Answers

Answer:

Two ways in which young entrepreneurs can benefit from the Black industrialist scheme are as follows: To gain the access to the private banking sector and finance, by equipping with the necessary equity BIP will enhance Black Manufacturing enterprises

Related Questions

Calculate Net Pay

Enter your gross pay, taxes, and deductions

below. Press calculate when you're ready.

Start period 02/01/2019

End period 02152019

Gross Pay

Gross Pay

$1,560.00

1,560.00

Earnings

Taxes

Deductions

$1.560.00

Federal (757) $118.09

Tax

FICA Medicare (1451 - 52262

294.37

FICA Social Security 16.2012 - 596.72

Deductions

State OK 13.650 - 55604

1,265.63

Total $2931

Calculate

Net Pay

Ok

Answers

Answer:

0

Explanation:

just did the module, there is no deduction cost

The calculated net pay is equal to 0

The formula for net pay is given as

Net pay = Gross pay - Deductions

The value for gross pay has been given to be = $1560

The value for deductions has also been given as = $1560

When we put these values into the formula:

Net pay = $1560 - $1560

= 0

Therefore we conclude that given a gross pay of 1560 and a deduction of 1560, the net pay is equal to 0

Read more on https://brainly.com/question/15858747?referrer=searchResults

In the context of automation strategy, what is a Center of Excellence?

Answers

Sariah sets challenging sales targets for her team.

Answers

"Sariah sets lofty sales targets for her team" is an example of planning.

What is Planning?Thinking about the steps necessary to accomplish a goal is the process of planning. Foresight, the fundamental ability for mental time travel, is the foundation of planning.

The ability to plan ahead and exhibit foresight is assumed to have evolved early in the course of human evolution.

An essential characteristic of intelligent conduct is planning.

It entails applying logic and creativity to visualize both the desired outcome and the processes required to get there.

Planning's relationship to forecasting is a crucial factor.

Planning envisions what the future may look like while forecasting attempts to anticipate what it will look like.

"Sariah sets ambitious sales targets for her team" is an example of planning.

Therefore, "Sariah sets lofty sales targets for her team" is an example of planning.

Know more about Planning here:

https://brainly.com/question/25453419

#SPJ1

Correct question:

"Sariah sets challenging sales targets for her team" is an example of ____.

what is selection of business.

Answers

the definition of revenues is: revenues (increase/decrease) (liabilities/equity) and are earned from the sale of products and services.

Answers

The definition of revenues is: revenues increase equity and are earned from the sale of products and services.

Revenues are the amount of money that a company earns from its business activities, such as the sale of products or services. When a company earns revenues, it increases its equity, which is a measure of the company's net assets or the value of the company's assets minus its liabilities. This is because revenues represent an inflow of economic resources that increase the company's assets, and the company's equity represents the residual interest in the assets of the company.

To know more about revenue here

https://brainly.com/question/14811584

#SPJ4

Which is a characteristic of a market economy?

a. all resources are owned communally

b. economic activity is coordinated by government decision-makers

c. individuals own all of the resources

d. governments own the parks and roads but the rest is owned by the people

Answers

The characteristic of a market economy is c. individuals own all of the resources

In a market economy, people receive salaries and have the freedom to purchase whatever they want. It may be described as a system of economics. In this system, the numerous interactions between businesses, markets, and the people in any country determine economic decisions as well as the costs of commodities.

Economic activity is largely influenced by human choices and the principles of supply and demand in a market economy. This indicates that people and organisations control the resources they employ to generate commodities, including labor, capital, and land. In a market economy, the function of the government is largely restricted to defending property rights, upholding agreements, and fostering competition.

Read more about market economy on:

https://brainly.com/question/30197415

#SPJ1

Application of Forensic Accounting Concepts

Complete Case 21 & 28. Refer to the Case in the textbook for detailed instructions.

Submission Instructions:

Complete and submit the assignment by 11:59 PM ET Sunday.

You should submit your completed work in a Word document or Excel spreadsheet if needed.

Your work should be formatted and cited in current APA style with appropriate references.

Late submissions will have a grade of 0.

Your assignment will be graded according to the case rubric.

