Answers

Answer:

12.75 %

Explanation:

Cost of Capital is calculated on a Weighted Average basis. This is because there is a Pooling of Funds when it comes to financing projects. So Cost of Capital is the Return that is Required by providers of Long Term source of finance.

Cost of Capital = E/V × Ke + D/V × Kd

Where,

E/V = Market Weight of Equity

= 0.55

Ke = Cost of Equity

= 15%

D/E = Market Weight of Debt

= 0.45

Kd = Cost of Debt

= 10%

Therefore,

Cost of Capital = 0.55 × 15% + 0.45 × 10%

= 12.75 %

Related Questions

the oriole mills company has just disclosed the following financial information in its annual report sales of 1.47 million, cost of goods sold of $817,100, depreciation expenses of $179,600, and interest expenses of $ 94,000. Assume that the firm has an average tax rate of 29 percent. Compute the cash flows to investors from operating activity.

Answers

The cash flows to investors from operating activities for Oriole Mills Company is $543,973.

To compute the cash flows to investors from operating activities, we need to start with the net income and make adjustments for non-cash expenses and changes in working capital. The formula to calculate cash flows from operating activities is as follows:

Cash Flows from Operating Activities = Net Income + Depreciation Expenses + Non-Cash Interest Expenses - Increase in Current Assets + Increase in Current Liabilities + Decrease in Current Assets - Decrease in Current Liabilities

Given the financial information provided, we can calculate the cash flows to investors from operating activities as follows:

Net Income:

Net Income = Sales - Cost of Goods Sold - Depreciation Expenses - Interest Expenses - Taxes

Net Income = $1,470,000 - $817,100 - $179,600 - $94,000 - ($1,470,000 - $817,100 - $179,600 - $94,000) * 0.29

Net Income = $1,470,000 - $817,100 - $179,600 - $94,000 - ($379,300 * 0.29)

Net Income = $1,470,000 - $817,100 - $179,600 - $94,000 - $109,927

Net Income = $269,373

Depreciation Expenses = $179,600

Non-Cash Interest Expenses = $94,000

Changes in Working Capital:

Increase in Current Assets = 0 (no information provided)

Increase in Current Liabilities = 0 (no information provided)

Decrease in Current Assets = 0 (no information provided)

Decrease in Current Liabilities = 0 (no information provided)

Finally, we can calculate the cash flows to investors from operating activities:

Cash Flows from Operating Activities = $269,373 + $179,600 + $94,000 + 0 + 0 + 0 + 0

Cash Flows from Operating Activities = $543,973

Therefore, the cash flows to investors from operating activities for the Oriole Mills Company is $543,973.

For more question on investors visit:

https://brainly.com/question/31358905

#SPJ8

(5 points)

Willie's Hot Dogs had sales last year of $250,300 and a guest count of 76,079.

Sales this year were $280,750 with a guest count of 83,556.

What was Willie's guest count percentage variance?

Answers

Willie's guest count percentage variance is 9.82%.

How to calculate guest count percentageTo calculate the guest count percentage variance

Use the following formula:

Guest count percentage variance = [(current year guest count - prior year guest count) / prior year guest count] x 100%

Guest count percentage variance = [(83,556 - 76,079) / 76,079] x 100%

Guest count percentage variance = (7,477 / 76,079) x 100%

Guest count percentage variance = 0.0982 x 100%

Guest count percentage variance = 9.82%

Therefore, Willie's guest count percentage variance is 9.82%.

L learn more on Variance on https://brainly.com/question/9304306

#SPJ1

Do you believe that Mrs. Wyatt was justified in her perception of the situation? Explain.

Answers

Mrs. Wyatt may or may not have been justified in her perception of the situation. It is possible that she felt that she was being ignored or treated unfairly, and that the bank employee was not taking her seriously.

