Kleen Windows received $770 (including GST) from its customer John Jones for services previously supplied to him on credit. Which of the following entries correctly records this receipt? DR Debtors $770; CR Bank $770. DR Bank $770; CR Debtors $770. DR Bank $770; CR Services revenue $700; CR GST payable $70. DR Debtors $770; CR Services revenue $700; CR GST payable $70.

Answers

The correct entry to record the receipt from John Jones for services previously supplied on credit by Kleen Windows would be:

DR Bank $770

CR Debtors $770

This entry reflects the increase in the company's cash balance (Bank) and the decrease in the amount owed by the customer (Debtors). The amount of $770 represents the total payment received, including the Goods and Services Tax (GST).

The debit to Bank indicates an increase in the asset account as the cash is received and deposited into the company's bank account. The credit to Debtors reduces the amount owed by John Jones, as he has now made the payment for the services provided.

It is important to note that in this entry, we are only recording the receipt of cash and the reduction in the outstanding amount owed by the customer. There is no need to separately account for the services revenue or the GST payable in this entry.

The services revenue would have been recognized when the services were initially provided, and the GST payable would have been recorded separately at that time as well. Therefore, the correct entry in this case focuses solely on the cash receipt and the adjustment to the customer's outstanding balance.

By recording the receipt accurately, Kleen Windows ensures that its financial records reflect the actual cash inflow and the corresponding reduction in its accounts receivable from John Jones. This helps maintain accurate and up-to-date financial information for the company's management and external stakeholders.

Learn more about GST here:

https://brainly.com/question/33024568

#SPJ11

Related Questions

Korean government decides to reduce air pollution by discouraging the country’s reliance on gasoline use. They will impose a 500 KRW (won, Korean currency unit) tax on each liter of gasoline sold. The government expects this policy will be very effective in cutting the gasoline consumption (they care less about tax revenue from the new policy), particularly in the short run than in the long run. True or false? Why? Explain with a demand-supply diagram.

Answers

The imposition of a tax on gasoline will increase the cost of production for suppliers, which will shift the supply curve to the left (from S1 to S2) as shown in the diagram.

This will result in a higher equilibrium price for gasoline (from P1 to P2) and a lower equilibrium quantity demanded (from Q1 to Q2). In the short run, consumers may not have many alternatives to gasoline and therefore may continue to purchase it despite the higher price. However, over time, consumers may shift to alternative forms of transportation, such as electric cars, which will further reduce the demand for gasoline.

Therefore, while the policy may be more effective in the short run than in the long run, it is still expected to be effective in reducing gasoline consumption and thus, air pollution. The government's primary goal is to reduce consumption, and not to generate tax revenue from the policy.

Read more about consumption here:https://brainly.com/question/28449010

#SPJ11

You are managing a project to build an urgent care clinic. Your company is expanding and has constructed 25 clinics so far. Which estimating technique makes the most sense to use in this situation?

Answers

Answer:

Delphi technique

Explanation:

The Delphi model is a technique of group communication in which a panel of experts reach consensus on a set of questions and discussions. This is used to predict or to forecast. First, choose an effective facilitator and experts with relevant expertise, and ensure that the issue is well established after that they reach with a decision

Therefore in the given case, the delphi technique is used

identify what accounting is by selecting the correct statement. multiple choice question. accounting information is primarily used only at the end of a year when tax returns and financial statements are prepared. accounting is a system that identifies, records and communicates financial information. accounting information impacts internal users only.

Answers

The best alternative that accurately conveys the significance of accounting is "Accounting is a system that identifies, records, and transmits financial information."

The best way to define accounting is as the process of keeping financial records in accordance with the laws. Accounting is used to evaluate the figures and facts that are relevant to the organisation and to portray its financial position. Its breadth has grown in almost every commercial company. Accountants' labour is the foundation of today's financial markets. Business executives would lack the transparency they require to manage risks or plan initiatives without accounting, and investors would be unable to rely on up-to-date, accurate financial data.

To know more about Accounting ,visit:

https://brainly.com/question/30310030

#SPJ4

Type the correct answer in the box. Spell all words correctly. The demand curve has what kind of slope?

Answers

Answer:

Usually slopes downwards

Explanation:

in a negative association

outline 2 reasons for completing assigned tasks daily

Answers

In summary, it is important to complete your tasks because it helps you feel better, helps you identify what you should be working on and together that means you complete more tasks.

1. What is the profit for the month when the income is $14,000 and the expenses are

$12,500?

