Required information [The following information applies to the questions displayed below] Nicole's Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness programs at NGS. The machine was purchased at the beginning of the year at a cost of $18,500. The estimated useful life was five years and the residual value was $1,500. Assume that the estimated productive life of the machine is 10,000 hours. Expected annual production was year 1, 2,200 hours: year 2,2,400 hours; year 3,2,300 hours; year 4,2,100 hours; and year 5,1,000 hours. Required: 1. Complete a depreciation schedule for each of the alternative methods. a. Straight-line. b. Units-of-production. c. Double-declining-balance.

Answers

To complete the depreciation schedule for each of the alternative methods (straight-line, units-of-production, and double-declining-balance), we will use the following information:

Machine cost: $18,500

Residual value: $1,500

Useful life: 5 years

Expected annual production hours: Year 1: 2,200 hours; Year 2: 2,400 hours; Year 3: 2,300 hours; Year 4: 2,100 hours; Year 5: 1,000 hours

a. Straight-line Depreciation:

The straight-line depreciation method allocates an equal amount of depreciation expense over the useful life of the asset.

Depreciation Expense per Year = (Machine Cost - Residual Value) / Useful Life

Depreciation Expense per Year = ($18,500 - $1,500) / 5 = $3,400

Depreciation Schedule for Straight-line Method:

Year 1: $3,400

Year 2: $3,400

Year 3: $3,400

Year 4: $3,400

Year 5: $3,400

b. Units-of-Production Depreciation:

The units-of-production method allocates depreciation based on the actual usage or production of the asset.

Depreciation Expense per Hour = (Machine Cost - Residual Value) / Total Estimated Production Hours

Depreciation Expense per Hour = ($18,500 - $1,500) / (2,200 + 2,400 + 2,300 + 2,100 + 1,000) = $6.34 per hour

Depreciation Expense per Year = Depreciation Expense per Hour * Actual Production Hours

Depreciation Schedule for Units-of-Production Method:

Year 1: $6.34 * 2,200 hours = $13,948.00

Year 2: $6.34 * 2,400 hours = $15,216.00

Year 3: $6.34 * 2,300 hours = $14,582.00

Year 4: $6.34 * 2,100 hours = $13,314.00

Year 5: $6.34 * 1,000 hours = $6,340.00

c. Double-Declining-Balance Depreciation:

The double-declining-balance method applies a depreciation rate that is double the straight-line rate and applies it to the remaining book value of the asset each year.

Depreciation Rate = (1 / Useful Life) * 2

Depreciation Rate = (1 / 5) * 2 = 0.4 or 40%

Depreciation Schedule for Double-Declining-Balance Method:

Year 1: Beginning Book Value = $18,500

Depreciation Expense = Beginning Book Value * Depreciation Rate = $18,500 * 40% = $7,400

Ending Book Value = Beginning Book Value - Depreciation Expense = $18,500 - $7,400 = $11,100

Year 2: Beginning Book Value = $11,100

Depreciation Expense = Beginning Book Value * Depreciation Rate = $11,100 * 40% = $4,440

Ending Book Value = Beginning Book Value - Depreciation Expense = $11,100 - $4,440 = $6,660

Year 3: Beginning Book Value = $6,660

Depreciation Expense = Beginning Book Value * Depreciation Rate = $6,660 * 40% = $2,664

To know more about depreciation here

https://brainly.com/question/1203926

#SPJ4

Related Questions

compensating balances and effective annual rates industries has a line of credit at bank two that requires it to pay % interest on its borrowing and to maintain a compensating balance equal to % of the amount borrowed. the firm has borrowed $ during the year under the agreement. calculate the effective annual rate on the firm's borrowing in each of the following circumstances: a. the firm normally maintains no deposit balance at bank two. b. the firm normally maintains $ in deposit balance at bank two. c. the firm normally maintains $ deposit balance at bank two. d. compare, contrast, and discuss your findings in parts a, b, and c. question content area bottom part 1 a. if the firm normally maintains no deposit balance at the bank, the effective annual rate of interest is enter your response here%. (round to two decimal places.)

Answers

The effective annual rate will be higher when a deposit balance is maintained because it reduces the effective borrowing amount, resulting in a higher interest expense as a percentage of the effective borrowing amount.