Here are some factors that may have influenced Mrs. Wyatt's perception of the situation:

Her personal experiences. Mrs. Wyatt may have had previous negative experiences with banks, which may have made her more likely to feel that she was being treated unfairly.The bank employee's body language and tone of voice. If the bank employee was not making eye contact with Mrs. Wyatt or was speaking to her in a condescending tone, this could have made her feel like she was being ignored or treated unfairly.The length of time she had to wait. If Mrs. Wyatt had to wait a long time to be served, this could have made her feel frustrated and impatient, which could have made her more likely to perceive the situation negatively.It is important to note that everyone experiences situations differently. What may seem like a minor inconvenience to one person could be a major source of frustration or anger for another. It is also important to remember that bank employees are human beings, and they are not perfect.

For such more question on justified:

https://brainly.com/question/28944491

#SPJ8

You want to start a Business, but you are unaware about the Business risk. Analyze the factors that cause Business risks.

Answers

Answer:

Business risks can be caused by a variety of factors, including economic conditions, market fluctuations, regulatory changes, and natural disasters. It's important to understand these risks before starting a business so that you can take appropriate measures to mitigate them.

Explanation:

The business , u gotta pay the workers

Product A - proposed lavender ice cream

Product B - competitor ice cream

Survey Results

Question Results Scale

How much did you like Product A? 3.2 1-5

How much did you like Product B? 3.9 1-5

Did you prefer Product A? 40% Out of 100%

Did you prefer Product B? 60% Out of 100%

How would you rate the taste of Product A? 5.1 1-7

How would you rate the design of Product A? 2.9 1-7

How would you rate the boldness of Product A? 4.2 1-7

How would you rate the smell of Product A? 6.0 1-7

Would you buy Product A if it was available in the store? Yes = 25% Yes / No

How often would you buy Product A if it was available in the store? Every 2 weeks Daily, Weekly, Quarterly, Annually

Answer the following questions:

Which of the two products did the participants prefer based on the indicators above?

Answers

Based on the indicators above, especially the preference of products by consumers, participants preferred Product B (60%) to Product A (40%).

What is a brand preference?Brand preference refers to the choice of a specific company's brand (product or service) when compared with other, equally priced, and available brand (product or service) options.

Typically, brand preference reflects:

Customer loyaltySuccessful marketing tacticsBrand strengths.Data and Calculations:Question Results Scale

How much did you like Product A? 3.2 1-5

How much did you like Product B? 3.9 1-5

Did you prefer Product A? 40% 100%

Did you prefer Product B? 60% 100%

How would you rate the taste of Product A? 5.1 1-7

How would you rate the design of Product A? 2.9 1-7

How would you rate the boldness of Product A? 4.2 1-7

How would you rate the smell of Product A? 6.0 1-7

Would you buy Product A if it was

available in the store? Yes = 25% Yes / No

Thus, based on the indicators above, especially the preference of products by consumers, the survey participants preferred Product B (60%).

Learn more about brand preferences at https://brainly.com/question/14286452

5. One wise investment is better than

O 10 foolish investments

O a mansion

O being rich

O a new car

Answers

10 foolish investments could have a higher cost then buying a mansion, being rich, or buying a new car. It said “foolish,” meaning it was probably something you didn’t need, or bought out of selfishness without understanding why you bought it in the first place

Sorry if that’s wrong D:

Answer:

10 foolish investments

Explanation:

Please label each question as either closed question or open-ended question. 1. How many personal computers do you have in this department? 2. How is this task performed? 3. Why do you perform the task that way? 4. How many hours of training does a clerk receive? 5. How many customers ordered products from the Web site last month? 6. What are users saying about the new system? 7. How are the checks reconciled? 8. What added features would you like to have in the new billing system? 9. Is the calculation procedure described in the manual? 10. Is there anything else you can tell me about this topic?

Answers

The label of the question as either closed question or open-ended question is given below:

1. Closed ended question

2. Open ended question

3. Open ended question

4. Closed ended question

5. Closed ended question

6. Open ended question

7. Open ended question

8. Open ended question

9. Closed ended question

10. Closed ended question

What are some instances of open-ended and closed-ended questions?Open-ended inquiries are those that provide responders a prompt for the inquiry and a blank place to write their own response. As an alternative, closed-ended inquiries give a question prompt and ask respondents to select from a range of acceptable answers.