Answers

Answer:

profit =$1,500

Explanation:

profit = revenue - expense

profit = $14,000 - $12,500

profit =$1,500

The profit for the month is $1,500. Profit is defined as the financial benefit realized when revenue from a business activity exceeds expenses.

What is a profit?Profit is the money left over after deducting business expenses. Profit is classified into : gross profit, operating profit, and net profit. The gross profit is the highest. It demonstrates how much money was left over after paying for the goods and services sold.

Profit is defined as the financial benefit realized when revenue from a business activity exceeds expenses.

A profit is the amount of money earned from a specific product or service, which is calculated by deducting costs from sales and establishing the profit margin.

There are four levels of profit or profit margins:

Gross profit.Net profit Pre-tax profit.Operating profit.Profit = Income- expenses

Profit = $14000- $12500

= $1500

Hence, the profit is $1500.

To learn more about profit

https://brainly.com/question/15699405

#SPJ5

At December 31, 2021 and 2022, Frist Company had outstanding 50 million common shares and 4 million shares of 10%, $10 par cumulative preferred stock. Net income for 2022 was $20 million. No dividends were declared in 2022. EPS for 2022 was: rev: 03_01_2021_QC_CS-255248 Multiple Choice $0.32. $0.37. $0.40. $0.48.

Answers

The dividend is a payout of profits from a firm to its investors. As long as a corporation makes a profit or surplus, it can distribute a part of that profit to shareholders. Any money left over is re-invested money into the organization. So, the answer is "\(\bold{\$0.32}\)" and its calculation can be defined as follows:

Given:

The Net income for \(\bold{2022= \$20\ million}\)

Common shares = \(4 \ million\)

share= \(10\%\)

Cumulative preferred stock= \(\$10\)

\(\to \bold{\frac{[\$20 - (10\% \times \$10\ par \times 4)]}{50}}\\\\\to \bold{\frac{[\$20 - (0.10 \times \$40\ par)]}{50}}\\\\\to \bold{\frac{[\$20 - \$4\ par]}{50}}\\\\\to \bold{\frac{[\$16]}{50}}\\\\\to \$ 0.32\)

Learn more:

brainly.com/question/14037923

What does accounting help you achieve in an organization?

Answers

Answer:

Accounting plays a vital role in running a business because it helps you track income and expenditures, ensure statutory compliance, and provide investors, management, and government with quantitative financial information which can be used in making business decisions.

Explanation:

A customer needs to attach a

A. credit report

to a customer authorization form

Answers

at which of the capability maturity model integration maturity levels, are processes well defined, understood, and consistent across the organization? a. initial b. defined c. managed d. quantitatively managed

Answers

Maturity levels, are processes well defined

What is maturity at Level 3?Maturity According to Tutorials Point, Level 3 refers to your organization's processes being "fully characterized and understood and are described in standards, procedures, tools, and methodologies." Processes should be well defined, well-documented, and, to some extent, improved over time. A process that is highly mature means that you have the data necessary to comprehend how it is working, how variations in its implementation and execution effect performance, and what the likely costs and benefits of any modification will be. Statistical and other quantitative techniques are used to govern these chosen subprocesses. Process management uses quantitative objectives for process performance and quality as criterion.

To learn more about maturity refer to

https://brainly.com/question/13190101

#SPJ4

Brie has a really busy day. She has several tasks to do and she needs to get them all done by the end of the day. She’s worried that she won’t be able to complete them all. Which of the following actions should her get each task done?

A. NOT LOOK AT THE CLOCK

B. SAVE SOME TASK FOR TOMMOROW

C. SPEND TIME REORGANIZING HER "TO DO" LIST

D. IMPOSE A TIME LIMT ON EACH TASK

Answers

Answer : C

Explanation:

Brie has a really busy day. She has several tasks to do and she needs to get them all done by the end of the day. The following actions should her get each task done spend time reorganizing her "To Do List."

What is "TO DO LIST?A to-do list is simply a list of tasks that need to be completed. In other words, pretty much anything and everything can be on your to-do list. However, just because you've written your tasks down doesn't mean they'll actually be done. You can prioritize your tasks and produce excellent work by keeping track of when they are due.

It is a list of things you need to get done or desire to do. They are usually arranged according to priority. They serve as a memory aid and are typically written on paper or post-it notes.

Further that TO DO LIST have to complete is one of the core time management tools. It places all of your tasks in one location. From there, you can order them by importance and focus on the most crucial ones first.

Therefore brain is not the most effective memory tool and only relies on methods that it is certain will work.

