Marc, a single taxpayer, earns $64,800 in taxable income and $5,480 in interest from an investment in city of birmingham bonds. using the u.s. tax rate schedule for 2021, how much federal tax will he?

Answers

Federal Tax = $4,617.50 + (22%*(64800-40125))= $10046

Tax liability is calculated on the taxable income of $64800 using tax rate schedule 2020 for single taxpayer. Interest from an investment in city of Birmingham bonds are not taxable.

Your financial obligation to local, state, and federal governments as well as other taxing bodies is known as your tax liability (e.g., the IRS). You owe your creditor money when you owe taxes. This is a binding debt. Tax obligations can exist for both people and corporations.

The government utilizes tax revenue to pay for administrative and social activities. Retirement and disability benefits, for instance, are paid for by Social Security taxes.

Tax obligations are current obligations. Debts with a one-year payment period are considered current liabilities. In most cases, short-term liabilities result from regular company activities. On your small business balance statement, include tax liabilities alongside other current debts.

Learn more about Tax liability, here

https://brainly.com/question/15394738

#SPJ4

Related Questions

once a person reaches the age of majority and ratifies a contract made when he or she was a minor, the contract is still voidable until the person is 25 years old.

Answers

Once a person reaches the age of majority and ratifies a contract made when he or she was a minor, the contract is still voidable until the person is 25 years old.The above-given statement is false.

The law of contract ratifiedAfter attaining the age of majority, the person cannot void the contract ratified earlier by them. Only the minors can void their contracts upon attaining the age of majority. In contract law, a person who is below the age of majority, usually 18 years, is referred to as a minor.

The law of contract has certain rules that apply to contracts made by minors. A minor's contract is voidable if the minor wants to cancel it. A contract made with a minor is voidable at the minor's option, which means that the minor has the right, but not the duty, to cancel it.

A contract made by a minor is voidable at their option until they reach the age of majority. They can avoid their obligations under the agreement by an affirmative act, such as returning the goods that they purchased. However, the ratification of the agreement after the person attains majority will have the effect of making the contract valid from its inception.

Your question is incomplete but most probably your full question was:

Determine True or False: Once a person reaches the age of majority and ratifies a contract made when he or she was a minor, the contract is still voidable until the person is 25 years old.

Learn more about contract ratified at

https://brainly.com/question/30655482

#SPJ11

what is the difference between the three governmental protection companies?

FDIC

CFPB

SEC

full explanation please

Answers

Based on functionalities and jurisdictions, the difference between the governmental protection companies listed here is that FDIC ensures the safety of financial institutions, CFPB ensures financial markets work for all parties involved, and SEC ensures the protection of investors in corporate sectors.

What is the difference between the FDIC, CFPB, and SEC?Generally, the term FDIC is an acronym for Federal Deposit Insurance Corporation and was established to maintain stability and public confidence in financial institution practices.

On the other hand, CFPB is an acronym for the Consumer Financial Protection Bureau and was established to ensure that consumer financial markets work for consumers, responsible providers, and the economy in general.

Also, the SEC which stands for Securities and Exchange Commission (SEC) is the national government regulatory agency responsible for monitoring the corporate sector, the capital market participants, the securities and investment instruments market, and the protection of the investing public.

Therefore, it is concluded that while all these aforelisted government agencies are created to solve impending issues in financial sectors, their roles, and functionalities are different.

FDIC protects financial institutions

CFPB protects financial markets

While SEC protects investors.

Learn more about government agencies here: https://brainly.com/question/18150165

#SPJ1

just recently paid a dividend of $1.84 per share. The expected

growth rate in the dividend is 2.50%. If the required rate of

return is 7.35%, calculate the theoretical price for stock.

Answers

The theoretical price for the stock is approximately $37.94. This represents the estimated intrinsic value of the stock based on the expected dividend growth rate and the required rate of return.

The theoretical price of the stock can be calculated using the Gordon Growth Model, also known as the dividend discount model. The formula is as follows:

Theoretical stock price = Dividend per share / (Required rate of return - Expected growth rate)

In this case, the dividend per share is $1.84 and the expected growth rate in the dividend is 2.50%. The required rate of return is 7.35%.

Theoretical stock price = $1.84 / (0.0735 - 0.025) = $1.84 / 0.0485 ≈ $37.94

Therefore, the theoretical price for the stock is approximately $37.94.