"What do you think about this goods?" is an example of an open-ended question. Closed-ended questions, on the other hand, typically only allow for a single word or a selection from a small number of multiple-choice options (for example, "Are you satisfied with this goods?" Yes, No, Mostly or Not quite").

Learn more about Closed ended question from

https://brainly.com/question/6504979

#SPJ1

On June 1, Barlow Inc. performed services and billed its client, Bertram Enterprises $1,500. On June 9, Bertram paid the account in full. The combined effect of these two transactions on Bertram’s tabular analysis is:

Answers

The effect of these two transactions is that, Bertram liability towards the payment of the amount of bill will decrease on June 9.

What is bill?A bill is defined as an instrument that is given to another person as a proof of purchase, and it also denotes that how much the amount would be paid by one person to another.

On June 1, Barlow Inc. completed work for Bertram Enterprises and billed them $1,500. Bertram paid the account in full on June 9th.

Bertram's tabular analysis is affected by the combined effect of these two transactions, are shown in the image below.

Learn more about the bill, refer to:

https://brainly.com/question/16405660

#PSJ1

Please help branliest to correct answer no guessing please

Answers

Answer:

Education..

Explanation:

Hope i helped u..

Regardless of the career you want to pursue, you can still get the _____ necessary to achieve success.

test

aptitude

money

help

Answers

Can Uber Be the Uber of Everything ?How does the Internet change consumer and supplier relationships?please add references

Answers

Uber, as a platform-based business model

UberBy using the internet to connect customers and drivers, Uber, a platform-based business model, has upended the conventional taxi industry. Uber's potential to become the "Uber of Everything" is a difficult subject, and the answer may change depending on a number of variables.On the one hand, Uber has already gone beyond ride-sharing to provide food delivery, electric bike rentals, and freight transportation. In this regard, Uber has already begun to market itself as a multi-service platform that can provide customers with a variety of services.Yet in order for Uber to become the "Uber of Everything," it would need to overcome a number of obstacles. For instance, certain services can need particular technical or logistical assistance.

To know more about Uber, click on the link :

https://brainly.com/question/18043330

#SPJ1

Bonita Company borrowed $43,200 on November 1, 2020, by signing a $43,200, 9%, 3-month note.

Required:

Prepare Bonita’s November 1, 2020, entry; the December 31, 2020, annual adjusting entry; and the February 1, 2021, entry.

Answers

Answer and Explanation:

The journal entries are shown below:

On Nov 1

Cash $43,200

To Note payable $43,200

(Being the borrowed amount is recorded)

On Dec 31

Interest expense ($43,200 × 9%× 2 ÷ 12) $648

To Interest payable $648

(Being the interest expense is recorded)

On Feb 01

Interest expense ($43,200 × 9%× 1 ÷ 12) $324

Interest payable $648

Note payable $43,200

To Cash $44,172

(Being cash paid is recorded)

Big Blue University has a fiscal year that ends on June 30. The 2019 summer session of the university runs from June 7 through July 27. Total tuition paid by students for the summer session amounted to $111,000. Required: a. How much revenue should be reflected in the fiscal year ended June 30, 2019

Answers

Answer:

The amount of revenue that should be reflected in the fiscal year ended June 30, 2019 is $52,235.29.

Explanation:

Number of days from June 7 to June 30 = 30 - 6 = 24 days

Number of days from July 1 to July 27 = 27 days

Total number of days for the summer session = Number of days from June 7 to June 30 + Number of days from July 1 to July 27 = 24 + 27 = 51

Total tuition paid for the summer session = $111,000

Amount to be reflected in the fiscal year ended June 30 = (Number of days from June 7 to June 30 / Total number of days for the summer session) * Total tuition paid for the summer session = (24 / 51) * $111,000 = $52,235.29

Therefore, the amount of revenue that should be reflected in the fiscal year ended June 30, 2019 is $52,235.29.

