Answers

The link between the Scarcity and choice is the study of how individuals and society choose to allocate scarce resources.

What is the Meaning of Scarcity?Scarcity refers to the insufficient or the shortage of the resources with the individual or in the particular nation. For Example In any Industry there is the shortage of the skilled workers.

The complete question is attached below.

The link between the Scarcity and the Opportunity Cost is that it has the direct implication on the scarcity. In decision making process, one must has to sacrifice the opportunity cost of that action.

The link between the Scarcity and competition is due to the Lack of resources which forces people to compete for the limited resources that are accessible because there aren't enough to satisfy everyone's wants.

Additionally, people would compete for the rationing tool, such as money, whatever it may be.

Learn more about Scarcity here:

https://brainly.com/question/13186252

#SPJ1

Related Questions

4. What was the closing price of the corporation on July 26th?

Answers

The closing price of a security, such as a stock or a commodity, is the final price at which it was traded on a particular trading day. The calculation of the closing price depends on the market in which the security is traded.

What is closing price?If you have access to the historical data of the security, you can easily calculate the closing price by finding the last recorded price of the security on a given trading day. Many financial websites and data providers offer this information in their daily summary of a security's trading activity.

However, if you are looking to calculate the closing price in real-time, you can use a real-time data provider that offers the latest market quotes for the security you are interested in. The closing price is usually determined at the end of the trading day, which varies depending on the market and the security being traded.

In general, to calculate the closing price of a security, you need to find the last traded price of the security for the day. This information can be obtained from various sources, such as stock exchange websites, financial news websites, or real-time data providers. Once you have this information, you can use it to calculate the closing price of the security for that particular trading day. An overview was given.

Learn more about closing price on

https://brainly.com/question/30155035

#SPJ1

List at least Two functional digital wallet

Answers

I’m not sure.. hope it’s correct!

DONT ANSWER PLZZZZZZZZZ

Answers

Answer:

ok i gochu

Explanation:

1. Briefly summarize the actions a firm can take to enhance the ethical behavior of its purchasing

personnel?

Answers

The actions which a firm can take to enhance the ethical behavior of its purchasing personnel are:

Enforce strict compliance with rules and regulationsTake them on periodic trainings about ethicsGive out fines for employees who do not act ethicallyAccording to the given question, we are asked to show the actions which a firm can take to enhance the ethical behavior of its purchasing personnel

As a result of this, we can see that if a firm wants to improve the ethical behaviour, then they would have to make some rules and regulations with the guidelines on how best to use them so that the workers would always act in an ethical way such as being honest, faithful in their duties, etc

Read more about ethical behavior here:

https://brainly.com/question/8189804

A group of students is studying for an economics quiz about economic cycles and how the government manages in an economy. In a market economy, strategies that change spending or taxes in order to influence economic conditions are known as:

O fiscal policy.

O equity promotion.

O monetary policy.

O economic stimulus.

Answers

Answer:

A market economy is an economic system in which the production and distribution of goods and services are determined by the forces of supply and demand. In a market economy, the government can use various strategies to influence economic conditions, including fiscal policy and monetary policy.

Fiscal policy refers to the government's use of spending and taxation to influence the level of economic activity and manage the economy. This can include measures such as increasing government spending, reducing taxes, or a combination of both.

Monetary policy refers to the actions taken by a central bank, such as the Federal Reserve in the United States, to manage the supply and demand of money and credit in the economy. This can include measures such as adjusting interest rates or the amount of money in circulation.

The options "equity promotion" and "economic stimulus" are not typically used to describe government strategies to influence economic conditions in a market economy.

Answer:

A fiscal policy.

Explanation:

Fiscal policy deals with the government's taxation and spending policies and is the principal tool used by the government to influence aggregate demand and achieve macroeconomic policy objectives such as high employment, price stability, and economic growth.

Max is a 14 year old dependent of his parents. During 2021, Max earned $1800 working part-time jobs, and received $1500 of interest income from corporate bonds that were given to him last year. What is Max's 2021 taxable income?

Answers

Answer: Max is a 14-year-old dependent of his parents. During 2019, Max earned $1,800 working part-time jobs, and he received $1,500 of interest income from corporate bonds that were given to him last year. What is Max's 2019 taxable income? How much of Max's income is subject to the Kiddie Tax?

* Note: Please provide the calculations for your answer. Thanks!!!