Learn more about "TO DO LIST":

https://brainly.com/question/28316147

#SPJ2

under current us gaap, firms may account for an investment in an equity security using any of the following three approaches: held-to-maturity (htm), available-for-sale (afs), or trading.

Answers

Under current US GAAP (Generally Accepted Accounting Principles), firms may account for an investment in an equity security using any of the following three approaches: held-to-maturity (HTM), available-for-sale (AFS), or trading.

1. Held-to-Maturity (HTM): With the HTM approach, firms account for equity securities that they have the intent and ability to hold until maturity. These securities are reported at amortized cost on the balance sheet, with any unrealized gains or losses unrecognized.

2. Available-for-Sale (AFS): Under the AFS approach, equity securities that are not classified as HTM or trading securities are accounted for. These securities are reported at fair value on the balance sheet, with unrealized gains or losses recorded as a separate component of shareholders' equity until realized.

3. Trading: Equity securities classified as trading are those bought and held principally for the purpose of selling them in the near term. They are reported at fair value on the balance sheet, with unrealized gains or losses recognized in the income statement.

Each approach has specific criteria and reporting requirements, and firms must carefully consider the nature of the investment and their intentions in order to determine the appropriate accounting treatment.

Under US GAAP, firms have the flexibility to account for investments in equity securities using the held-to-maturity, available-for-sale, or trading approaches. The choice of approach depends on the firm's intent and the nature of the investment.

Learn more about Held-to-maturity, vitsit:

brainly.com/question/14805952

#SPJ11

Joe owns a business which produces wooden furniture he employs 20 workers in the production Department and three workers in the office is Joe pays all his workers wages which are calculated by time rate but he is thinking of changing to peace rate

Answers

Answer:

The peace rate will result in lower total wages than time rate.

Explanation:

Piece rate is a wages calculator in which labors are paid for the piece of work done by them. They are paid for the quantity of units produced irrespective of time consumed. Time rate is wage calculation method in which wages are calculated based on hours worked. The major disadvantage for this method is that labors can waste time making products due to securing high wage.