To know more about dividend, click here, https://brainly.com/question/30030205

#SPJ11

Q2. Consider what makes this particular industry unique from others. Data management is constrained by certain requirements such as (a) government regulations, (b) business concerns and (c) legitimate needs. These should be mentioned in your discussion. To address Q2a you must locate legislation or rules specific to Australia that pertain to the collection, storage or use of medical or healthcare records. These may consist of general privacy legislation as well as specific acts relating to healthcare

However Q2 is more general in nature and you will find more suitable sources (likely online) for information about Australian legislation. All sources used should be referenced appropriately using APA

Answers

Australian healthcare industry is unique from other industries because of the availability of data that is important for decision-making and patient care. The healthcare industry deals with sensitive data that should be managed carefully.

Data management is restrained by several requirements such as government regulations, business concerns, and legitimate needs. All these factors should be considered while managing healthcare data. The collection, storage, and use of medical or healthcare records are regulated by certain legislation in Australia.

It is important to locate the legislation or rules specific to Australia that pertain to the collection, storage, or use of medical or healthcare records. The Australian regulations that pertain to the collection, storage or use of medical or healthcare records include Health Records Act 2001, National Health (Privacy) Regulations 2018, Privacy Act 1988, and Health Insurance Act 1973. These laws protect the privacy and confidentiality of patients' information. All sources used should be referenced appropriately using APA.

To know more about Australian healthcare visit:

brainly.com/question/32759547

#SPJ11

It is not necessary, when rejecting a job candidate, to worry about how the rejection is worded, as it will have minimal, if any, impact on the organization. True False

Answers

A company's total liabilities decreased by $105,000 and its stockholders' equity decreased by $35,000 during a period of time. By what amount and in what direction must the company's total assets have

Answers

The total assets of the company would have decreased by $70,000 to balance the equation, which is also known as the balance sheet equation. Liabilities and stockholders' equity are the two sides of the equation. One side decreases and the other side also needs to decrease to maintain the balance of the equation.

Every transaction in accounting should have an effect on at least two accounts. The dual-entry system ensures that the equation remains in balance. Liabilities and stockholders' equity are the two sides of the balance sheet equation. If one side decreases, the other side must decrease to maintain the balance. According to the question, the company's total liabilities decreased by $105,000, and its stockholders' equity decreased by $35,000. This is a decrease in both liabilities and equity sides of the equation. As a result, we need to determine by how much and in what direction the total assets must have changed to balance the equation. The change in total assets is equal to the difference between the changes in total liabilities and stockholders' equity. Total assets must have decreased by $70,000 to balance the equation because the decrease in total liabilities ($105,000) exceeds the decrease in stockholders' equity ($35,000).

Learn more about Liabilities here:

https://brainly.com/question/30805836

#SPJ11

When forming a business strategy, the firm needs to compare the cost advantages and drivers of uniqueness across its different activities and compare with that of other firms. True False

Answers

in personal finance, one makes decisions based on needs vs wants. what is considered a need?

Answers

istp

1.Use the results of your personality test and write an essay.

2.Based on the test results write an essay describing your personality, learning style, and communication skills.

3. Post your essay on the "Question" page. Respond to all posts to your essay.

please pwede nyo ba sagutan due date na kasi Yan bucks please

Answers

Answer:

As an ISTP, I am characterized as a practical and logical person who enjoys solving problems and engaging in physical activities. I prefer to work independently and focus on the task at hand rather than engaging in social interactions.

My learning style is hands-on and experiential. I prefer to learn by doing rather than reading or listening to lectures. I thrive in situations where I can apply my knowledge and skills to solve real-world problems. I am good at analyzing complex situations and breaking them down into manageable parts.

When it comes to communication skills, I tend to be concise and to the point. I don't like to waste time on small talk and prefer direct communication. I am a good listener and pay attention to details. However, I may come across as aloof or detached in social situations, which can be misinterpreted by others.

As an ISTP, I have several strengths that I bring to any team or group. I am dependable, practical, and resourceful. I enjoy taking on challenges and coming up with creative solutions to problems. I am adaptable and can work in a variety of settings and situations.

However, there are also some weaknesses that I need to be aware of. I can sometimes come across as insensitive or indifferent to others' feelings, which can lead to misunderstandings and conflicts. I also have a tendency to procrastinate and avoid tasks that I find uninteresting or challenging.

To improve my communication skills, I can work on being more expressive and open with my thoughts and feelings. I can also try to be more patient and understanding with others, even if their communication styles differ from my own. To improve my learning style, I can seek out more opportunities for hands-on experience and experimentation, and try to engage with different learning materials to broaden my knowledge.