Explanation:

the FTC projects consumers by stopping unfair, deceptive, or fraudulent practices. How do they do this?

Answers

The FTC protects consumers by doing research on the company's methods of selling and collecting information from customers about the different organizations and checking their business patterns.

What is FTC ?The term FTC is an acronym for Federal trade Commission designed with the objective to provide protection to consumers while doing trade as well as prevent them from any kind of exploitation, or unfair or fraudulent practices.

The FTC protects consumers by collecting information from them about any unfair trade practices and conducting investigations over them and taking action against the firms or sellers who are breaking the law and consulting unethical business activities.

Learn more about FTC, here:

https://brainly.com/question/24744043

#SPJ1

Which of the following statements is most correct concerning a project with normal cash flows (i.e., a cash outflow in Year 0 followed by cash inflows in all subsequent years)?

a) If the NPV of a project is positive then the payback period rule will always accept the project.

b) If the NPV of a project is negative, then the profitability index of the project will always be greater than one.

c) If the profitability index of a project is greater than one, then the IRR will always be less than the project’s cost of capital.

d) If the NPV of a project is zero, then the IRR of the project will be equal to the discount rate for the project.

e) If the discount rate of a project is zero, then the project will always be accepted.

Answers

Answer: D. If the NPV of a project is zero, then the IRR of the project will be equal to the discount rate for the project.

Explanation:

Net present value (NPV) refers to the difference that exist between the present value of the cash inflows and that of the cash outflows for a particular period of time.

The net present value is used in capital budgeting to determine if a projected investment or project will be profitable or not. For a project with normal cash flows, if the NPV of a project is zero, then the IRR of the project will be equal to the discount rate for the project.

Therefore, the correct option is D.