To calculate the effective annual rate (EAR) on the firm's borrowing in each circumstance, we need to consider the interest rate and the compensating balance requirement.

a. If the firm normally maintains no deposit balance at the bank, the effective annual rate of interest can be calculated as follows:

1. Calculate the interest expense: Multiply the borrowing amount ($x) by the interest rate (%y) to get the interest expense.

2. Calculate the compensating balance requirement: Multiply the borrowing amount ($x) by the compensating balance percentage (%z) to get the compensating balance requirement.

3. Calculate the effective borrowing amount: Subtract the compensating balance requirement from the borrowing amount to get the effective borrowing amount.

4. Calculate the EAR: Divide the interest expense by the effective borrowing amount, then multiply by 100 to get the EAR as a percentage.

b. If the firm normally maintains $ in deposit balance at the bank, follow the same steps as in part a, but subtract the deposit balance from the borrowing amount before calculating the compensating balance requirement.

c. If the firm normally maintains $ deposit balance at the bank, follow the same steps as in part a, but add the deposit balance to the borrowing amount before calculating the compensating balance requirement.

d. Compare and discuss the findings in parts a, b, and c. Analyze how the presence or absence of a deposit balance affects the effective annual rate. Consider the impact on the interest expense and the effective borrowing amount.

Therefore, the effective annual rate will be higher when a deposit balance is maintained because it reduces the effective borrowing amount, resulting in a higher interest expense as a percentage of the effective borrowing amount. Conversely, when no deposit balance is maintained, the effective borrowing amount is higher, resulting in a lower interest expense as a percentage of the effective borrowing amount.

Learn more about annual rate from the below link:

https://brainly.com/question/31261623

#SPJ11

The effective annual rate (EAR) is the total annualized cost of borrowing, taking into account both the interest rate and any compensating balances required by the bank. To calculate the EAR, we need to consider the interest rate and the compensating balance requirement.

a. If the firm normally maintains no deposit balance at the bank, the effective annual rate of interest can be calculated as follows:

Step 1: Calculate the amount of compensating balance required:

Compensating balance = 0% of the amount borrowed = $0

Step 2: Calculate the interest paid on the borrowed amount:

Interest paid = % interest rate x amount borrowed = % x $ = $

Step 3: Calculate the effective annual rate (EAR):

EAR = (Interest paid / (Amount borrowed - Compensating balance)) x (365 / Loan period)

= ( $ / ($ - $0)) x (365 / 1)

= ( $ / $) x 365

= 365%

When the firm maintains no deposit balance, the effective annual rate of interest is equal to the interest rate itself. This means that the total annualized cost of borrowing is solely determined by the interest rate charged by the bank. In this case, the EAR is 365%, indicating that the firm is not receiving any benefits from maintaining a deposit balance at the bank.

To know more about effective annual rate visit:

https://brainly.com/question/28347040

#SPJ11

Harry’s shoe store has noticed a significant increase of revenue of $123,000. The manager has also determined that the total expenses equal to $128,000. Will this business net a profit or loss? _____ How much of a profit or loss?_____

Answers

Answer:

Net loss; $5,000

Explanation:

$123,000 (income)

- 128,000 (expenses)

_________________

-5,000

QUESTION 3 of 10: Two major circus acts have agreed to perform at the stadium if they can get seven consecutive days each. On average,

each performance will provide a profit margin of $35,000 for the stadium. How much will the stadium's profit margin be if it signs both acts to

one-week deals?

a) $100,000

b) $250,000

c) $490,000

d) $500,000

Answers

35000x7 = 245000

245000x2 = 490000

There are 2 acts, and they want to perform for 7 consecutive days each. The stadium gets $35000 per performance, and there will be a total of 14 performances. This means that the stadium will have a profit margin of $490000.

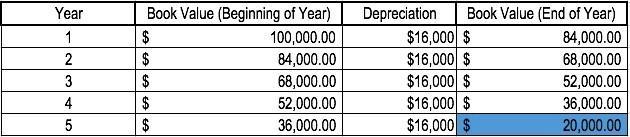

Use the sum-of-year depreciation method to calculate the depreciation for the

following scenario. Company XYZ bought a new machine for $100,000 and

expects the machine will last for 10 years.

Answers

Answer:

20%

Explanation:

How to Calculate Straight Line Depreciation

The straight line calculation steps are:

Determine the cost of the asset.

Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount.

Determine the useful life of the asset.