Overall, as an ISTP, I am a problem-solver who prefers practical solutions and hands-on experiences. While my communication style may come across as aloof, I am a good listener and pay attention to details. By being aware of my strengths and weaknesses, I can work to improve my skills and become a more effective member of any team or group.

Explanation:

a budget serves as much as a control tool as a planning tool because

Answers

A budget as much as a control tool as a planning tool because it helps organizations to track actual performance against expected performance.

A budget enables organizations track actual performance against planned performance, making it as effective a control tool as a planning instrument.

A corporation can rapidly determine if it is adhering to its financial priorities by comparing its actual expenses and revenues to those projected. Budgets guarantee that resources are allocated and used efficiently, and they enable prompt identification and remedial action of unforeseen costs or decreases in revenue.

This helps uncover possible possibilities or issue areas that need to be addressed in addition to ensuring that activities are carried out effectively.

Budgets can be used to create goals and objectives, measure performance, and ensure that projects are completed and departments are being operated within the allocated financial resources.

Complete Question:

A budget serves as much as a control tool as a planning tool because it helps organizations to track _________ against expected performance.

To learn more about budget visit:

https://brainly.com/question/17198039

#SPJ4

Lymen International is considering a significant expansion to its product line. The sales force is excited about the opportunities that the new products will bring. The new products are a significant step up in quality above the company’s current offerings, but offer a complementary fit to its existing product line. Fred Riddick, senior production department manager, is very excited about the high-tech new equipment that will have to be acquired to produce the new products. Barbara Dyson, the company’s CFO, has provided the following projections based on results with and without the new products.

Without New Products

With New Products

Sales revenue $12,149,200 $16,618,200

Net income $488,900 $885,800

Average total assets $5,282,800 $13,930,400

(a) Compute the company’s return on assets, profit margin, and asset turnover, both with and without the new product line. (Round answers to 0 decimal places, e.g. 2% and asset turnover to 1 decimal place, e.g. 6.2)

Without new products

With new products

Return on assets

International sidering offerings, xut offer compl step up with New Products Sales 2,145.20 Average tel Without new products with now products ej abou: red Riddick, bring. Th producti depart

%

%

Profit margin

%

%

Asset turnover

Answers

Answer:

I don't know sorryyyyyjdkd

The computation of the Lymen International Company's return on assets, profit margin, and assets turnover, both with and without the new product line, is as follows:

a) Return on assets = Net Income/Average total assets

Without New Products With New Products

Net income $488,900 $885,800

Average total assets $5,282,800 $13,930,400

= 9% 6%

b) Profit margin = Net Income/ Sales revenue

Without New Products With New Products

Sales revenue $12,149,200 $16,618,200

Net income $488,900 $885,800

= 4% 5%

c) Asset Turnover = Net Sales / Average Total Assets

Without New Products With New Products

Sales revenue $12,149,200 $16,618,200

Average total assets $5,282,800 $13,930,400

= 2.3 x 1.2 x

How useful are accounting ratios?The accounting ratios above help investors understand the efficiency, profitability, and effectiveness that companies achieve when compared with previous years or with competitors.

For instance, the assets turnover ratio helps investors understand Lymen International Company's effectiveness in using its assets to generate sales.

Data and Calculations:Without New Products With New Products

Sales revenue $12,149,200 $16,618,200

Net income $488,900 $885,800

Average total assets $5,282,800 $13,930,400

Total assets = $10,565,600 $2,786,0800

Learn more about financial ratios at https://brainly.com/question/9091091

Khalil's teacher has asked him to change the orientation of his images. What does Khalil need to do? O A. O B. O C. O D. Change the shutter speed of his camera. Change the composition of the objects in the pictures. Change the position or direction of the pictures. Change the lighting in the pictures.

Answers

Answer:

C: change the position or direction of the pictures

Explanation:

I just took the quiz

George has asked Mary to agree to marriage counseling before filing for a divorce to determine if they can resolve their marital problems.

Answers

The first task of the marriage counseling is to create a better communication between George and Mary.

Marriage counseling is a type of psychological treatment that is utilized to assist couples who are having marital problems.

Goals of marriage counselingIt is a type of psychological therapy that aims to enhance communication, develop empathy, and reduce negative behaviors. Marriage counseling can be beneficial for couples who are having communication problems, emotional detachment, financial issues, and intimacy problems.

Marriage counseling can help couples to deal with psychological issues that may be causing problems in their relationship. A therapist can assist couples in identifying problematic behaviors and assist them in developing a plan to change them.

A therapist can also assist couples in developing effective communication skills and identifying the source of their disagreements. Overall, marriage counseling can assist couples in developing a deeper understanding of one another and assist them in resolving their marital problems.