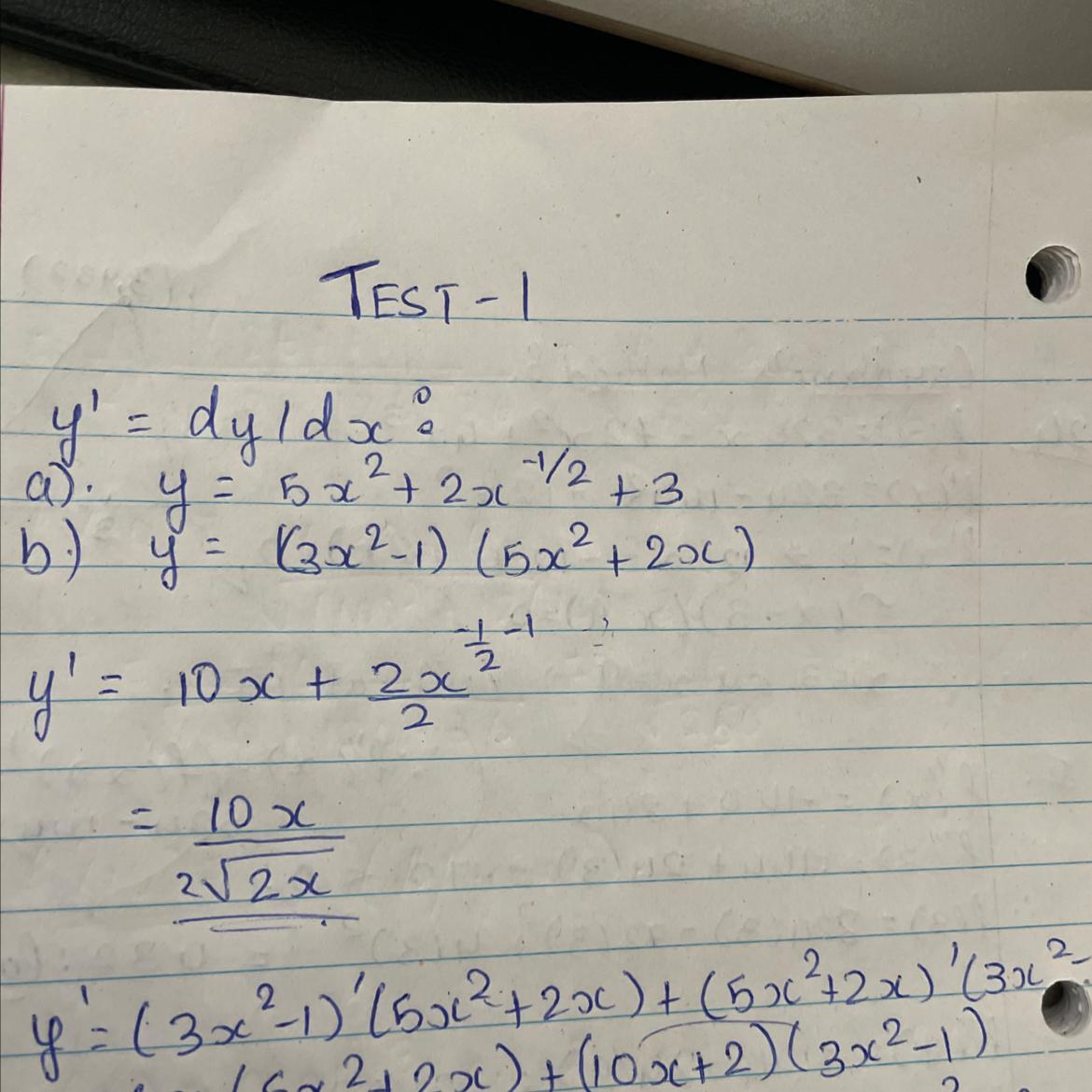

1. Find the derivative y' = dy/dx:

(a) y = 5x2 + 2x-1/2 + 3

(b) y = (3x2 - 1)(5x2 + 2x)

What is the y prime?

Answers

Answer:

you did the questions right . very good

Nutrient cycling and purification of water are both examples of

Answers

Answer:

Nutrient cycling and purification of water are both examples of Essential Services

Microsoft sells its wireless laser desktop mouse and keyboard for $70. Unit variable costs are$45.60 and fixed costs associated with this product total $277,200.

a. What is the break-even point in units?

b. What is the net income or loss if 40,000 units are sold?

Answers

Answer:

11,361 units and profit $698,800.00

Explanation:

The break-even point is obtained by dividing fixed costs by contribution margin per unit.

Break-even =fixed costs/contribution margin per unit

In this case, fixed costs are $277,200.

Contribution margin per unit = selling price- variable cost

= $70 - $45.60

=$24.60

Break-even point in units will be

=$277,200/$24.60

=11,361 units

Net income after sales of 40,000 units

Total revenue =sales x volume

=$70 x 40,000

=$2,800,000.00

net income will be $2,800,000.00 -( variable costs+ fixed costs)

=$2,800,000.00- {($45.60 x 40,000) + $277,200}

=$2,8000,000.00 -($1,824,000.00 + $ 277,200)

=$2,8000,000.00- $2,101,200.00

=$698,800.00

A profit of $698,800.00

What will produce more accurate results when giving a survey?

A. Using the word "frequently" in a question

B. Creating face-to-face interviews

C. Adding boxes to check for answers

D. Creating an open questions

Answers

Answer:

Option B; Creating face-to-face interviews

Explanation:

Research has shown that face-to-face interviews tend to produce more accurate results when giving a survey. So the correct answer is option B.

In a progressive tax structure, the higher a taxpayer's

income, the greater percentage he or she must pay in

taxes. This chart shows a sample progressive income tax

CEPTS for a taxpayer with total taxable income of $100,000.

Income According to the chart, what would be the total

tax on taxable income of $65,000?

Answers

Answer:According to the chart, the total tax on taxable income of $65,000 would be $16,250.

Explanation:

How do i get as much mony as bill gates todey?

Answers

Answer:

be very famous

Explanation:

why do i need to have 20 letters

Part A

Step 1 Starting at MIDNIGHT, (12:01am) ending 3 days later (72hr) at MIDNIGHT (11:59pm) You can start any day of the week, upto Sat Mar 04.

For a minimum of 3 consecutive days monitor the time you spend doing the 8 different activities listed below

NOTE: Avoid using weekends only in your monitoring and try to stay with mid-week,

e.g. Tues, Wed, Thurs, where majority of days are mid-week.

Use the attached time sheets to record blocks of time. Round off to the nearest hour. Precision isn’t the goal. e.g. 2hrs and 20 minutes, would be rounded down to 2 hours. 2 hrs and 30 minutes would be rounded up to 3 hrs.

The full 24 hours of each day must be accounted for.

The following 8 categories are recommended to cover the majority of possible activities one might perform in the course of a day.

Sleep

Personal maintenance (showers, laundry, housecleaning, grocery shopping, family requirements etc.)