Answers

Forensic accounting is a distinct subdivision of accounting that brings together investigative practices with established accounting principles to provide an accurate assessment of financial data.

What is Forensic accounting?The primary objective of forensic accounting is to discover any financial fraud or discrepancies. Professionals in this domain are trained to take advantage of their analytical capabilities to identify financial deception and embezzlement, probe financial disputes, and submit expert tales during court trials.

Forensic accounting can be applied in multiple contexts, counting civil and criminal litigations, corporate examinations, and regulatory probes.

Learn more about account on

https://brainly.com/question/28145069

#SPJ1

Which of the following statements is true regarding project managers?

O a. Project managers have authority over the project but not over the people assigned to it.

O b. Project managers have authority over finances but not over the product assigned to them.

c. Project managers have authority over resources but not over the project assigned to them.

d. Project managers have authority over people but not over the project assigned to them.

O e. Project managers have authority over people but not over the other resources assigned to the project.

Answers

The truth regarding project managers is option a. Project managers have authority over the project but not over the people assigned to it.

As the leader of a project, a project manager is responsible for ensuring the project's success by overseeing various aspects such as planning, execution, monitoring, and closure. They are also in charge of managing the project's scope, time, cost, quality, and risks. However, a project manager's authority over the people assigned to the project is often limited.

While they can assign tasks and set deadlines, they may not have direct control over the team members, as these individuals usually report to their functional managers. Project managers work with functional managers to coordinate resources and ensure team members are engaged and contributing effectively to the project. This arrangement enables project managers to focus on the overall project objectives and delegate specific tasks to team members with relevant expertise.

Project managers rely on their communication, negotiation, and problem-solving skills to work effectively with team members and stakeholders to achieve project goals. In summary, project managers have authority over the project, but their authority over the people assigned to it is often limited, as team members usually report to their respective functional managers. Therefore, the correct answer is option a.

know more about Project managers here:

https://brainly.com/question/27995740

#SPJ11

What will be the inventory Cost that was valued at 286000 valued at

.And obsolete cost is 8400

Answers

All of the following are perks to working in sales that many other careers do not offer,

except

Answers

All the following are perks to working in sales that many other careers do not offer;

Monthly allowance covering expenses such as cell phone.Expenses account paying for fancy dinner, extravagant hotel room.yearly reviews for possibility for pay rises Company cars.Who is a sales personel?Sales personel can be regarded as one of the distribution channel that makes the goods available for final consumer.

However, perks to working in sales that many other careers do not offer could be Expenses account paying for fancy dinner, extravagant hotel room and others.

Therefore, all the above options are correct.

Learn more about sales at:

https://brainly.com/question/11408596

if the inventory turnover ratio cast co is 5x and its gross profits and sales are $270 million and $1,200 million respectivelly then the inventory account for cast is

a.$180 million

b.$182 million

c.$186 million

d.$196 million

Answers

Answer:

c.$186 million

Explanation:

Calculation to determine what the inventory account for cast is

Using this formula

Inventory account for cast =Sales - Gross profit/Inventory turnover ratio cast

Where,

Sales=$1,200 million

Gross profit=$270 million

Inventory turnover ratio cast =5x

Let x be the inventory account for cast

Let plug in the formula

5x=$1,200 million-$270 million

5x=$930 million

x=$930 million/5

x=$186 million

Therefore the inventory account for cast is $186 million

t is not always easy to determine the products and services that satisfy needs and those that satisfy wants.

a. True

b. False

Answers

A. True

Explanation:

cuz you might not know the true taste of the consumer but you have to manufacture a product to suit the taste of the consumer

Discuss the possible solutions that you would suggest for Mozambique (including their transmission mechanism in the economy) so as to ensure consistent growth. (NB: the use of diagrams and other supporting journal article evidence is expected) (30 marks)

Answers

To ensure consistent growth in Mozambique, there are several possible solutions that can be implemented. These solutions can be broadly categorized into two main areas: macroeconomic policies and sector-specific policies.

Macroeconomic Policies:

Fiscal Policy: The government can implement expansionary fiscal policies such as increasing government spending and reducing taxes to boost economic growth. This can be done by increasing public investment in infrastructure, education, health, and other sectors that can contribute to economic growth.