Learn more about marriage counseling: https://brainly.com/question/28279969

#SPJ11

2. The rate of assessment in Fulton County is 35%. The tax rate is

81.31 mills. What is the real estate tax on a piece of property that

has a market value of $238,500?

Answers

The real estate tax on a piece of property that has a market value of $238,500 is:$6,787.

Real estate taxUsing this formula

Real estate tax= (Tax rate/1000)× Real property ×Rate of assessment

Tax rate =18.31 mills

Real property=180,000

Rate of assessment=0.35

Let plug in the formula

Real estate tax = 81.31 /1000×$238,500×0.35

Real estate tax = $6,78

Therefore the real estate tax on a piece of property that has a market value of $238,500 is $6,787.

Learn more about real estate tax here:

https://brainly.com/question/17087328

https://brainly.com/question/17167608

#SPJ1

Assume you are a paralegal working for a corporate law firm. New clients Bradley Harris and Cynthia Lund have just finished an initial meeting with your supervising attorney, Belinda Murphy. Ms. Murphy has briefed you on their situation. Bradly Harris and Cynthia Lund have just incorporated a business called Cutting Edge Computer Repair, Inc. After consulting with Ms. Murphy, they feel it would be in their best interests to be taxed as an S Corporation. Ms. Murphy has asked you to prepare the necessary Form 2553 to elect S Corporation status for their signatures.

Using the earlier information and the information in Appendix B-3 on pages 689-690 of this text, do a Form 2553 for Cutting Edge Computer Repair, Inc. This form may be downloaded from the Internal Revenue Service's website at http://www.irs.gov (Links to an external site.)

Answers

As a paralegal at the corporate law firm, I would assist in preparing the Form 2553 for Cutting Edge Computer Repair, Inc. to elect S Corporation status.

Form 2553 is the official document required by the Internal Revenue Service (IRS) to elect S Corporation tax treatment. It allows eligible entities to choose to be treated as an S Corporation for federal tax purposes.

To complete the form accurately, I would gather the necessary information from Bradley Harris and Cynthia Lund, the owners of Cutting Edge Computer Repair, Inc., as well as consult Appendix B-3 on pages 689-690 of the relevant text for guidance.

The Form 2553 typically requires details such as the entity's legal name, address, and Employer Identification Number (EIN), as well as the tax year for which the S Corporation election is effective. I would ensure that all required fields are accurately filled out and that the form is signed by the appropriate parties.

It's important to note that since the specific details of Bradley Harris and Cynthia Lund's situation and their business were not provided in the prompt, the exact completion of the form cannot be provided here. The completion of Form 2553 should be tailored to the unique circumstances of Cutting Edge Computer Repair, Inc. It is recommended to consult the official IRS website and any relevant tax professionals or resources to ensure accurate completion of the form based on the specific requirements and guidelines provided by the IRS.

Learn more about corporate here: brainly.com/question/30098772

#SPJ11

When making decisions, managers often must decide between doing what is beneficial for the firm in the short term, and what is beneficial for both the firm and society in the long term. To address this conflict, a firm must

Answers

When making decisions, managers are often faced with a conflict between what is beneficial for the firm in the short-term and what is beneficial for both the firm and society in the long-term.

This conflict arises because the actions that benefit the firm in the short-term may not necessarily align with the interests of society as a whole, which can lead to negative consequences for both the company and society in the long-term.

To address this conflict, a firm must adopt a long-term orientation and consider the broader social and environmental impacts of its decisions. This means looking beyond immediate financial gains and recognizing that actions taken today can have far-reaching implications for the company's reputation, customer loyalty, employee morale, and overall sustainability.

Firms that prioritize social responsibility and sustainable business practices are more likely to build strong relationships with stakeholders, including customers, employees, investors, and regulators. They are also better equipped to weather economic downturns and other disruptions, as they have diversified their risk and invested in building resilient supply chains and communities.