Travel (to work, to school, or for appointments)

Work hours (total hours at the workplace, excluding lunch or breaks)

School (total hours in classes, plus time spent, studying, re-writing notes, completing assignments, time on blackboard)

Fitness (formal or informal, attending the gym or walking home from work)

Recreation (other than fitness related, TV, Movies, Leisure reading, online shopping, crafts, Video games, children’s sports activities, dates, coffee meet ups)

Volunteer activities (United Way, Big Brothers/Sisters, your religious institution activities, PTA with schools)

Three day's activities

Time day day day

Activities Activities Activities

12:01-

1:00am

1:00am-

2:00am

2:00am-

3:00am

3:00am-

4:00am

4:00am

5:00am

5:00am-

6:00am

6:00am=

7:00am

7:00am-

8:00am

8:00am-

9:00am

9:00am-

10:00am

10:00am

11:00am

11:00am-

12:00pm

12:00pm

1:00pm

1:00pm-

2:00pm

2:00pm-

13:00pm

3:00pm-

4:00pm

4:00pm-

5:00pm

5:00pm-

6:00pm

6:00pm-

7:00pm

17:00pm-

8:00pm

8:00pm-

9:00pm

9:00pm-

10:00pm

10 00pm

11:00pm

11:00pm-

11:59pm

Answers

Here is an example of a three-day activity log:

The Activity LogDay 1:

Time Sleep Personal Travel Work School Fitness Recreation Volunteer

12:01-1:00 1

1:00-2:00 1

2:00-3:00 1

3:00-4:00 1

4:00-5:00 1

5:00-6:00 1 1

6:00-7:00 1 1

7:00-8:00 1 1

8:00-9:00 1 1

9:00-10:00 1 1

10:00-11:00 1 1

11:00-12:00 1 1

12:00-1:00 1

1:00-2:00 1

2:00-3:00 1

Day 2:

Time Sleep Personal Travel Work School Fitness Recreation Volunteer

12:01-1:00 1

1:00-2:00 1

2:00-3:00 1

3:00-4:00 1

4:00-5:00 1

5:00-6:00 1 1

6:00-7:00 1 1

7:00-8:00 1 1

8:00-9:00 1 1

9:00-10:00 1 1

10:00-11:00 1 1

11:00-12:00 1 1

12:00-1:00 1

1:00-2:00 1

2:00-3:00 1

Day 3:

Time Sleep Personal Travel Work School Fitness Recreation Volunteer

12:01-1:00 1

1:00-2:00 1

2:00-3:00 1

3:00-4:00 1

4:00-5:00 1

5:00-6:00 1 1

6:00-7:00 1 1

7:00-8:00 1 1

8:00-9:00 1 1

9:00-10:00 1 1

10:00-11:00 1 1

11:00-12:00 1 1

12:00-1:00 1

1:00-2:00 1

2:00-3:00 1

Note: The actual activities and time allocation would depend on the individual's personal and work life. This is just an example to illustrate how the log can be filled out.

It's important to be honest and accurate while filling out the log to get the most benefit from it.

Read more about activity logs here:

https://brainly.com/question/8052360

#SPJ1

How do businesses solve the problem of an economic shortage?

A. They will move prices to the market equilibrium price.

B. They will lobby for higher tariffs on imports.

C. They will stop production until government provides cubsidies.

Answers

Answer: c

Explanation:

Discuss the benefits of businesses that are involved in the macro environment

Answers

Go back to the Standard Repayment plan in #1 above. Now pay an extra $100 per month (this gets put toward the principal),.

Print out the amortization schedule and on the back of the schedule answer these questions:

1.

Write down the facts of the loan: loan amount, interest rate, extra monthly payment, length of the loan

2.

What is the total principal, interest paid?

3.

What is the last monthly payment?

4

How many payments is this loan with the additional principal?

5

How much faster was this loan than the original in #1?

6.

How much money was saved by paying $100 extra toward principal each month?

7.

What is the point?

Answers

Answer:

3000* (1+ 0.06) (that little 1 at the corner there <)

= $3,180

3,180 - 3000 = $180 first year

180/12 =$15 per month

The formula is

Principal (money borrowed/3000$) times/*/x (1+ rate (0.06) ) to the power of 1

Please correct me if i got it wrong i’m studying this in class too.