Divide the sum of step (2) by the number arrived at in step (3) to get the annual depreciation amount.

Straight Line Example

Company A purchases a machine for $100,000 with an estimated salvage value of $20,000 and a useful life of 5 years.

The straight line depreciation for the machine would be calculated as follows:

Cost of the asset: $100,000

Cost of the asset – Estimated salvage value: $100,000 – $20,000 = $80,000 total depreciable cost

Useful life of the asset: 5 years

Divide step (2) by step (3): $80,000 / 5 years = $16,000 annual depreciation amount

Therefore, Company A would depreciate the machine at the amount of $16,000 annually for 5 years.

The depreciation rate can also be calculated if the annual depreciation amount is known. The depreciation rate is the annual depreciation amount / total depreciable cost. In this case, the machine has a straight-line depreciation rate of $16,000 / $80,000 = 20%.

Assume that the MPC is 0.75. If government spending increases by $400, equilibrium output ______; and if taxes increase by $400, equilibrium output ______.

Answers

Equilibrium output will decrease by $1200 if taxes increase by $400.

Assuming that this is a closed economy with no international trade and no investment, the impact of changes in government spending and taxes on equilibrium output can be determined using the Keynesian Cross Model.

In this model, equilibrium output (Y) is determined by the intersection of aggregate demand (AD) and aggregate supply (AS), where AD is the sum of consumption (C), investment (I), government spending (G), and net exports (NX), and AS is the total quantity of goods and services that firms are willing to produce and sell at each price level.

The formula for the MPC (Marginal Propensity to Consume) is the change in consumption divided by the change in income. In this case, the MPC is 0.75, which means that for every additional dollar of income, people will spend 75 cents.

If government spending increases by $400, this will increase aggregate demand by $400, since government spending is one component of AD. Using the formula for the Keynesian multiplier (1/1-MPC), we can calculate the total increase in equilibrium output as:

ΔY = (1/1-0.75) x $400 = $1600

Therefore, equilibrium output will increase by $1600 if government spending increases by $400.

If taxes increase by $400, this will decrease disposable income by $400, which will reduce consumption by $300 (since the MPC is 0.75). Using the same formula for the Keynesian multiplier, we can calculate the total decrease in equilibrium output as:

ΔY = (1/1-0.75) x -$300 = -$1200

Therefore, equilibrium output will decrease by $1200 if taxes increase by $400.

To learn more about equilibrium here

https://brainly.com/question/517289

#SPJ4

damien co. has $10,000 of unearned revenues on its balance sheet. damien expects that it will earn $8,000 of these revenues in the upcoming twelve months. how much will be recorded in long-term liabilities?

Answers

Damien co. has $10,000 of unearned revenues on its balance sheet. damien expects that it will earn $8,000 of these revenues in the upcoming twelve months. $2,000 will be recorded in long-term liabilities.

The financial balance of an organization is summarized on the financial balance sheet, whether the entity is a sole proprietorship, business partnership, corporation, limited liability company, or several another type of entity such as a government or non-profit organization.

From a certain date, such as the end of the financial year, equity, liabilities, and assets are listed. A "snapshot of a company's financial health" is how the balance sheet is often called. The balance sheet is one of the only four basic financial statements that apply to a single point in a company's calendar year.

to know more about Balance sheet here-

https://brainly.com/question/26323001

#SPJ4

Josh is a full-time college student who is not working or looking for a job. The bureau of labor statistics counts josh as.

Answers

The bureau of labor statistics counts Josh a full-time college student who is not working or looking for a job as labor force.

What is labor force?Labour force can be defined as the number of people in the country who work and are also capable of working. They are people who are willing and able to work.

It is to be noted that the total number of people who are currently employed plus the number of people who are unemployed and seeking employment refers to labor force.

Hence, Josh a full-time college student who is not working or looking for a job can be termed as labor force.

Learn more about labor force here : https://brainly.com/question/333305

Which of the following could be considered collateral for a loan? (Select all that apply.)

A. buildings

B. inventory

C. machinery

D. wages

Answers

Option B: inventory

Collateral is simply an asset, such as a car or home, that a borrower offers up as a way to qualify for a particular loan. collateral can make a lender more comfortable extending the loan since it protects their financial stake if the borrower ultimately fails to repay the loan in full.