Ultimately, the key to addressing the conflict between short-term gains and long-term benefits is a commitment to corporate social responsibility (CSR) and sustainable business practices. By prioritizing the needs of society and the environment alongside those of shareholders, firms can create value for all stakeholders over the long-term, ensuring their continued success and impact.

learn more about managers here

https://brainly.com/question/32150882

#SPJ11

Alpine Stables, Inc. , is established in Denver, Colorado, on April 1, 2017, to provide stables, care for animals, and grounds for riding and showing horses. You have been hired as the new assistant controller. The following transactions for April 2017 are provided for your review. A. Received contributions from five investors of $ 60,000 in cash ($ 12,000 the following), a barn valued at \,000 , land valued at $ 90,000 , and supplies valued at $ 12,000. Each investor received 3,000 shares of stock with a par value of $ 0. 01 per share. B. Built a small barn for $ 62,000. The company paid half the amount in cash on April 1,2017 , and signed a three-year note payable for the balance. C. Provided $ 35,260 in animal care services for customers, all on credit. D. Rented stables to customers who cared for their own animals; received cash of $ 13,200. E. Received from a customer \ ,400 to board her horse in May, June, and July (record as unearned revenue). F. Purchased hay and feed supplies on account for $ 3,810 to be used in the summer. G. Paid $ 1,240 in cash for water utilities incurred in the month. H. Paid $ 2,700 on accounts payable for previous purchases. I. Received $ 10,000 from customers on accounts receivable. J. Paid $ 6,000 in wages to employees who worked during the month. K. At the end of the month, purchased a two-year insurance policy for \,600. L. Received an electric utility bill for $ 1,800 for usage in April; the bill will be paid next month. M. Paid $ 100 cash dividend to the following of the five investors at the end of the month. Required:

(d) Write a short memo to the five owners offering your opinion on the results of operations during the first month of business

Answers

A short memo to the five owners on the results of operations during the first month of business is as follows:

To: Stockholders (Alpine Stables, Inc.)

From: Analyst

Date: October 31, 2054

Subject: Business Performance in the First Month

The company earned $39,420 in net income before taxes and retained earnings of $38,920 for April 2017.

These show an impressive performance, with more than 98% reinvested from the company's earnings.

Currently, the company has almost $80,000 in working capital, showing its ability to settle its debts without recourse to additional debts. See Notes below.

Regards,

Transaction Analysis:Cash $60,000 Barn $120,000 Land $90,000 Supplies $12,000 Common Stock $150 Additional Paid-in Capital $281,850

Barn $62,000 Cash $31,000 Note Payable $31,000

Accounts Receivable $35,260 Service Revenue $35,260

Cash $13,200 Service Revenue $13,200

Cash $2,400 Unearned Revenue $2,400

Supplies $3,810 Accounts Payable $3,810

Utility Expense $1,240 Cash $1,240

Accounts Payable $2,700 Cash $2,700

Cash $10,000 Accounts Receivable $10,000

Wages Expense $6,000 Cash $6,000

Prepaid Insurance $9,600 Cash $9,600

Utility Expense $1,800 Accounts Payable $1,800

Dividend $500 Cash $500

Trial BalanceAccount Titles Debit Credit

Cash $34,560

Accounts Receivable 25,260

Supplies 15,810

Prepaid Insurance 9,600

Land 90,000

Barns 182,000

Common Stock $150

Additional Paid-in Capital 281,850

Dividend 500

Note Payable 31,000

Accounts Payable 2,910

Unearned Revenue 2,400

Service Revenue 48,460

Utility Expense 3,040

Wages Expense 6,000

Totals $366,770 $366,770

Income StatementService Revenue $48,460

Utility Expense 3,040

Wages Expense 6,000 9,040

Net income $39,420

Dividends (500)

Retained Earnings $38,920

Cash $34,560

Accounts Receivable 25,260

Supplies 15,810

Prepaid Insurance 9,600

Total current assets $85,230

Note Payable $31,000

Accounts Payable 2,910

Unearned Revenue 2,400

Total liabilities $36,310

Working Capital = $79,920 (Current assets - Current liabilities)

Learn more about determining performance from financial statements at https://brainly.com/question/22941895

#SPJ1

Marissa is traveling in Great Britain and is surprised when the server brings her cookies when she ordered biscuits for breakfast. What communication concept best explains the mix-up?A. Communication is symbolic.

B. Communication is relational.

C. Communication is a process.

D. More communication is always better.

Answers

Answer:

B. Communication is relational.

Explanation:

Communication being relational is the best concept that explains the mixup between the server and Marissa who is travelling through Great Britain. For Marissa to request for biscuits, the sever was able to relate her request to cookies which is commonly served as a breakfast meal in Britain. Hence the reason why she brought it to her.

why is etiquette important in debate tournaments

Answers

Suppose the United States can produce either 90 apples and 20 oranges or 80 apples and 30 oranges. What is the opportunity cost of producing 1 apple?

Answers

Answer: The opportunity cost of producing 1 apple will be 1 orange.

Explanation:

Opportunity cost is defined as the loss or cost of another alternative when another alternative is being chosen by an economic agent.