Monetary Policy: The central bank can implement expansionary monetary policies such as lowering interest rates and increasing the money supply to stimulate economic activity. This can encourage private investment and consumer spending.

Exchange Rate Policy: The government can adopt a flexible exchange rate policy that allows the exchange rate to adjust to market conditions. This can help to maintain external competitiveness, which can contribute to economic growth.

Sector-Specific Policies:

Agriculture: Mozambique has a largely agriculture-based economy. To promote growth in this sector, the government can increase investment in irrigation, research and development, and extension services. This can help to improve agricultural productivity and increase food security.

Manufacturing: The government can also promote growth in the manufacturing sector by providing incentives to attract foreign investment and supporting local entrepreneurs. This can help to create jobs, increase exports, and reduce the country's dependence on imports.

Infrastructure: Mozambique has significant infrastructure deficits, particularly in transport, energy, and water. The government can increase investment in these areas to improve the country's competitiveness and promote economic growth.

One possible transmission mechanism for these policies is the multiplier effect. When the government increases its spending or investment in a particular sector, it can stimulate economic activity in that sector. This can lead to an increase in employment, income, and output. As a result, these individuals can then spend their increased income, creating a ripple effect throughout the economy. This multiplier effect can also be seen in the case of the manufacturing sector, where increased investment can lead to increased exports, which can in turn lead to increased income and employment.

In conclusion, implementing a combination of macroeconomic policies and sector-specific policies can help to ensure consistent growth in Mozambique. These policies can be supported by the multiplier effect, which can help to create a positive cycle of economic growth and development.

Which is these is true about trusts?

OA. They have less tax liability.

OB. They have multiple beneficiaries.

C. They require power of attorney.

OD. They have more tax liability.

Answers

Answer: The answer is They have more tax liability.

Explanation:Trust is a fiduciary relationship.In this, a first party gives the right to assets or the right to hold the title to a second party for the benefit of a third party.The first party is called the Grantor.The second party is called as the Trustee.The third party is called as the Beneficiary.As the trust is a seperate legal and taxable entity, the tax payment of the trusts depend upon whether it is a simple trust,complex trust or a grantor trust.The tax brackets of trusts are more compressed.So, the trusts pay more taxes than individual taxpayers.

enthnocentrism as a barrier in cross-cultural communication

Answers

Identify the effective imagery technique employed in the following sentences. Starting a new company is similar to watching anewly planted garden grow. O Analogy O Metaphor O Personal anecdota

Answers

Answer:

Personal anecdoteMetaphor

An analogy is an explicit comparison of similar traits between seemingly dissimilar things.

Explanation:

Anecdotes, which are very brief stories that are important to the subject at hand and typically contribute personal knowledge or experience, are pronouced an-ik-doht. Essentially, anecdotes are tales. Anecdotes are typically told verbally rather than through writing, like many stories.

The Greek word "o," which means "things unpublished," is where the word "anecdote" first appeared.

A coworker has just told an anecdote if, for instance, during a conversation about pets, she describes how her cat only enters the downstairs area at a specific time of the night.

Learn more about Personal anecdoteMetaphor visit: https://brainly.com/question/12940154

#SPJ4

The initial cash outlay of a project is X is Rs 100,000 and it can generate cash inflow of Rs 40,000, Rs 30,000, Rs 50,000 and Rs 20,000 in year 1 through 4. Assume a 10 per cent rate of discount. Assume that a project Y requires an outlay of Rs 50,000 and yields annual cash inflow of Rs 12,500 for 7 years at the rate of 12%.

Answers

On the net present value analysis, project Y is expected to generate a higher return on investment compared to project X.

To evaluate the two projects, X and Y, we will calculate their net present value (NPV) using the given cash inflows, discount rate, and initial cash outlay.

For project X:

The cash inflows for each year are Rs 40,000, Rs 30,000, Rs 50,000, and Rs 20,000 for years 1 through 4, respectively.

The initial cash outlay is Rs 100,000.

The discount rate is 10%.