The biggest risk of a pawn loan is that you can lose your assets if you don't repay the loan. it's especially dangerous if you back your loan with a very valuable asset like your home. It requires you to have valuable assets.

many banks and credit unions offer savings accounts, certificates of deposit (CD) funds, or secured personal loans, which are personal loans secured by your car. for this reason, these loans are sometimes referred to as mortgages. often there is no limit to these types of credits.

Learn more about collateral for a loan here https://brainly.com/question/1397667

#SPJ2

Scenario: NewTel, Inc.

NewTel is a telephone company with a policy of filling positions internally, through promotions, rather than hiring from outside. Until recently, the company had a strong engineering focus and tended to promote people into senior executive positions from the engineering areas. Consequently, almost all of the company’s 14 senior executives joined the company over 20 years ago in junior engineering positions. There is increasing pressure on NewTel to become more marketing and service-oriented. As a result, four people were hired last year from consumer products and retail firms to fill new senior executive positions in marketing and service management. The external hires were necessary because current employees were not sufficiently qualified. Now there are signs of tension among senior executives, particularly during budget deliberations where there is limited discretionary spending on new corporate activities. The four new hires have been frustrated in their attempts to have the company put more money into marketing and customer services instead of technology investment. The conflict episodes are viewed by both sides as personal attacks rather than attempts to resolve the problem.

The four new hires’ attempt to have the company put more money into marketing and customer services instead of technology investment. This is mainly an example of conflict due to:

A. role ambiguity.

B. lack of communication.

C. sequential task interdependence.

D. overt behaviors.

E. goal incompatibility.

Answers

Answer:

E. goal incompatibility.

Explanation:

Analyzing the scenario above, it is possible to see that the cause of the conflict is due to incompatibility of goals, that is, there are different objectives and goals between the teams and organizational departments, which causes a lack of consensus that culminates in the conflict.

This is a negative situation for the company, which is a set of systems that must operate in favor of the same objectives and goals. in order to listen to all the parties involved, and then start from a principle where everyone feels heard and integrated in the development of organizational goals, creating an environment of trust and positive relationship in the company.

Cultures that score high on the Uncertainty Avoidance Index

O seldom experience much stress.

O take an empirical approach to knowledge.

O enjoy ambiguity.

O value security and try to always follow the rules.

Answers

Answer:

seldom experience much stress.

Explanation:

countries that have high levels of uncertainty avoidance tend to be less stress-prone and more likely to take an empirical approach to knowledge. They also generally enjoy ambiguity and value security.

It is difficult to say definitively what the effects of scoring high on the Uncertainty Avoidance Index are, as every culture is different. However, in general, it seems that cultures that score higher on this index tend to experience more stress, take an empirical approach to knowledge, and value security more. They may also try to always follow the rules, which can lead to a feeling of rigidity.

31.4X R. James drew up the following statement of financial position on 31 December 2017. Statement of Financial Position of R. James as at 31 December 2017 $ Non-current assets Furniture and fittings Motor vehicles Current assets Inventory Accounts receivable Cash at bank Less Current liabilities Accounts payable Net current assets Capital 1 January 2017 ⁸0 7,870 When checking the books, the following errors and omissions were found. (i) A purchase of fittings, $140, had been included in the ******ebook converter DEMO Watermarks******* purchases account. (ii) Motor vehicles should have been depreciated by $280. (iii) A debt of $41 included in accounts receivable was Required: (a) show your calculation of the correct net profit (b) draw up a corrected statement of affairs as at 31 December 2017.

Answers

(a) the corrected net profit is: Capital 1 January 2017 + Net current assets - Non-current assets = $7,870 + ($0 - $140) - $7,590 = $140 b) Total capital $8,010

a) To calculate the correct net profit, we need to adjust for the errors and omissions found. Firstly, the purchase of fittings that was included in the purchases account should have been included in the furniture and fittings non-current asset account.

Therefore, we need to deduct $140 from the purchases account and add it to the furniture and fittings account. Secondly, the motor vehicles should have been depreciated by $280, which means we need to reduce the value of the motor vehicles account by $280. Finally, the debt of $41 that was included in accounts receivable was not paid, so we need to deduct it from the accounts receivable account.