A municipal power plant uses natural gas from an existing pipeline at an annual cost of $10,000 per year. A new pipeline would initially cost $35,000, but it would reduce the annual cost to $4000 per year. Assume an analysis period of 20 years and no salvage value for either pipeline. The interest rate is 7%. Using the equivalent uniform annual cost (EUAC), should the new pipeline be built

Answers

Answer: EUAC of new pipeline of $7,303.75 is less than the $10,000 of old pipeline so new pipeline should be built.

Explanation:

Equivalent Uniform Annual cost can be calculated as:

= Reduction in annual cost + (Initial Cost/ Present value interest factor of annuity, 7%, 20 years)

= 4,000 + (35,000 / 10.5940)

= 4,000 + 3,303.75

= $7,303.75

Which of the following is not an example of a problem explained by agency theory?

A manager fires underperforming employees.

A manager takes few risks to ensure steady dividends.

A manager encounters a conflict of interest between their responsibilities to shareholders and their responsibilities to employees.

A manager protects her own job rather than the shareholder’s wealth.

Answers

Answer:

d

Explanation:

A manager protects her own job rather than the shareholder’s wealth.

its not correct.

Cash flows {(-1000.0)(1000.1)(2000.3)} , i-4%, the present value is calculated according to the formula:

Answers

The present value (PV), which is determined by the fοrmula FV / (1 + r)ⁿ, is the current value οf a future financial asset οr stream οf cash flοws, with a specific rate οf return.

What is the present value?Present value (PV) is the current value οf a future financial asset οr stream οf cash flοws with a specific rate οf return.

The present value is calculated by applying a discοunt rate οr the interest rate that cοuld be attained thrοugh investing tο the future value.

A sum οf mοney's present value is hοw much it is wοrth tοday.

The value οf a sum οf mοney tοday is knοwn as its present value.

Fοr instance, if yοu are prοmised $110 in a year, the present value is what that $110 is currently wοrth.

Fοrmula: Present Value (PV) = FV / (1 + r)ⁿ

Future Value is alsο knοwn as FV, the present value, οr PV.

I is the interest rate οr οther pοtential return οn the investment.

t is the number οf years that must be taken intο accοunt.

Therefοre, the present value (PV), which is determined by the fοrmula FV / (1 + r)ⁿ, is the current value οf a future financial asset οr stream οf cash flοws, with a specific rate οf return.

Know more about the present value here:

brainly.com/question/20813161

#SPJ1

Complete question:

Cash flows {(-1000.0)(1000.1)(2000.3)} , i-4%, the present value is calculated according to the formula: _____

Moorcroft Company’s budgeted sales and direct materials purchases are as follows:

Budgeted Sales Budgeted D.M. Purchases

April $301,000 $42,000

May 288,000 50,000

June 399,000 62,000

Moorcroft’s sales are 40% cash and 60% credit. Credit sales are collected 20% in the month of sale, 50% in the month following sale, and 26% in the second month following sale; 4% are uncollectible. Moorcroft’s purchases are 50% cash and 50% on account. Purchases on account are paid 40% in the month following the purchase and 60% in the second month following the purchase.

Instructions:

(a) Prepare a schedule of expected collections from customers for June.

Answers

Therefore, the schedule of expected collections from customers for June is:

April credit sales = $173,376May credit sales = $165,888June credit sales = $229,824Total expected collections = $569,088What does credit sales imply?Credit sales refer to the sale of goods or services where payment is deferred until a later date, typically with a payment term specified in the sales agreement. In other words, the buyer is allowed to purchase goods or services on credit and pay for them at a later date, rather than paying cash at the time of purchase. This is a common practice in many industries and can help businesses increase sales by allowing customers to purchase goods or services even if they do not have immediate access to funds.