In this scenario, the opportunity cost of producing every additional apple will be 1 orange due to the fact that as there's an increase in the production of apple from 80 to 90, there'll be a reduction in the production of orange from 30 to 20.

This indicates that for the increase of 10 apples, there's a reduction of 10 oranges which implies that an increase of 1 apple brings about a reduction by 1 orange.

1. The apartment was so cool, but there is no bus stop within miles and I don't have a car. Rent

Not rent

2. The renting agent says I have to rent for at least one year. But I'm not sure how many months I'll be in town.

Rent

Not rent

3. I'm not sure how many months I'll be in town. The renting agent says I can leave with 30 days notice.

Rent

Not rent

4. It fits my budget, and I can get to school and work easily.

Rent

Not rent

5. The apartment is great! Bigger bath than I have at home. Close to work! Rent is reasonable! On the "down side," I like cranking my tunes, but the walls are thin and this apartment is loaded with retirees. Plus, they don't allow pets, and I'm thinking about getting a pet boa constrictor.

Rent

Not rent

6. I did my homework on the landlord and found out he has a lot of complaints against him from former renters. He never repairs problems in apartments and never gives deposits back without a fight.

Answers

The apartment was so cool, but there is no bus stop within miles and I don't have a car. This was the based on the not rent. Thus, option (b) is correct.

The renting agent says I have to rent for at least one year. But I'm not sure how many months I'll be in town. This was the based on the rent. Thus, option (a) is correct.

I'm not sure how many months I'll be in town. The renting agent says I can leave with 30 days notice. This was the based on the rent. Thus, option (a) is correct.

What is rent?The term rent refers to the based on the deal with the landlord and tenant's. The landlord was the received the payment on the behalf of the give the property was the used.

It fits my budget, and I can get to school and work easily. This was the based on the rent.

The apartment is great! A bigger bath than I have at home. This was the based on the rent.

I did my homework on the landlord and found out he has a lot of complaints against him from former renters. This was the based on the not rent.

As a result, the significance of the sentence are rent or not rent are the aforementioned.

Learn more about on rent, here:

https://brainly.com/question/26268428

#SPJ1

What ethical dilemmas do you think professionals in the marketing and advertising industry face? Explain.

Answers

Answer:

knowing how to play on emotions but also not make people feel like terrible human beings?

Explanation:

Record the following transactions on the books of Vaughn Manufacturing (Omit cost of goods sold entries.) (Credit account titles are automatically indented when amount is entered. Do not indent manually.) (a) On July 1, Vaughn Manufacturing sold merchandise on account to Stacey Inc. for $22,600, terms 3/10, n/30. (b) On July 8, Stacey Inc. returned merchandise worth $2,500 to Vaughn Manufacturing. (c) On July 11, Stacey Inc. paid for the merchandise. No. Date Account Titles and Explanation Debit Credit (c)

Answers

Stacey Inc. returned merchandise worth $2,500 to Vaughn Manufacturing.

(a) On July 1, Vaughn Manufacturing sold merchandise on account to Stacey Inc. for $22,600, terms 3/10, n/30.

Step 1: Record the sale on account

Date: July 1

Account Titles and Explanation | Debit | Credit

Accounts Receivable - Stacey Inc. | 22,600 |

Sales Revenue | | 22,600

(b) On July 8, Stacey Inc. returned merchandise worth $2,500 to Vaughn Manufacturing.

Step 2: Record the return of merchandise

Date: July 8

Account Titles and Explanation | Debit | Credit

Sales Returns and Allowances | 2,500 |

Accounts Receivable - Stacey Inc. | | 2,500

(c) On July 11, Stacey Inc. paid for the merchandise.

Step 3: Calculate the payment amount after the return and discount (3%)

Payment Amount = (22,600 - 2,500) * (1 - 0.03) = 20,100 * 0.97 = 19,497

Step 4: Record the payment

Date: July 11

Account Titles and Explanation | Debit | Credit

Cash | 19,497 |

Sales Discounts | 603 |

Accounts Receivable - Stacey Inc. | | 20,100

For more about merchandise worth:

