single taxpayer with a taxable income of $455,000 in 2021, all of his income is the salary from his employer.

Income tax $133,794.25

Net investment income tax $0

Total tax liability $133,794.25

b. His $455,000 of taxable income includes $2,000 of long-term capital gain that is taxed at preferential rates.

Income tax $133,094.25

Net investment income tax $0

Total tax liability $133,094.25

c. His $455,000 of taxable income includes $49,000 of long-term capital gain that is taxed at preferential rates.

Income tax $116,644.25

Net investment income tax $1,290

Total tax liability $117,934.25

d. Henrich has $197,500 of taxable income, which includes $51,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $210,000.

Income tax $29,181

Net investment income tax $1,590

Total tax liability $30,771

Data and Calculations:a) Taxable income = $455,000

Taxable Income Income tax

For $209,425 = $47,843

For $245,575 = $85,951.25 ($455,000 - $209,425 x 35%)

Total income tax = $133,794.25

b) Taxable income = $455,000

Less Dividend income = $2,000

Net = $453,000

Taxable Income Income tax

For $209,425 = $47,843

For $243,575 = $85,251.25 ($453,000 - $209,425 x 35%)

Total income tax = $133,094.25

c) Taxable income = $455,000

Taxable Income Income tax

For $209,425 = $47,843

For $196,575 = $68,801.25 ($406,000 - $209,425 x 35%)

Total income tax = $116,644.25

Investment Tax:0% Up to $40,400

15% x $8,600 = $1,290

Total tax liability = $117,934.25

d) Taxable income = $197,500

Taxable Income Income tax

For $86,375 = $14,751

For $60,125 = $14,430 ($146,500 - $86,375 x 24%)

Total income tax = $29,181

$197,500 of taxable income, which includes $51,000

Investment Tax:0% Up to $40,400

15% x $10,600 = $1,590

Tax Rates:$47,843 plus 35% of the amount over $209,425

$14,751 plus 24% of the amount over $86,375

Investment Tax Rates:0% Up to $40,400

15% from $40,401 to $445,850

Learn more about taxable income and tax brackets at https://brainly.com/question/24102952

#SPJ1

Midyear on July 31st, the Digby Corporation's balance sheet reported: Total Assets of $205.498 million Total Common Stock of $6.350 million Cash of $10.050 million Retained Earnings of $44.117 million. What were the Digby Corporation's total liabilities?

a) $165.081 million.

b) $144.981 million.

c) $155.031 million.

d) $161.381 million.

Answers

Answer:

The value of total liabilities is $155.031 million and option c is the correct answer.

Explanation:

The basic accounting equation states that the total value of assets is always equal to the sum of the total value of liabilities and the total value of equity.

Thus, we can say that,

Total Assets = Total Liabilities + Total Equity

The equity part can contain various components. In the given question it has two components namely Common Stock and retained earnings.

205.498 = Total Liabilities + (6.350 + 44.117)

205.498 = Total Liabilities + 50.467

205.498 - 50.467 = Total Liabilities

Total Liabilities = $155.031

Unlike separate taxpaying entities. _______ entities do NOT pay taxes. Rather, owners of these entities pay taxes on income generated by the entities.

Answers

Unlike individual taxable entities, flow-through entities do not pay taxes. Rather, these company owners pay taxes on the income generated by the company.

What is flow-through entity?A flow-through entity is a company in which revenue is passed directly to shareholders, owners, or investors. As a result, only individuals, not companies, are taxed on their income, avoiding double taxation. All of the following are flow-through entities: Foreign partnership (excluding withholding tax) Foreign simple or foreign trust company (excluding withholding tax)

What types of flow-through entity are there?There are following type of flow-through entity: Sole proprietors, partnerships (limited, general, and limited partnerships), LLCs, and S corporations are all types of flow-through entities.

What's the difference between a C Corp and a flow-through entity?flow-through entity, all taxes are paid in the year the income is reported. In a C corporation, taxes on the gain on the sale of shares are deferred at the shareholder level until the shares are sold.

To learn more about flow-through entity visit:

https://brainly.com/question/28507474

#SPJ4

A cash budget:______.A. Would be as useful to a business which makes sales only on a credit basis, as it is to a business making sales for cash. B. Should include labor, material, and overhead variances. C. Should ignore any projected balances of a negative amount of cash. D. Should not include payments for noncontrollable elements of factory overhead.

Answers

Answer:

A. Would be as useful to a business which makes sales only on a credit basis, as it is to a business making sales for cash.

Explanation:

A cash budget shows the cash flow for a business over a certain time period in which the budget determines if the business has enough cash to operate.

Economists who believe that the Federal Reserve is likely to make a lot of mistakes in the conduct of monetary policy believe that the Federal Reserve should not respond to all AD shocks.

trueFasle

Answers

true, The Federal Reserve shouldn't react to all AD shocks, according to economists who believe the Federal Reserve is likely to make many mistakes while conducting monetary policy.

The Federal Reserve System is the name of the American central bank (FRS). It is commonly referred to as "the Fed" and is perhaps the most powerful financial institution in the world. It was created to provide the country with a stable, flexible, and secure financial and monetary system. There are seven members of the Fed's board. There are further 12 Federal Reserve banks, each of which is run by the president of a separate district. The central bank is a financial institution with sole control over the production and distribution of money and credit for a nation or a collection of nations. The formulation of monetary policy and member bank regulation are normally the responsibility of the central bank in modern economies.

learn more about Federal Reserve System here:

https://brainly.com/question/3603615

#SPJ4

Assume that your grandmother wants to give you a generous gift. She wants you to choose which one of the following sets of cash flows you would like to receive: Option A: Receive a one-time gift of $ 10,000 today. Option B: Receive a $1500 gift each year for the next 10 years. The first $1500 would be received 1 year from today. Option C: Receive a one-time gift of $18,000 10 years from today. Compute the Present Value of each of these options if you expect the interest rate to be 3% annually for the next 10 years. Which of these options does financial theory suggest you should choose?

Answers

The present value for option:

A = $10,000, B = $12,795.30, C = $13,393.69

Financial theory would suggest I pick option C

Present value is the value today of a series of cash flows discounted at their interest rate.

Present value of option A = $10,000

Present value of option B :

(1500 ÷ 1.03) + (1500 ÷ 1.03²) + (1500 ÷ 1.03³) + (1500 ÷ 1.03^4) + (1500 ÷ 1.03^5) + (1500 ÷ 1.03^6) + (1500 ÷ 1.03^7) + (1500 ÷ 1.03^8) + (1500 ÷ 1.03^9) + (1500 ÷ 1.03^10) = $12,795.30

Present value of option C : 18,000 ÷ 1.03^10 = $13,393.69

Financial theory would suggest I pick the option with the highest present value.

A similar question was solved here: brainly.com/question/9641711?referrer=searchResults