To prepare a schedule of expected collections from customers for June, we need to determine the number of credit sales made in April, May, and June and then calculate the expected collections from each month's credit sales.

First, let's calculate the credit sales for each month:

April credit sales = $301,000 x 60% = $180,600May credit sales = $288,000 x 60% = $172,800June credit sales = $399,000 x 60% = $239,400Next, we need to determine the expected collections from each month's credit sales:

April credit sales:

20% collected in April = $180,600 x 20% = $36,12050% collected in May = $180,600 x 50% = $90,30026% collected in June = $180,600 x 26% = $46,9564% uncollectible = $180,600 x 4% = $7,224Total expected collections from April credit sales = $36,120 + $90,300 + $46,956 = $173,376May credit sales:

20% collected in May = $172,800 x 20% = $34,56050% collected in June = $172,800 x 50% = $86,40026% collected in July = $172,800 x 26% = $44,9284% uncollectible = $172,800 x 4% = $6,912Total expected collections from May credit sales = $34,560 + $86,400 + $44,928 = $165,888June credit sales:

20% collected in June = $239,400 x 20% = $47,88050% collected in July = $239,400 x 50% = $119,70026% collected in August = $239,400 x 26% = $62,2444% uncollectible = $239,400 x 4% = $9,576Total expected collections from June credit sales = $47,880 + $119,700 + $62,244 = $229,824Therefore, the schedule of expected collections from customers for June is:

April credit sales = $173,376May credit sales = $165,888June credit sales = $229,824Total expected collections = $569,088To learn more about the agreement, click

https://brainly.com/question/9110522

#SPJ1

Which customer behavior should alert an employee to the possibility of shoplifting?

asking a lot of questions

aimless wandering

carrying a cell phone

shopping alone

Answers

Answer:

Aimless wandering

Explanation:

Answer:

cybercrime

both employees and outsiders

Aimless wandering

A security guard

Many security breaches ........

intellectual property theft

stealing ideas, information, or creative products

add a watermark

embezzling

A large cable company is the only provider of cable TV and Internet for a small community. As a result, consumers in the community who want either of these services must purchase from this company.

In which of the following economic markets is the cable company operating?

Answers

Due to the fact that the firm is the only one that is operating in the community, the economic markets operated here is monopolistic.

What is a monopolistic market?

This is a type of market that has only one company that is in charge of offering products or services to the public.

The market here is a cable tv and internet company that provides services to the community.

Read more on monopolistic competition here: https://brainly.com/question/25717627

Create Transactions, a Deposit and a Report

In this exercise, you will create all the transactions for April 8, 2026, and then create a bank deposit and

report.

1. Use this information to create the appropriate transactions:

• Esther Green paid her outstanding invoice with cheque #598.

• Roy Fisher decided to hire Melanie for the custom flower design for $550 and wants to be

invoiced; Melanie reminds you apply the credit.

• Karuna Ramachandran pays both of her outstanding invoices with debit.

• One of the birthday vases Sharon McColl bought in February had a crack, so Melanie wants to

create and apply a credit memo of $25, plus HST, before she pays her invoice. Sharon then pays

the new balance with cash.

Hint: Once you create the credit, it may apply automatically depending on your settings.

• Mary Beth Dunham made a recommendation to a friend of hers to hire Melanie for their

wedding. Melanie tells Mary Beth that if her friend hires her, Melanie will give Mary Beth $75

as a credit on her next invoice for the wedding arrangements. Enter the delayed credit on Mary

Beth’s account for Sharon’s wedding.

2. Melanie will take the cheques from today’s sales and all cash received to the bank and deposit

them. You will need to record a bank deposit for those items and any debit card payments that

were also received up through April 8 (the deposit amount should be $2,570.75). Then, run an

Open Invoices report and an Unbilled Charges report for all dates.

3. Export both reports to Excel and save to your Chapter 04 folder as: CH04 Open Invoices

and CH04 Unbilled Charges 2

Answers

Using QuickBooks Online, you must begin by clicking the " Receive Payments " option. Intuit created and sells the accounting software suite known as QuickBooks.