So, the adjusted statement of financial position is:

Non-current assets:

Furniture and fittings $140

Motor vehicles $7,590 (original value of $7,870 - $280 depreciation)

Current assets:

Inventory

Accounts receivable $0 (original value of $41 - $41 debt)

Cash at bank

Less Current liabilities:

Accounts payable

Net current assets:

Capital 1 January 2017

Therefore, the corrected net profit is:

Capital 1 January 2017 + Net current assets - Non-current assets = $7,870 + ($0 - $140) - $7,590 = $140

(b) The corrected statement of affairs as at 31 December 2017 is:

Non-current assets:

Furniture and fittings $140

Motor vehicles $7,590

Current assets:

Inventory

Accounts receivable $0

Cash at bank

Less Current liabilities:

Accounts payable

Net current assets: $0

Capital 1 January 2017 $7,870

Add: Corrected net profit $140

Total capital $8,010

For more such questions on net profit

https://brainly.com/question/28390284

#SPJ11

Which of the following are most commonly included in a benefits package for

an American working full time for an international corporation?

A. Guaranteed annual increases in salary and benefits

B. Child tuition support and use of a company vehicle

C. Health insurance, vacation time, and sick leave

O D. Company funded opportunities to travel abroad

Answers

Answer: health insurance, vacation time, and sick leave

Explanation:

A PE.

What is the purpose of a design brief?

Answers

How education is medium to enhance the ability of human beings?

Answers

The general education of a populace enhances the overall ability of humans by allowing a greater number of humans to be given the (intellectual) tools necessary (in agreence with Rene Descartes theory of obtaining “new knowledge” to improve upon previously held inclinations or even create new ones in order to increase efficiency or another set of reasons one might alter their natural inclinations. With that being said, general education is a tool that, when used properly, can be used to increase the overall ability of humans by means of increased intellectual ability.

wth fill in the blanks

Bankruptcy

Cash

Check

Credit

Debit

Debt

Foreclosure

Expenditures

Credit Card

Debit Card

Impulse Buying

Long-Term Goals

Needs

Short-Term Goals

Wants

Budget

Discretionary Income

Fixed Expenses

Variable Expenses

Scarcity

(not all the words are being used)

1. The amount of financial trust extended to a person or a business by a lender; a loan.

2. Money owed.

3. A legal process that gives a debtor protection from creditors.

4. Goods or services that make people more comfortable or content but which are not necessary for survival.

5. Goods or services that people cannot survive without, such as water, food, shelter, and clothing.

6. Money that is spent on goods, services, and bills.

7. A purchase based on an immediate want or due to the pressure of advertising.

8. Plans that take a year or more to accomplish.

9. Plans that can be accomplished within three months to a year.

10. A record of income and spending and a plan for managing money.

11. Money available to spend on goods and services that are not essential.

12. The economic condition of limited resources that prevents people from having everything they want.

13. Expenses that do not change from month to month, such as auto insurance or rent.

Answers

Answer:

1. Credit 2. Debt 3. Bankruptcy 4. Wants 5. Needs 6. Cash 7. Impulse Buying 8. Long-term goals 9. Short-term goals 10. Budget 11. Discretionary income 12. Scarcity 13. Fixed Expenses

Explanation:

The costs of producing, distributing and promoting the product will all influence the product's:

Answers

The costs of producing, distributing and promoting the product will all influence the product's PRICE

What are products?Products are goods and services offered by an organization. These products can be tangible or intangible. Most intangible products are in form of ideas.

The costs of producing, distributing and promoting the product will all influence the product's price. The higher the price, the lower the level of demand and vice versa.

Learn more on product price here; https://brainly.com/question/24494976

#SPJ12

Elevating the risk decision up the chain-of-command is part of what risk management principle?

Answers

Making risk decisions at the right level in the chain of command is part of the risk management principle.

What is a chain of command?

"Chain of command" in an organisational structure refers to a company's hierarchy of reporting connections, or who must answer to whom from the bottom to the top of an organisation. The chain of command outlines a company's lines of authority and decision-making power in addition to establishing responsibility. Every activity, job position, and department must have one person taking accountability for performance, which is ensured by an appropriate chain of command.

The succession of commands is not a coincidence. It is the final stage that organisational designers take when building an organisational structure. Since organisational structure must complement strategy, planners start by taking into account a company's objectives. The tasks required to accomplish the goals are the next step for designers.

Designers then determine how to divide up the duties into departments. Sharing resources, communication, and task coordination are all impacted by grouping. Designers allocate responsibility for tasks and areas after departmentalizing. Planners can ultimately map out the connections between roles to establish a chain of command once authority has been delegated.