Explanation:

Al-Baida wants to buy a new machine with special purposes for an amount $ (1) million for the production of a product, and the economic life of the machine is (10) years, bearing in mind that there is no residual value for the machine at the end of its useful life. The company adopts the straight-line method in calculating the depreciation, and it is expected that the annual revenues from operating the machine will be 1,200,000 ID, and the annual expenses excluding taxes, (700,000 ID. If you know that the company adopts a discount rate of 12% The income tax rate is 30% for all years. Required: Calculate the following: .1. payback period. 2. Rate of accounting return on investment.

Answers

1. Payback period will be 2 years.

2. The rate of accounting return on investment for the machine is 35%.

To calculate the payback period, we need to determine the number of years it takes for the company to recover the initial investment of $1 million.

Step 1: Calculate the annual net cash flow.

Annual net cash flow = Annual revenues - Annual expenses excluding taxes

Annual net cash flow = $1,200,000 - $700,000 = $500,000

Step 2: Determine the payback period.

Payback period = Initial investment / Annual net cash flow

Payback period = $1,000,000 / $500,000

Payback period = 2 years

Therefore, the payback period for the investment in the machine is 2 years.

To calculate the rate of accounting return on investment, we need to determine the average annual net income generated by the investment.

Step 1: Calculate the average annual net income.

Average annual net income = (Annual revenues - Annual expenses excluding taxes) * (1 - Tax rate)

Average annual net income = $500,000 * (1 - 0.30)

Average annual net income = $350,000

Step 2: Calculate the rate of accounting return on investment.

Rate of accounting return on investment = Average annual net income / Initial investment * 100

Rate of accounting return on investment = $350,000 / $1,000,000 * 100

Rate of accounting return on investment = 35%

for more such questions on investment

https://brainly.com/question/29547577

#SPJ11

What aspect does line weight represent? A. angle of a line B. color of a line C. length of a line D. thickness of a line

Answers

Answer:

D

Explanation:

Describe how economic barriers such as economic development, infrastructure, exchange rates, and devaluation affect international trade.

Answers

International Trade involves trade between two or more independent countries. This type of trade is influenced by factors such as

economic developmentinfrastructureexchange ratesDevaluationBelow you can read more concerning how these factors affect international trade.

Effect of economic Development of International TradeThe effect of a countries' economic development to international trade cannot be overemphasized. This is because, international trade has a direct relationship with economic development. Countries that are open to international trade develop faster, innovate, improve productivity and provide higher income and more opportunities to their people.

In other words, Less economically developed countries are likely to have much less participation in international than developed countries

Effect of Infrastructure on International TradeUnderdeveloped infrastructure hinders international trade. this is because, infrastructure generally influences the prices of goods and services. for instance, bad road infrastructure inevitable will increase the cost of transporting goods and this will increase the cost of the goods in the market thereby decreasing the demand for such goods

Effect of Exchange rates on International TradeExchange rates plays a very vital role in international trade. The exchange rates helps to determine the final price of a particular goods. for instance, increase in a country's exchange rate relative to another country's, leads to a rise in the price of its goods and services.

This will make Importation cheaper. Ultimately, this can decrease that country's exports and increase imports.

Effect of Devaluation on International TradeThe principle of devaluation plays a major role in international trade. This is because devaluation makes the cost of a country's exports cheaper, which in turn makes their goods more competitive in the global market, and hence increasing the cost of imports.

When imports become more expensive, domestic consumers are less likely to purchase them and will opt for the local alternative, further strengthening domestic businesses.

Learn more about International Trade at https://brainly.com/question/14926566

#SPJ1

1. Deirdre has one hour this afternoon in which she can either practice the piano for the upcoming school concert, work at

the library for $7 per hour, or babysit her neighbor's son for $10 per hour. Deirdre chooses to practice the piano, but

if she hadn't chosen to practice the piano, she would have chosen to babysit over working at the library. What is the

opportunity cost of Deirdre's decisions

A. The value gained from practicing the piano for an hour.

B. The value of babysitting her neighbor's son for an hour.

C. The value of working at the library for an hour.

D. The value of babysitting her neighbor's son and working at the library for an hour.

Answers

Answer:

The correct answer is B) The value of taking care of her neighbours son for 60 minutes.

Explanation:

Opportunity Cost belongs more in the parlance of microeconomics and is used to describe the idea that one cannot have everything all the time. There are alternative ends competing for limited means. In order words, when we decide to take a course of action, in the hope of achieving a thing or getting a reward, there is always another benefit forgone.