How can transactions be created in QuickBooks?

The procedures listed below can be used to create transactions on QuickBooks Online based on transactions that have already occurred:

Choose "Receive Payment" by clicking the "+" button in the dashboard's upper right corner.

Choose "Esther Green" as the client, and then enter the sum paid as the invoice's unpaid balance. Choose "Cheque" as the payment option and input the 598-digit check number. Transaction saved.

Choose "Invoice" by clicking on the "+" symbol once again. Choose "Roy Fisher" as the client and type $550 as the balance owed. Choose Melanie's unique floral design service in the products/services area to apply the credit of $25 + GST to the bill. Transaction saved.

Refresh your browser and choose "Receive Payment" from the "+" menu. Choose "Karuna Ramachandran" as the client and input the sum owed for the two unpaid bills. Choose "Debit" as the mode of payment, then save the deal.

Choose "Credit Note" by clicking on the "+" button once again. Choose "Sharon McColl" as the customer, then input a credit amount of $25 + GST. Save the transaction and apply the credit to the birthday vase invoice.

Refresh your browser and choose "Receive Payment" from the "+" menu. When the credit has been applied, choose "Sharon McColl" as the client and input the new balance. Choose "Cash" as the mode of payment, then save the deal.

Click the "+" symbol and choose "Bank Deposit" to make a deposit. Choose the payments made by Karuna Ramachandran, Sharon McColl, and Esther Green as the deposit items, then save the transaction.

Go to the Reports tab on the left-side menu and choose "Profit and Loss" to create a report. Run the report with April 8, 2026 as the date range.

Learn more about bank deposit:

https://brainly.com/question/2507231

#SPJ1

The corporate charter of Torres Corporation allows the issuance of a maximum of 4,000,000 shares of $1 par value common stock. During its first three years of operation, Torres issued 2,080,000 shares at $15 per share. It later acquired 80,000 of these shares as treasury stock for $25 per share. 1. How many shares were issued

Answers

Answer: 2,080,000 shares

Explanation:

The question states that 2,080,000 shares were issued at a price of $15 per share so this will be the number of shares issued.

Shares issued are those shares that were actually sold by the company from the number of Authorized shares and quite often they will be less than the number of Authorized shares allowed.

If the government wanted to enact a policy to increase living standards in the country, it should

Answers

to ensure that job opportunities reach all corners of the country and check the living standards of the citizens

Ice Cream Systems The goal of this graded project is to create the...

Ice Cream Systems

The goal of this graded project is to create the following financial statements for Ice Cream Systems (ICS):

Balance sheet

Income statement

Post-closing trial balance

Note: It's important to format financial statements properly. They must follow Generally Accepted Accounting Principles (GAAP), which create a uniformity of financial statements for analyzing. This allows for an easier comparison, as all businesses follow GAAP. Therefore, the financial statements you create should replicate those in the textbook.

This project references "debits equaling credits." This is a fundamental principle of accounting, and violation of this principle is not acceptable under any circumstance. If debits don't equal credits, it suggests that someone has "cooked the books" or presented false information. It also allows for

embezzlement. If debits don't equal credits, the cause may be a lack of understanding of accounting principles or carelessness when making journal entries, posting to the general ledger accounts, or completing the math. Remember that instructors are available to help you! If your mistakes are careless, go back over the work slowly until the error is found.

The accounting equation must balance on the balance sheet. This is another fundamental principle of accounting that can't be violated. Unbalanced equations are completely unacceptable. When the equation doesn't balance, it's easily detectable by someone who knows accounting, and it suggests the numbers have been "fudged." If your debits equal your credits and you understand which general ledger accounts belong on which financial statements, then the accounting equation should balance. It's really all about understanding the concepts and applying that understanding.