https://brainly.com/question/23877321

#SPJ11

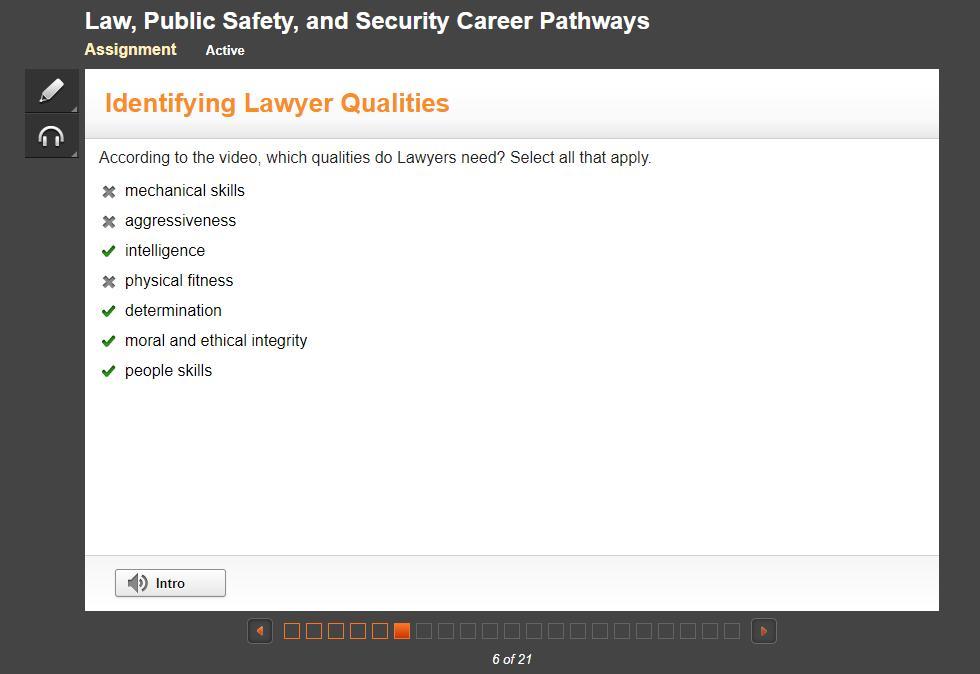

According to the video, which qualities do Lawyers need? Select all that apply.

x mechanical skills

x aggressiveness

intelligence

x physical fitness

determination

moral and ethical integrity

people skills

Answers

Answer:

C E F G

Explanation:

According to the video, The qualities Lawyers need, The first is intelligence, the second one was determination, moral and ethical integrity people skills.

What are skills?A skill is the acquired capacity to move with deliberate intent and good execution, frequently in a pre-determined window of time or energy or both. Domain-general and domain-specific skills are two common categories of skills.

As, The qualities the lawyer needs in the Curveballs will probably be thrown throughout a case session, and they must be able to understand them and react accordingly.

As, The important quality, the lawyer needs is zeal for one's work. Successful attorneys nearly usually have a genuine enthusiasm for what they do as a profession.

Therefore, The right option (C, E, F, G)) is correct.

Learn more about skills here:

https://brainly.com/question/28464758

#SPJ6

too many rigid rules and regulations in place, his managers' ability to influence others will be influenced by which contingency factor? question 46 options: low visibility low centrality low discretion

Answers

Answer: Im guessing mainly for the points so i can give people more when i have a question i have no clue what this question is but im big brain so yeah but i think its LOW DISCRETION

Explanation: There isn't one it's just ONE option

6. Which of the following describes a non-employee business? (1 point)

an architect who has only a part-time assistant

a small ice cream shop where only one person works at a time

a person who works from home for a larger company

a manicurist who works from her home or at clients houses

Answers

Answer:

a manicurist who works from her home or at clients’ houses

Explanation:

What are the five C's of the marketing mix

Answers

The 5Cs in the marketing mix are Company, Collaborators, Customers, Competitors, and Context.

What is a Marketing mix?The marketing mix is the collection of activities, or tactics, that a business employs to market its brand or merchandise.

A marketing framework called the 5C Analysis is used to examine the environment in which a company operates.

Along with risk exposure to various environmental factors, it can shed light on the main success factors. The 5Cs are Company, Collaborators, Customers, Competitors, and Context.

Learn more about marketing mix here:

https://brainly.com/question/28395764

#SPJ1

If real gdp per capita in the united states is $8,000 in 2022, and if real gdp per capita is $12,000 in 2032, what is the total percent change in the growth rate of gdp per capita between 2022 and 2032?

Answers

To calculate the total percent change in the growth rate of GDP per capita between 2022 and 2032, we need to use the formula for the compound annual growth rate (CAGR). The formula for CAGR is ((Ending Value/Beginning Value)^(1/Number of Years))-1.

So, using the values given in the question, we can calculate the CAGR as ((12,000/8,000)^(1/10))-1. This gives us a CAGR of 4.1%.