Learn more about the chain of command from the link below

https://brainly.com/question/28334510

#SPJ4

How did the goal described in this excerpt most affect the u. S. Economy?.

Answers

The described goal that most affect the economy according to the excerpt is when Federal Reserve raised interest rates to control inflation.

What was described in the excerpt?The excerpt quoted George Bush speech about the Iraqis and how their relationship with Saddem Hussein will most affect them and their economy.

However, the goal that most affect the economy according to the excerpt is if Federal Reserve raised interest rates to control inflation.

Therefore, the Option A is correct.

Read more about Federal Reserve

brainly.com/question/25817380

PLZZ HELP

just need 50 words for a justification on this topic.....that's all....plzzzzz.......its worth max points so plzzzz make it good.

Analyse how Nike has dominated globally throughout the decades and drives the economy.

Answers

Every company develops a brand reputation. Sometimes it helps the company bring in more revenue, and sometimes it plays against it. That's not the case for Nike, which by sponsoring many high-profile athletes and sports teams all over the world has become one of the most recognized global symbols.

Strong branding is just one of Nike's many competitive advantages. A culture of innovation, plenty of international opportunities for revenue expansion, and significant pricing power make this stock a must watch. Its shares are up almost 50% since early January, but this may be just the beginning.

Founded in 1964 by University of Oregon track athlete Philip Knight and his coach Bill Bowerman, Nike has become a leading player in the athletic footwear and apparel industry. Over the past 40 years, the company has built several competitive advantages:

Strong Brand: Nike has been able to establish strong emotional connections with athletes by building one of the most widely recognized brands in the world. Interbrand puts Nike in the 26th position of its Best Global Brands 2012 Ranking, well above Adidas , which is in the 60th position. Pricing Power: Nike's strong brand has enabled the company to set high prices, and therefore enjoy a higher gross margin in footwear than most of its competitors. Just in the latest quarter, the company posted an increase of 110 basis points in gross margin to 43.9%. Global Supply Chain: With more than 1000 factories worldwide and 1 million workers employed, Nike's supply chain overshadows any other competitor. The company has the resources needed to supply the world with top-quality shoes without any trouble.

These advantages have allowed the company to more than double its revenue in the past 10 years. As earnings per share grew at a compounded rate of 15%, management returned over $15 billion to shareholders via dividend payments and share repurchases. The key behind these figures is massive growth. It took the company 18 years to earn its first $2 billion in revenue. By growing 8% in 2012, the company added that much in just 12 months.

Emerging markets are a massive opportunity for Nike. Asia and Latin America in particular are set to become the firm's primary growth engines. Both regions will continue experiencing strong demand for its products due to increasing economic prosperity and a strong interest in sports.

The brand is already the leading player in China with more than $2.4 billion in sales in 2012. Because of increasing competition coming from Adidas and Hennes & Mauritz, however, Nike's inventories have started to grow faster than its sales after growing its business 23% between 2011 and 2012. That being said, Nike still has plenty of room left for discounts in order to protect its leading position from Adidas.

Brazil is another key market. According to the company's latest letter to shareholders, management is preparing a marketing plan more ambitious than anything they have done before for the 2014 World Cup and the 2016 Olympics.

Nike's classic rival, Adidas, became stronger after the 2006 acquisition of Reebok. The German sports equipment maker is making steady progress in international expansion, and will also benefit from a sales boost coming from the World Cup next year as it will be sponsoring strong teams, such as Germany, Argentina and Spain. However, by securing more than half of the teams in the 2010 World Cup, including the French and Brazilian national soccer teams, Nike will be the main figure.

The industry certainly looks fierce. That should not be a problem for Nike, however, which has all the competitive advantages needed to keep its leading position in the global athletic footwear, apparel, and equipment market, which is worth as much as $284 billion. With more than a thousand factories all over the world and one of the strongest global brands ever created, Nike is well prepared to capitalize on its emerging markets business and welcome one billion new consumers on the way.

Consumers have to make tradeoffs in deciding what to consume because.

Answers

Consumers have to make tradeoffs in deciding what to consume because of the scarcity of resources relative to the unlimited wants and needs that people have.

Consumers have limited income, time, and other resources, so they must prioritize their spending and make choices about what goods and services to consume based on their preferences and available resources.