To calculate the NPV, we discount each cash inflow to its present value using the discount rate and subtract the initial cash outlay:

NPV(X) = (40,000 / (1 + 0.10)^1) + (30,000 / (1 + 0.10)^2) + (50,000 / (1 + 0.10)^3) + (20,000 / (1 + 0.10)^4) - 100,000

Simplifying the calculations:

NPV(X) = 36,363 + 24,793 + 34,979 + 13,167 - 100,000

= 9,302

The net present value (NPV) for project X is Rs 9,302.

For project Y:

The cash inflow for each year is Rs 12,500 for 7 years.

The initial cash outlay is Rs 50,000.

The discount rate is 12%.

Using the same formula as above, we calculate the NPV for project Y:

NPV(Y) = (12,500 / (1 + 0.12)^1) + (12,500 / (1 + 0.12)^2) + ... + (12,500 / (1 + 0.12)^7) - 50,000

Simplifying the calculations:

NPV(Y) = 11,161 + 9,960 + 8,888 + ... + 3,637 - 50,000

= 11,042

The net present value (NPV) for project Y is Rs 11,042.

For more such question on investment. visit :

https://brainly.com/question/29547577

#SPJ8

QUESTION 8 of 10: The function of a financial planner is:

Oa) To share in the profit/loss of your investments

b) To convince you to purchase large-cap stocks

c) To design your personal budget plan

Od) To help you define and reach your financial goals

Answers

The function of a financial planner is to help individuals or organizations define and reach their financial goals through a variety of services, including budget planning. So, correct option is D.

Unlike an investment advisor who is primarily focused on managing investments, a financial planner takes a more holistic approach to a client's financial well-being. They work closely with clients to understand their current financial situation, identify their goals and objectives, and develop a personalized financial plan to achieve those goals.

Financial planners do not share in the profit or loss of their clients' investments, nor do they aim to convince their clients to purchase specific stocks. Instead, they provide unbiased advice and recommendations based on their clients' individual needs and objectives.

Ultimately, the goal of a financial planner is to help clients achieve financial security and success by providing expert guidance, ongoing support, and customized solutions to meet their unique financial needs.

So, correct option is D.

To learn more about financial planner click on,

https://brainly.com/question/29219626

#SPJ1

The units-of-production method is ideal for equipment whose activity

a

can be measured in units of output.

b

can be measured in units of input.

c

is consistent from year to year.

d

is based on time.

Answers

The units-of-production method is ideal for the equipment whose activity can be measured in units of output. The units-of-production method is a depreciation method. Thus option (a) is correct.

What is output ?The output refers to the quantity of goods or products produced by the manufacturing process during a given period of time.

The output of a factory can be measured in different ways, such as the number of units produced, the weight of the products, or the volume of goods produced.

The units-of-production method is particularly useful for equipment that produces a measurable output or activity.

Learn more about output here:

https://brainly.com/question/27972321

#SPJ1

Double declining balance

Answers

The double-declining balance method is an effective way to depreciate assets in the early years of their useful life and reduce the balance of the asset more quickly than the straight-line method. This helps companies to account for the asset's cost more accurately over time and to recognize its diminishing value as it ages.

Double-declining balance method is a method of depreciation that is an accelerated method.

The depreciation rate is twice as much as the straight-line method's depreciation rate.

This method begins with an asset's value at the beginning of its use and then decreases at a constant rate throughout its useful life until it reaches the asset's salvage value.

This depreciation method is most commonly used for assets that depreciate quickly at the beginning of their useful life and then slowly depreciate over time until they are scrapped or sold.

Assets such as computers, vehicles, and machinery are common examples of assets that use this method of depreciation.

Double-declining balance method can be calculated using the following formula:Annual depreciation = (2 / useful life in years) * book value at the beginning of the yearOrDepreciation rate = 2 / useful life in years.

For more such questions on depreciate

https://brainly.com/question/29894489

#SPJ8

Determine the missing amount:

Assets=Liabilities+owners Equity x 272000 573000

Answers

Based on the given amounts of assets and liabilities, the missing amount of Owner's equity is $301,000

How to find the equity?The Owners equity is one of the parts of the Accounting equation which is:

Assets = Liabilities + Owners Equity

The Assets in this instance is $573,000 and the Liabilities are $272,000.