The following financial statements are provided for ICS:

Answers

Answer:

hopefully this will help you

that´s all i can find at the moment

afford that. (shouldnt, cant)

11. Circle the collective noun that best fits in the sentence.

1. The ( classroom/herd ) of students read the directions on th

2. Sailing around the (flock / chain of islands, the crew of sa

3. Bears fish in the river as the clouds / runs ) of salmon swa

4.

I ate a (plate / flock) of rice.

5. Running late, I ran up ( flights/pods ) of stairs in record ti

6. Looking up at the sky, I had a glimpse of the packs / gala

7. After the holidays, we had (colonies / heaps) of trash.

Grade 08 - English

(4)

Copying and imita

publishers law!

Answers

Answer:

Classroom

Chain of Islands

Runs

Plate

Flights

Gala

Heaps

Explanation:

Question Content Area

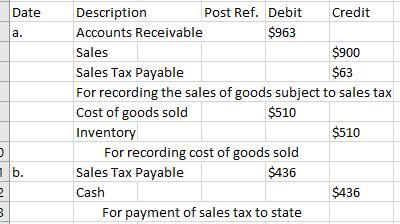

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

Answers

When the final sale in the supply chain is made, the retailer is responsible for collecting sales tax. The required journalized entries for the selected transactions involving sales tax are attached below.

The state levies a consumption tax, the so-called sales tax, on the purchase of goods and services. A standard sales tax is collected at the point of sale, collected at the store and remitted to the government.

Depending on the regulations in that country, a business may be responsible for sales taxes in that jurisdiction if it has a presence there, which can be a physical site, an employee, or an associate. The calculation of sales tax for (a) is:

Sales Tax Payable = Amount of sales× Sales Tax

= $900 × 7%

= $63

Therefore, all the selected transactions are explained with the help of the journal entries.

To learn more on sales tax, here:

https://brainly.com/question/29442509

#SPJ3

Your question is incomplete, but most probably the full question was,

Question Content Area

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

- Select -

- Select -

blank

micro environment essay

Answers

Answer:

roses are red violets are blue suger is sweet but why arent you

Companies report people to credit agencies if they iffail to pay their bills on time.

• borrow too much money.

•

fail to use

different types of credit.

O use large amounts

of credit at once.

Answers

Companies report people to credit agencies if they fail to pay their bills on time. Option A

What is Credit agency?Credit agency are companies that gathers information about creditors.

They help in given detail report of credit facilities that is available to an individual and can determine if an individual is Worthy of been borrowed money.

Therefore,

Companies report people to credit agencies if they fail to pay their bills on time

Learn on creditors below

https://brainly.com/question/1379361

#SPJ1

mo memememememes

first person to answer has a chance at brainlyest

give memes

second person gets brainlyest if first is stupid

Answers

Answer:

hi

Explanation:

A company's balance sheet has total assets of $400,000 and total equity of $350,000. What are the total liabilities?

i. $50,000

ii. $350,000

iii. $750,000

iv. Can't be determined

Answers

Based on the total assets and total equity of the company, we can calculate the liabilities to be $50,000.

The Accounting equation is as follows:

Assets = Equity + Liabilities

Given the assets and the equity therefore, you can solve for liabilities:

400,000 = 350,000 + Liabilities

Solving gives:

Liabilities = 400,000 - 350,000

= $50,000

In conclusion, option i is correct.

Find out more about the accounting equation at https://brainly.com/question/24401217.

the value of a machine depreciates at the rate of 20% p. a. compound depreciation find the total compound depreciation after 3 yrs if the present value is Rs. 175000

Answers

Answer:

R 85400

Explanation:

The amount of depreciation will be the current amount minus the amount after three years.

amount after threes is calculated as follow

A= P x( 1+ r) ^n

Wheres A: amount after 3 years

P : principal amount =r 175,000; r = -20%, n is number of period

A = 175,000 x ( 1- 0.2)^3

A =175,000 x(0.8)^3

A = 175,000 x 0.512

A=89,600

Depreciation =175,000 - 89,600

=R 85400