So knowing that there is an opportunity that was foregone helps the microeconomist to think carefully about what they want to achieve using the limited resources at their disposal.

Further simplified, if I have $5 dollars to spend, and that amount can purchase either a cupcake or a cup of ice cream, the one I chose to buy becomes the opportunity taken, whilst the alternative forgone is the opportunity cost.

Therefore, the cost of an item is not just the amount of money for which it was purchased, but all other alternatives with which the same amount could have been purchased.

In the question above, Deidre would have chosen to babysit her neighbor's son. That to her is the next best use of her time, and therefore the opportunity cost. According to the question, she wouldn't have worked in the library even if she had nothing else to do. Hence, that does not pass as opportunity cost.

Opportunity cost must be an alternative choice and is very subjective.

Cheers!

discuss five engagement-specific controls to be instituted by an audit firm to ensure quality control

Answers

Answer:

The quality control policies and procedures applicable to a firm's accounting and auditing practice should encompass the following elements:

Independence, Integrity, and Objectivity.

Personnel Management.

Acceptance and Continuance of Clients and Engagements.

Engagement Performance.

Monitoring.

PLEASE HURRY

If you are paid according to a rate of $15 per hour, what is your type of payment?

a. Commission

b Salary

C Wage

d. Pension

Please select the best answer from the choices provided

A

оооо

С

Answers

Answer:

C Wage

Explanation:

Wage is compensation paid per hour worked. The term wage is most applicable to piecemeal jobs. Wage is usually paid per hour, per day, per week, or a piece of work completed.

Wage differs from salary in that salary is a fixed amount of compensation paid after the lapse of an agreed time, mostly monthly. Wage is not a fixed amount but depends on the hours worked or the amount of work done.

Answer:

C

Explanation:

i took test 80% -w- lol

ABC Inc. has the following data for September:

Physical Units

Units in beginning work in process 8,000 units

Percentage complete:

Materials 100 %

Conversion costs 50 %

Units Started in September 10,000 units

Units completed & transferred out 15,000 units

Units in ending work in process 0 ?

Percentage complete:

Materials 100 %

Conversion costs 20 %

Costs

Materials Conversion Costs

Beginning work in process $20,000 $ 6,000

Costs added during September $30,000 $40,000

Calculate cost per equivalent unit for conversion cost

Using FIFO method & calculate:

(1) Prepare a physical unit schedule.

(2) Compute equivalent units.

(3) Compute unit costs.

(4) Prepare a cost reconciliation schedule.

Answers

The cost per equivalent unit for conversion cost is 9,000 units.

What is a cost?The cost is the amount of money needed to produce, market, and sell goods and services or buy assets.

When a product is sold or consumed, a cost is charged to expense. In the case of a buying of an asset, the charge to expense could be significantly deferred.

The cost concept underlies the transition of assets from the balance sheet to expenses in the income statement.

The cost can be a fixed cost like the lease of a building which will not vary every month or can be a variable cost like the telephone cost which can vary every month.

The cost per equivalent unit for conversion cost is 9,000 units.

Read more about cost here:

https://brainly.com/question/29509552

#SPJ1

ou may pay $15,000 for an annuity that pays $2500 per year for the next 10 year. You want a real rate of return of 5%, and you estimate inflation will average 6% per year what is the annual cost to own this annuity

Answers

Answer:

The annual cost to have this annuity is 16.66%

Explanation:

Solution

Given that

You pay an annuity of = $15,000

Annuity pays =$2500 per year

n =10 years

The rate of return = 5%

The estimated inflation is -6% average

Now

We find the annual cost to own this annuity

Thus

We find the real or actual yield given as:

I =PNR

$2500 = $15,000 * 1 * r

So,

R=$2500/$15,000

=0.1666 or 16.66 %

Please answer i need help

Answers

Explanation:

I can't really answer this but it's like a essay about the future job of your best customers of what I believe like it says use your imagination is all I can think of. sorry

Submission Requirements Hurry Pls Help ASAP!!!

Nine hundred word response.

When submitting written assignments, please remember to:

Submit the assignment question(s) and your responses.

Proofread for spelling, grammar, and punctuation.

Remember complete sentence structure.

Paragraphs need to have minimum of six sentences.

Submit your E.T.H.I.C.S. model of one of the provided scenarios.

Answers

When submitting written assignments, please remember to Proofread for spelling, grammar, and punctuation. Hence, option B is correct.