The Owner's equity is the missing amount and it can be found as:

573,000 = 272,000 + Owners Equity

Owners Equity = 573,000 - 272,000

Owners Equity = $301,000

Find out more on owner's equity at https://brainly.com/question/28222828

#SPJ1

What is the best answer if a customer has a better price with the competition?

A customer informs that they have found a competitive provider who can offer service for less than what ADT currently offers.

What do you do?

Transfer the customer and have them speak further with account management.

Ask the customer for key features of the competitor and highlight how your offerings compare with overall value.

Explore the pricing differences with the customer and look for additional discounts that could be provided.

Answers

A customer informs that they have found a competitive provider who can offer service for less than what ADT currently offers, the best answer is to ask the customer for key features of the competitor and highlight how your offerings compare with overall value.

Thank the customer for their feedback and for considering ADT for their security needs.Ask the customer about the features and benefits that they are looking for in a security provider.Ask the customer to share details about the competitive provider's offerings, such as the price, contract terms, installation fees, equipment costs, etc.Listen carefully to the customer's needs and concerns.Explain the benefits of ADT's offerings and highlight the differences between the competitor's offerings and ADT's offerings.Emphasize ADT's strengths, such as the quality of the equipment, the expertise of the technicians, the responsiveness of the customer service team, the reliability of the monitoring service, and the range of features that are included in the package.If possible, offer the customer a special discount or promotion that would help to lower the overall cost of the service.Thank the customer again for their time and consideration, and let them know that you are available to answer any further questions they may have.For such more questions on customer

https://brainly.in/question/22960025

#SPJ8

Discuss the difference between the income statement of Variable and absorption costing.

Answers

Dennis 51 purchased a $10000 13 week treasury bill as a short term investment. He paid $9960.00 for the security, which was issued on June 17th 2021 , when the bill matured on sept. 16,2021 Dennis received $10000.00 how is the $40.00 is interest reported on his tax return form 6251?

Answers

The interest of Dennis's treasury bill is not reported on his tax return form 6251, but Form 1099-INT.

How does AMT tax work?Certain taxpayers who make a significant amount of money are subject to the Alternative Minimum Tax (AMT), even though they can use deductions and credits to keep the majority, if not all, of their income from being taxed. It increases the amount of income that is taxed by adding items that are not typically taxed and by excluding many deductions under the regular tax system.

The AMT is a parallel tax system that runs in the background of the regular tax system. Treasury bills, notes, and bond interest income are taxed federally but not state or locally. However, this income is not taxed on the interest received. Treasury bills, notes, and bond interest income are taxed federally but not state or locally. However, this revenue is not taxed on the interest received.

To learn more about treasury bills, visit:

https://brainly.com/question/24084275

#SPJ1

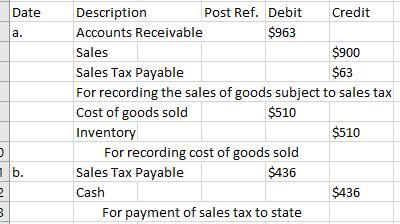

Question Content Area

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

Answers

When the final sale in the supply chain is made, the retailer is responsible for collecting sales tax. The required journalized entries for the selected transactions involving sales tax are attached below.

The state levies a consumption tax, the so-called sales tax, on the purchase of goods and services. A standard sales tax is collected at the point of sale, collected at the store and remitted to the government.

Depending on the regulations in that country, a business may be responsible for sales taxes in that jurisdiction if it has a presence there, which can be a physical site, an employee, or an associate. The calculation of sales tax for (a) is:

Sales Tax Payable = Amount of sales× Sales Tax

= $900 × 7%

= $63

Therefore, all the selected transactions are explained with the help of the journal entries.

To learn more on sales tax, here:

https://brainly.com/question/29442509

#SPJ3

Your question is incomplete, but most probably the full question was,

Question Content Area

Journalize the entries to record the following selected transactions:

a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510.

b. Paid $436 to the state sales tax department for taxes collected.

If an amount box does not require an entry, leave it blank.

a.

- Select -

- Select -

blank

- Select -

- Select -

- Select -

- Select -

b.

- Select -

- Select -

blank

Assignment: Create a Marketing Plan

Answers

Your targeted marketing and advertising actions are outlined in a marketing plan for a set time period, often the following 12 months.