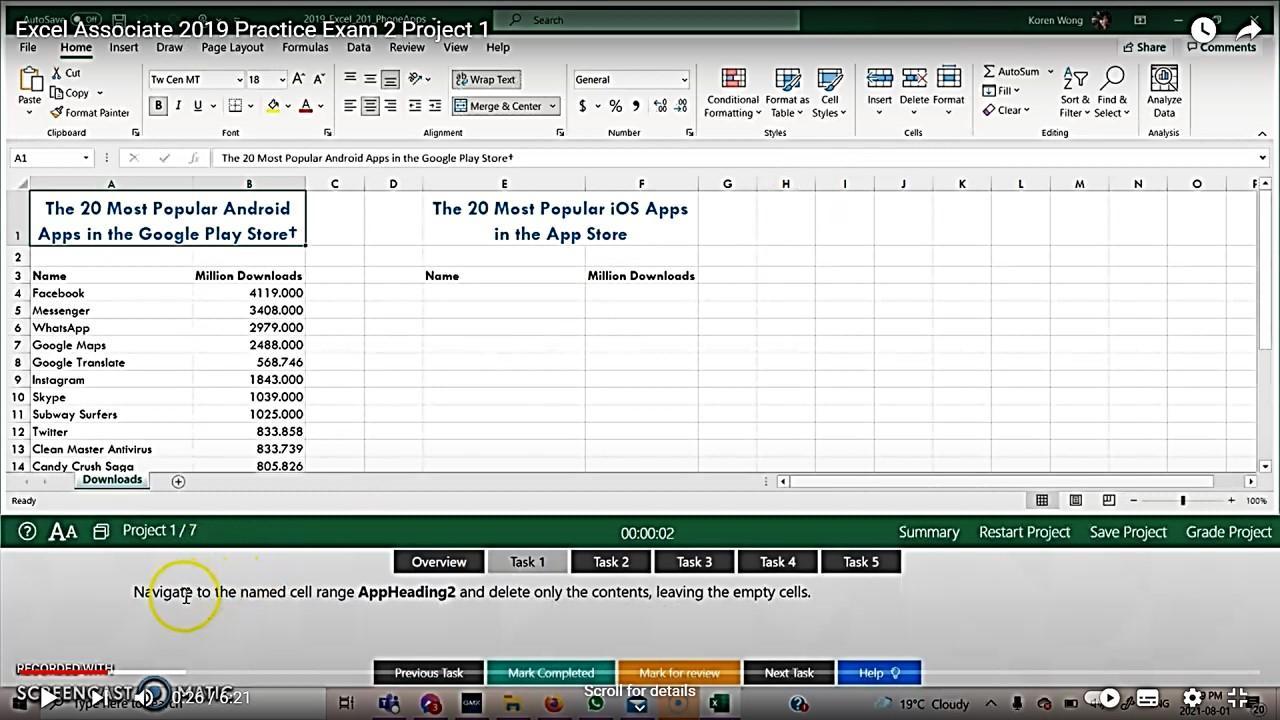

6.4.1 Microsoft Excel Associate Practice - Form A

Answers

In Microsoft Excel, to navigate to the named cell range "AppHeading2" and delete only the contents, leaving the empty cells, you can follow these steps.

What are the steps to follow?1. Open the spreadsheet where the named range "AppHeading2" is located.

2. Click on the "Name Box" at the top-left corner of the screen (the box that displays the name of the active cell).

3. Type "AppHeading2" into the "Name Box" and press "Enter". This will take you directly to the named range.

4. Once you are in the named range, select all the cells that you want to delete the contents of.

5. Right-click on the selected cells and choose "Clear Contents" from the menu.

6. This will remove the content from the selected cells, leaving them empty.

Note: Be careful when deleting cell contents, as it can't be undone and can result in data loss. Always make a backup of your spreadsheet before making significant changes.

Learn more about Microsoft Excel at:

https://brainly.com/question/24202382

#SPJ1

Full Question:

Although part of your question is missing, you might be referring to this full question: See the attached image.

Navigate to the named cell range AppHeading2 and delete only the contents, leaving the empty cells.

After careful analysis of stock ticker DAE, you believe that one of three scenarios are likely: What is the variance of the return of this stock? 0.0228 0.0083 0.0172 0.0197 0.0128

Answers

The variance of the return of this stock is approximately 0.0001004106. To calculate the variance of the return of the stock, you can use the following formula:

Variance = Σ((Ri - Ravg)^2) / N

Where: Σ denotes the sum of the values,Ri represents each individual return, Ravg is the average return, N is the total number of returns. Given the returns 0.0228, 0.0083, 0.0172, 0.0197, and 0.0128.

Calculate the average return (Ravg):

Ravg = (0.0228 + 0.0083 + 0.0172 + 0.0197 + 0.0128) / 5

Ravg = 0.01616

Calculate the squared differences for each return:

\((R1 - Ravg)^2\) = \((0.0228 - 0.01616)^2\) is 0.000305216

\((R1 - Ravg)^2\) =\((0.0083 - 0.01616)^2\) is 0.0000628744

\((R1 - Ravg)^2\) = \((0.0172 - 0.01616)^2\) is 0.000010624

\((R1 - Ravg)^2\) = \((0.0197 - 0.01616)^2\) is 0.0000127224

\((R1 - Ravg)^2\) =\((0.0128 - 0.01616)^2\) is 0.000111616

Calculate the sum of the squared differences: Σ\(((Ri - Ravg)^2)\)= 0.000305216 + 0.0000628744 + 0.000010624 + 0.0000127224 + 0.000111616

Σ\(((Ri - Ravg)^2)\) = 0.0005020528

Calculate the variance: Variance = Σ\(((Ri - Ravg)^2)\) / N

Variance = 0.0005020528 / 5

Variance ≈ 0.0001004106

Therefore, the variance of the return of this stock is approximately 0.0001004106.

To know more about Variance visit-

brainly.com/question/14116780

#SPJ11

If you are at a university and someone asks "what's your MAJOR?" this is what they

want to know:

a) the secondary courses you are taking in college just for fun

b) the academic discipline to which you have formally committed so you can earn

an undergraduate degree

c) which credit cards you have maxed out to afford tuition, housing, food and books

d) which political party you will agree to join and promote on your campus

Answers

Answer:

the answer is B

Explanation:

How long will it take $300 to double if it earns the following rates? Compounding occurs once a year. Round your answers to two decimal places.

a. 6%. year(s)

b. 11%. year(s)

c. 17%. year(s)

d. 100%. year(s)

Answers

To determine how long it will take for an amount to double at different interest rates, we can use the Rule of 72.