What is meant by Proofread?Proofread is the double-checking of the written assignment or the work that is being already done to the person. It helps the person to identify the little mistakes that they have made during the making of the assignment.

Proofread is always a better solution to understand the work and makes the work complete and perfect. After Proofread, one can identify their mistakes and make them correct.

Thus, option B is correct.

For more details about Proofread, click here:

https://brainly.com/question/11845575

#SPJ1

the following balance where extracted from the book of Alfsal, a sole trader as at 31/12/2014 capital 198000 ,drawing 10700, building 300000, office equipment (cost le 22000) 15000, patent 24000, delivery van at cost63000, Accumulated depreciation delivery vans 14000, stock 01/01/2014 29000, sale485,000, purchase 196000, return outward 5300, return inward 17000, creditor 21900, debtor 34800, discount received 1400, wages and salaries 105,000, general expenses 13000,stationary 4800, tem loan(received on 01/04/2014) 50,000. vat 17300. provision for bad debts 2500. Advertising 5700. insurance 9,000. loan interest paid 1,000. bank42,600. PRSI/USU 10,200. profit and loss balance 01/01/2014 65,000. you are given the following aditional information: stock for resale at 31/12/2014 was le 19,000. stationary paid in advance was le 1,200. provision should be made for interest due on loan. the rate of interest is 6%per annum. wages and salaries are to be divided 75%for employees and drawings. building 10% of cost. delivery van 10% of net book value. office equipment 20% of cost. provision for bad debts is to be adjusted to 10% of debtors . you are required to prepare a trading and profit and loss account for the year ended 31/ 12/2014. balance sheet as at 31/12/2014.

Answers

Here is the trading and profit and loss account for the year ended 31/12/2014:

The Trading and Profit and Loss AccountFor the year ended 31/12/2014

Particulars Amount

Sales €485,000

Less: Cost of Goods Sold €196,000

Gross Profit €289,000

Less: Expenses

- Wages and Salaries (75%) €78,750

- General Expenses €13,000

- Stationary €4,800

- VAT €17,300

- Provision for Bad Debts €3,480

- Advertising €5,700

- Insurance €9,000

- Loan Interest €600

- PRSI/USU €10,200

Net Profit €157,370

Here is the balance sheet as at 31/12/2014:

Balance Sheet

As at 31/12/2014

Assets Liabilities

Cash €42,600

Bank €1,200

Debtors €34,800

Stock €19,000

Capital €213,570

Drawings €10,700

Building €300,000

Office Equipment €15,000

Patent €24,000

Delivery Vans €49,000

Accumulated Depreciation €28,000

Provision for Bad Debts €3,730

Loan €50,000

Profit and Loss €157,370

Total €618,570

Total €618,570

Read more about balance sheet here:

https://brainly.com/question/1113933

#SPJ1

The total factory overhead for Landen Company is budgeted for the year at $675,000. Landen manufactures two drapery products: sheer curtains and insulated curtains. These products each require 6 direct labor hours (dlh) to manufacture. Each product is budgeted for 7,500 units of production for the year. What would the factory overhead allocated per unit for insulated curtains using the single plantwide factory overhead rate be

Answers

Answer:

$45.00 allocated per insulated curtain

Explanation:

Calculation for What would the factory overhead allocated per unit for insulated curtains using the single plantwide factory overhead rate be

First step is to calculate the Total budgeted plantwide allocation base for sheer curtains and

insulated curtains

Budgeted plantwide allocation base for sheer curtains =7,500 units × 6 dlh

Budgeted plantwide allocation base for sheer curtains=45,000 dlh

Budgeted plantwide allocation base for insulated curtains =7,500 units × 6 dlh

Budgeted plantwide allocation base for insulated curtains = 45,000 dlh

Total budgeted plantwide allocation base=45,000 dlh+45,000 dlh

Total budgeted plantwide allocation base=90,000 dlh

Now let calculate the Single plantwide factory overhead rate using this formula

Single plantwide factory overhead rate =(Total budgeted factory overhead /Total budgeted plantwide allocation base) *Overhead rate

Let plug in the formula

Single plantwide factory overhead rate=($675,000 / 90,000) × 6 hours

Single plantwide factory overhead rate = $45.00 allocated per insulated curtain

Therefore What would the factory overhead allocated per unit for insulated curtains using the single plantwide factory overhead rate be is $45.00 allocated per insulated curtain