These tradeoffs are necessary because consumers cannot have everything they want, and every decision to consume one good or service means giving up the opportunity to consume something else. For example, choosing to spend money on a luxury item like a fancy dinner or a new designer outfit means sacrificing the opportunity to save or spend on other goods or services.

To know more about tradeoffs click here

brainly.com/question/26477884

#SPJ11

Why do you think it will be important to stay flexible if your goals change as you get

older?

Answers

Answer:

You will feel stronger once you gain a bit of flexibility, simply because that flexibility gives you the range of motion to let your muscles work more efficiently. Maintaining flexibility will aid in muscle and joints health, which can keep older adults doing their favorite daily activities and remain independent.

Drag each option to the correct location.

Match the scenarios to the factors that affect the labor market.

foreign direct investment

outsourcing

immigration

Answers

Each scenario should be matched to the factors that affect the labor market as follows:

Immigration: Carlos is moving from Mexico to the United States because he got a job in a bank. He had his interview last month, and the bank agreed to hire him because he was willing to work for 10% less than most American workers, even though he has the same qualifications.Foreign direct investment: A US supermarket chain is going to open a few supermarkets in Europe because a recent survey showed that the chain has a huge potential for profits in Europe.Outsourcing: A renowned US information technology firm has recently signed a contract with a company based in the Philippines. The Filipino company will handle the accounts of the US firm. The US firm made this decision to reduce labor costs.What is immigration?Immigration can be defined as the movement of a group of people from one geographical region to another geographical destination such as a city, especially in search of any of the following:

Good governanceSecurityBetter living conditions.WorkJobsSocial amenitiesWhat is a foreign direct investment?A foreign direct investment (FDI) simply refers to a type of investment which is made by an individual or business organization (investor) into an investment market that is located in another country.

In conclusion, an example of foreign direct investment (FDI) is a US supermarket chain that is planning to open a few supermarkets in a country in Europe.

Read more on immigration here: brainly.com/question/9809956

#SPJ1

Answer:

Post Test: Free Market and Businesses

Unit: 2

Economics

Question #12

__________________________________________________________

This is 100% right because I took the test

Go to explanation for picture with answers

l

l

∨

Explanation:

Here's the picture and I hope this helped!

Have a nice day!

When a hotel does not fill a room and therefore the sale of that room on that day is lost forever, that refers to...

a.) product services-mix length

b.) seasonability

c.) perishability

d.) productservices-mix width

e.) tangible

Answers

Answer:

c.) perishability

Explanation:

The term perishability is used in marketing to describe the inability to keep or store services for sale in the future. Services are intangible and by nature. Once a service has been performed, it is deemed to have been consumed and cannot be returned or resold.

Once a service is offered, and the customer does take up the offer, it cannot be stored or kept for sale at a later date. If a hotel room is not booked for a particular night, the room does not generate any revenues for that night. The hotel cannot store the room services for that night and offer them to customers any other time. The inability to preserve a service for sale at a later date is what marketers refer to as perishability.

52. The greatest advantage of using a credit card is that it provides

A. An easy way to establish a personal credit history.

B. An easy way to avoid going into debt.

C. A less expensive way to pay for college.

D. A safe way to improve one's credit score.

Answers

The greatest advantage of using a credit card is that it provides a safe way to improve one's credit score. Option D

What is a credit card score?A credit score is a three-digit figure that lenders use to determine how hazardous lending money to someone is. A good credit score indicates that a person is a low-risk borrower, which may result in cheaper loan interest rates in the future.

A poor credit score indicates a high-risk borrower, which may result in higher interest rates and less favorable loan terms.

Learn more about credit card at https://brainly.com/question/26867415

#SPJ1

when do diminishing marginal returns occur

Please help!!!!!!!

Answers

Answer:

Diminishing Marginal Returns occur when increasing one unit of production, whilst holding other factors constant – results in lower levels of output. In other words, production starts to become less efficient. For example, a worker may produce 100 units per hour for 40 hours.

Explanation:

Diminishing marginal returns occur when the addition of one more unit of a variable input leads to a decrease in overall output or productivity.

Diminishing marginal returns typically occur when the input of a particular factor of production, such as labor or capital, is increased while keeping other inputs constant. Initially, as more units of the input are added, the output or productivity increases at an increasing rate. This is known as increasing marginal returns.