The Rule of 72 is a quick estimation method that approximates the number of years required for an investment to double by dividing 72 by the interest rate.

a. 6%:

Number of years ≈ 72 / 6 = 12 years

b. 11%:

Number of years ≈ 72 / 11 ≈ 6.55 years (rounded to 2 decimal places)

c. 17%:

Number of years ≈ 72 / 17 ≈ 4.24 years (rounded to 2 decimal places)

d. 100%:

Number of years ≈ 72 / 100 = 0.72 years (rounded to 2 decimal places)

Therefore, the answers are:

a. 6%: 12 years

b. 11%: 6.55 years

c. 17%: 4.24 years

d. 100%: 0.72 years

To know more about interest rates follow the link:

https://brainly.com/question/28236069

#SPJ4

A major drugstore chain whose stocks are traded on the New York Stock Exchange was considering a 2-for 5 reverse split. If the pre-split market cap was 1.71B, what would the post-split market cap be?

Answers

A major drugstore chain whose stocks are traded on the New York Stock Exchange was considering a 2-for 5 reverse split. the post-split market cap be 684 million

What is market cap?Generally, In a 2-for-5 reverse split, every 5 shares of stock are combined into 2 shares. This means that the number of outstanding shares of stock will be reduced by 2.5 times. If the pre-split market cap is 1.71B, the post-split market cap can be calculated by dividing the pre-split market cap by 2.5:

1.71B / 2.5 = 684 million

So, the post-split market cap would be approximately 684 million. Please note that this calculation is based on the assumption that the value of the company's stock remains the same after the reverse split. In practice, the value of the stock may change as a result of the reverse split.

Read more about market cap

https://brainly.com/question/20376267

#SPJ1

Offer an example of an external motivator put into place by an organization to motivate others to avoid applying stereotypes or prejudicial behavior. What have you seen?

Answers

One example of an external motivator put into place by an organization to motivate others to avoid applying stereotypes or prejudicial behavior is implementing diversity and inclusion training programs. These programs are designed to educate employees about the importance of embracing diversity, challenging biases, and fostering an inclusive work environment.

During these training sessions, participants learn about the negative impacts of stereotypes and prejudice, and are provided with strategies and tools to recognize and overcome unconscious biases. The organization may also introduce policies that promote diversity and inclusivity, such as establishing diverse hiring practices, creating employee resource groups, and implementing inclusive language guidelines.

Additionally, some organizations may tie performance evaluations and rewards to individuals' ability to demonstrate inclusive behaviors and exhibit cultural competence. By linking promotions, bonuses, or other rewards to the employees' efforts in promoting diversity and eliminating stereotypes, the organization reinforces the importance of these values and provides external motivation for individuals to actively engage in inclusive practices.

Overall, these external motivators send a clear message that the organization values diversity, inclusivity, and the avoidance of stereotypes and prejudicial behavior, thereby encouraging individuals to align their behaviors with these principles.

Learn more about cultural competence here:

https://brainly.com/question/29817599

#SPJ11

is it better for ute company to take a take credit or a deduction on the $100k foreign taxes paid?

Answers

The decision should be based on a company’s individual needs and goals.

When it comes to international business, there is often a lot of money at stake when it comes to taxes. Companies have to decide whether they should take a credit or a deduction on the foreign taxes they have paid. This decision can significantly impact a company’s financial health, so it is important to understand the difference between the two and which is better for the company.

A tax credit is a dollar-for-dollar reduction in taxes owed. This means that a company can reduce the amount of taxes that it owes by the amount of the credit. For example, if a company has paid $100,000 in foreign taxes, it can take credit for this amount and reduce its taxes owed by $100,000.

On the other hand, a tax deduction is a reduction in taxable income. This means that a company can reduce its taxable income by the amount of the deduction. For example, if a company has paid $100,000 in foreign taxes, it can take a deduction for this amount and reduce its taxable income by $100,000.

Ultimately, the decision should be based on a company’s individual needs and goals. It is important to consult with a qualified tax professional to ensure that the best decision is being made for the company.

Learn more about tax credits and tax deductions:

brainly.com/question/17395659

#SPJ4

Identify the examples of backgrounds. Check all that apply.

Sabir was raised in a Muslim family.

Michael wants to earn a college degree.

Irene is planning to become a Carpenter.

Jean has parents who have strong political views.

George wants to learn how to style hair.

Bao grew up participating in Chinese cultural activities.

Answers

Answer: The answers are: Sabir was raised in a Muslim family, Jean has parents who have strong political views, and Bao grew up participating in Chinese cultural activities.

Hope this helps :)

in the context of contract law, consideration means something (money, or any object or thing) given in return for services performed or for products delivered.