Therefore, the total percent change in the growth rate of GDP per capita between 2022 and 2032 is 41% (calculated by multiplying the CAGR by 10 years).

This means that the real GDP per capita in the United States is expected to grow by 41% between 2022 and 2032. This growth rate is a positive sign for the economy, as it indicates that the country is becoming more prosperous and people are becoming wealthier. This growth could be driven by various factors, such as technological advancements, increased productivity, and investment in infrastructure and education.

to know more about GDP per capita click this link

brainly.com/question/31443762

#SPJ11

describe how net profit of a business is calculated?

Answers

Answer:

u must work out the total cost and variable cost and add them up, then you must count all your sales and figure out ur revenue. then u do ur total revenue minus ur total costs

mark as brainliest

The formula to calculate profit is: Total Revenue - Total Expenses = Profit. Profit is determined by subtracting direct and indirect costs from all sales earned. Direct costs can include purchases like materials and staff wages. Indirect costs are also called overhead costs, like rent and utilities.

For businesses, profit is often calculated by profit margin formula:follow me nice business

How does hard work help our economy?

Answers

Answer:How important is hard work for avoiding poverty?The phrase, “Pull yourself up by your own bootstraps” is one that is embedded in the American lexicon. As we have discussed in earlier modules, this is often the predominant mind set when it comes to explaining poverty. There is a widespread belief that with hard work and effort, anyone can avoid falling into poverty. In your group, ask yourselves, to what extent do you feel that hard work is sufficient for achieving economic success?The Role of Motivation and Hard WorkIn our research, we have given considerable thought to the role that motivation and hard work plays in getting ahead. In the course of writing Chasing the American Dream, we talked with dozens of people from many walks of life around this topic. Our overall conclusion is that hard work is a necessary but not a sufficient condition for getting ahead. In other words, hard work and effort are generally important ingredients for reaching one’s goals in life, but they do not guarantee success in and of themselves.We can think about this relationship in the following way. It is difficult to imagine individuals doing well in life without a decent amount of effort and work. Even for those born into wealth, hard work and motivation are generally required for reaching one’s goals. And for those starting with much less, hard work and initiative would appear to be essential.On the other hand, we have talked with many people who have worked very hard throughout their adult lives, but have struggled to achieve economic success. During the course of a year, we interviewed women and men who have worked extremely hard but nevertheless found themselves in poverty or close to poverty.A Hard Working ExampleWe asked one such woman who was interviewed for our Chasing the American Dream book about how the general notion of the American Dream stacked up against the economic realities that she had seen.I think for most people it’s sort of a Horatio Alger’s thing of going from rags to riches. That anybody through their own hard work can pull themselves up in this country. But I think a whole lot of people have worked really hard and not been able to pull themselves up.My dad worked really, really hard. And the only reason he had $10,000 in the bank when he died is because his brother died and left him some. And then his house sold for a little over $20,000. And this is from a guy who worked his tail off his whole life long. He had paid employment until after age 80 despite his physical disabilities. So, hard work doesn’t necessarily get you ahead. I know that.We then asked her, “How does this experience affect your sense of fairness?”Well it makes me mad that things are not fair and that we don’t value hard work. And, in fact, one of the surest indicators for how hard you’ll have to work is your income. The people with lower incomes will have to work harder from a standpoint of backbreaking physical labor.You know, I make a lot more money than Elaine Nelson from my church. But she mops floors down at St. Peters Hospital and changes sheets and makes sure that the operating room is sanitary so that people can go home without a staph infection. Her work is really essential, but she’s only making like $9 or $10 an hour to do that kind of work. And I take her to places to get help with her utilities and take her to the food pantry at my church now and then ‘cause she doesn’t have a car. And she’s faced an eviction so many times since I’ve known her.And to me, that’s just so unfair that a person that does really important work that cares for our community… You know, having a safe, clean hospital is a very important thing. Why don’t we reward that adequately? It makes me really mad.Hard Work May Not Be EnoughWhat this woman and many like her discussed in our interviews relates to the fact that there are simply not enough decent-paying jobs to support all Americans. In an earlier module (Module 6) we relied on the analogy of musical chairs to illustrate the mismatch between the number of individuals in need of a decent paying job versus the limited number and availability of such jobs. The result is that for some Americans, no matter how hard they work, they still may not be able to get ahead economically.Do you agree that hard work is a necessary but not a sufficient condition for getting ahead? Can you point to examples of people you know that would confirm this? Are there cases where hard work may not be important in getting ahead? How is this accomplished? Overall, how important is motivation and determination in avoiding poverty? These are some of tque