However, as the input continues to increase beyond a certain point, the additional output gained from each additional unit of input begins to diminish. This means that the increase in output becomes smaller and smaller for each additional unit of input. The law of diminishing marginal returns states that there is a point at which the marginal returns start to diminish.

This phenomenon can be explained by various factors. For instance, when more labor is added to a fixed amount of capital, the workspace may become crowded, leading to inefficiencies and reduced output per worker. Similarly, when more fertilizer is applied to a fixed plot of land, there comes a point where additional fertilizer has a minimal impact on crop yields.

In summary, diminishing marginal returns occur when the addition of one more unit of a variable input leads to a decrease in the overall output or productivity. This happens after a certain point when the marginal returns begin to diminish.

To know more about marginal return here

https://brainly.com/question/3116739

#SPJ6

Faiz would like to illustrate the commission savings delivered by a payment app compared with a credit card. He decides to use a company that has a monthly sales volume of $50,000 delivered over 100 equal transactions. From the information available, what is the difference between the payment app with the lowest charge, compared with a credit card charge?

(A) $575

(B) $1200

(C) $1050

(D) $480

(E) $1237

Answers

Full question(find attached) :

Faiz would like to illustrate the commission savings delivered by a payment app compared with a credit card. He decides to use a company that has a monthly sales volume of $50,000 delivered over 100 equal transactions.

From the information available, what is the difference between the payment app with the lowest charge, compared with a credit card charge?

A) $575

B) $1200

C) $1050

D) $480

E) $1237

Answer and Explanation:

Credit card processing firms charge an average of 3.5% and a flat fee of about 20 cents so we would make our comparison on this basis:

Since Faiz decides to use a company that has a monthly sales volume of $50,000 delivered over 100 equal transactions

The customer would pay $50000/100= $500 per instalment

Given the information I'm the table from question Instant wallet charges 3.5% +$0.20 for transactions lower than $1500

= 0.035*$500+$0.20=17.5+0.20=$17.7

An average credit card processing firms would charge :

0.035*500+$0.35=17.5+0.35= $17.85

Therefore instant wallet is cheaper and would save a customer =$17.85-17.7= $0.15

Someone who diversifies investments is more likely to

Answers

Answer:

offset their losses with gains.

Explanation:

Answer:

offset their losses with gains.

Explanation:

When a portion of a lease payment represents the transfer of a good or service to the lessee, it is considered a______.

Answers

When a portion of a lease payment represents the transfer of a good or service to the lessee, it is considered a leasehold improvement.

Leasehold improvements refer to alterations or enhancements made to a leased property that increase its value or usefulness for the lessee. These improvements are typically customized to meet the lessee's specific needs and are often made at the lessee's expense. When a portion of a lease payment represents the transfer of a good or service to the lessee, it is considered a leasehold improvement.

Leasehold improvements can include various modifications to the leased space, such as structural changes, installation of fixtures or equipment, renovations, or interior design enhancements. The lessee typically pays for these improvements either directly or through an increased lease payment. The leasehold improvement component of the payment reflects the transfer of ownership or possession of the customized improvement to the lessee.

This distinction is important because leasehold improvements differ from regular lease payments, which are solely for the use of the property itself. The portion of the lease payment that relates to leasehold improvements is considered a separate asset or service and is accounted for differently in financial statements. It represents the value-added by the improvements and signifies the transfer of a tangible or intangible asset to the lessee as part of the lease agreement.

Learn more about lease payment here:

https://brainly.com/question/28099518

#SPJ11

In order for a nation's PPF to bea straight line , resources must be somewhat specialized, so that the law of increasing opportunity cost holds. In order for a nation's PPF to bebowed outward , there must be complete interchangeability of resources.

Answers

When the PPF bowed outwards, the resources are specialized and cannot be interchanged and when slope of PPF is straight line, there is complete interchangeability of the resources.

What is the Production possibility frontier?The Production possibility frontier is an economic curve that illustrates the amounts of two products that can be produced while both of them depend on the exhaustible resources.

The slope of the PPF curve explains an opportunity cost of a production.

In conclusion, when the PPF bowed outwards, the resources are specialized and cannot be interchanged and when slope of PPF is straight line, there is complete interchangeability of the resources.

Read more about PPF

brainly.com/question/24462080

Using productivity software ensures that the end product will look professional.

Answers

Answer: false

Explanation:

on edge 2021

Answer: The answer is false

Explanation:

props to the other dude, give them brainliest