Answers

It is correct. In contract law, consideration refers to something of value given by one party to a contract in exchange for the performance of a promise or the delivery of a product by the other party. Consideration is an essential element of a valid contract and must agree legally enforceable.

Consideration can take various forms, including money, goods, services, property, or even a promise to do or refrain from doing something. It represents the bargained-for exchange that creates a mutual obligation between the parties involved. Both parties must provide consideration to begin a legally binding contract. For example, in a sales contract, the buyer offers care in the form of money, and the seller provides consideration by delivering the goods. This exchange of review establishes the contractual relationship and each party's obligations. The inspection ensures fairness and prevents one-sided contracts where one party receives the benefits without providing anything in return. It demonstrates that the parties have voluntarily entered into the agreement and exchanged something valuable to support their mutual promises.

Learn more about Contract Law here: https://brainly.com/question/30626918.

#SPJ11

Select all that apply.

Common skills assessments administered during the employment interview process include:

none of the above

science

keyboarding

math

Answers

Answer:

Keyboarding and Math :)

Explanation:

A family's financial plan is likely to be less complex than an

individual's.

True

False

Answers

Answer:

False

Explanation:

A family's financial plan inolves more than a single individual.

2. As a department supervisor, what decision(s) should Destiny make in regard to this romance?

Answers

As a supervisor, Destiny has a responsibility to maintain a professional and fair work environment for all employees.

What decision(s) should Destiny make in regard to this romance?

Address the situation with the employees involved: Destiny should have a private conversation with the employees involved in the romance and make it clear that their behavior should not affect their work performance or the work of their colleagues.

Establish clear workplace policies: Destiny should establish clear policies regarding workplace relationships and communicate them to all employees. This can include guidelines on how to conduct themselves professionally while at work and the consequences of violating these policies.

Consider reassigning one of the employees: Depending on the situation and the nature of the work, Destiny may consider reassigning one of the employees involved in the romance to a different team or department to avoid any potential conflicts of interest.

Seek advice from HR: If the company has a human resources department, Destiny should seek their advice on how to handle the situation in a professional and legal manner.

Overall, Destiny's decisions should prioritize maintaining a professional work environment while also respecting the privacy and personal lives of her employees.

Learn more about department supervisor from

https://brainly.com/question/28168059

#SPJ1

Customer service personnel typically need at least A. a high school diploma. B. a vocational school certificate. C. a community college degree. D. a four-year degree.

Answers

Answer:

A. a high school diploma.

Explanation:

Typically, a Customer service representative's minimum qualification is a high school diploma. They also need on the job training to acquire specific skills required to work in that particular organization. Companies organize classroom-like training to teach the customer service representatives about their products and services.

Some organizations, such insurance companies and banks, may demand higher qualifications due to the technical aspects of their job.

You're given a monthly budget of $400 for social media advertising. You want to set a daily budget for February to insure you don't overspend for the month. What is your daily budget? (It is not a leap year.)

Answers

Answer:

$14.28

Explanation:

you will have a couple of cents left over at the end because you cant evenly divide 400 by 28

Which of the following statements about check cashing companies is FALSE?

1. They charge low fees.

2. They offer bad deals where you'll owe a lot more than you borrowed.

3. They can take a percentage of your check on top of fees.

4. They make it easy to fall into a loan cycle that is hard to get out of.

Answers

What were the alternatives you considered at the time of choice? (Consumer Ed)

Answers

Suppose you are buying your first condo for $180,000, and you will make a $15,000 down payment. You have arranged to finance the remainder with a 30-year, monthly payment, amortized mortgage at a 6. 5% nominal interest rate, with the first payment due in one month. What will your monthly payments be?.

Answers

If we arranged to finance the remainder with a 30-year, monthly payment, amortized mortgage at a 6. 5% nominal interest rate, with the first payment due in one month. The monthly payments amount be $1,042.91

Purchase Price of Condo $180,000.00

Down payment $15,000.00

Loan amount $165,000.00

Terms in years 30

Annual interest rate 6.50%

Monthly interest rate 0.5417%

No. of monthly loan payment 360

Monthly payment amount $1,042.91

The term "Monthly Payment Amount" refers to the total of the interest payable under this Note on the portion allocated as Fixed Rate Tranche A at the Fixed Interest Rate in the amounts for each such Payment Date set forth on Annex 1 attached hereto and incorporated herein by this reference or as provided by Payee to Maker in connection with the initial Fixed Interest Rate Interest Period from and including the First Payment Date through the Maturity Date.

Learn more about Monthly Payment Amount, here

https://brainly.com/question/3347812

#SPJ4