The purpose of a marketing planA marketing strategy can assist you in identifying your target market and the advantages your product or service can provide for it. determine how you might entice new clients. Encourage your current clients to keep using your product or service.

What are the five marketing strategies?The five marketing Ps—Product, Pricing, Promotion, Place, and People—serve as a framework for marketing initiatives and help keep marketers focused where they should be.

To know more about marketing plan visit :-

https://brainly.com/question/29775565

#SPJ1

1 Outline the benefits of a good quality management system.

Answers

c) “Shadow price is the increase in value created by having one additional unit of a limiting resource at original cost”. Provide a comprehensive real world example of where a shadow price can be calculated with multiple limiting factors and with more than one product. Your answer should be in a form of a short case study roughly 4 or 5 sentences. (5 marks)

Answers

A real world example of shadow pricing would be in a case where a manufacturer produces two product A and B with 2 input such as raw materials and labor.

How is this so?Two products (A & B) are produced through the use of two primary resources: labor & raw materials. To produce one unit of product A, we require roughly an hour's worth (60 minutes) of work time from our available pool.

Also, approximately two pounds worth of our current stockpile must be incorporated into each instance as well. Comparatively speaking, producing one unit from group B takes almost three times that much effort (3 hours' time), but only requires about half as much by weight (a single pound).

Our maximum allowance stands at exactly 60 work-hours across all levels plus another hundred pounds maximum in terms concerning these earthly elements - with that established pricing amounts to a flat rate where five dollars buys us one metric pound whereas ten dollars goes towards hourly wages; so what is their shadow price?

When dealing with limited input availability, the optimal allocation of resources and production process optimization can be achieved using shadow prices. In this regard, it has been determined that labor's shadow price stands at $10 per hour while the shadow price for raw materials is set at $5 per pound.

Learn more about Shadow pricing:

https://brainly.com/question/30695369

#SPJ1

1. Prepare general journal entries to record the transactions above for Spade Company by using the following accounts: Cash; Accounts Receivable; Office Supplies; Office Equipment; Accounts Payable; Common Stock; Dividends; Fees Earned; and Rent Expense. 2. Post the above journal entries to T-accounts, which serve as the general ledger for this assignmen

Answers

Question Completion:

The transactions of Spade Company appear below. a. Kacy Spade, owner, invested $18,750 cash in the company in exchange for common stock. b. The company purchased office supplies for $544 cash. c. The company purchased $10,369 of office equipment on credit. d. The company received $2,212 cash as fees for services provided to a customer. e. The company paid $10,369 cash to settle the payable for the office equipment purchased in transaction c. f. The company billed a customer $3,975 as fees for services provided. g. The company paid $530 cash for the monthly rent. h. The company collected $1,670 cash as partial payment for the account receivable created in transaction f. i. The company paid $1,000 cash in dividends to the owner (sole shareholder).

Answer:

Spade Company

General Journal Entries:

a. Debit Cash $18,750

Credit Common stock $18,750

To record cash contributed in exchange of common stock.

b. Debit Office supplies $544

Credit Cash $544

To record the purchase of office supplies.

c. Debit Office Equipment $10,369

Credit Accounts Payable $10,369

To record the purchase of office equipment on account.

d. Debit Cash $2,212

Credit Fees Earned $2,212

To record the receipt of cash for earned fees.

e. Debit Accounts Payable $10,369

Credit Cash $10,369

To record the payment for office equipment.

f. Debit Accounts Receivable $3,975

Credit Fees Earned $3,975

To record the supply of services on account.

g. Debit Rent Expense $530

Credit Cash $530

To record payment for monthly rent.

h. Debit Cash $1,670

Credit Account receivable $1,670

To record the receipt of cash on account.

i. Debit Dividends $1,000

Credit Cash $1,000

To record the payment of cash dividend.

2. T-accounts:

Cash

Account Title Debit Credit

Common stock $18,750

Office supplies $544

Fees Earned 2,212

Accounts Payable 10,369

Rent Expense 530

Account receivable 1,670

Dividends 1,000

Accounts receivable

Account Title Debit Credit

Fees Earned $3,975

Cash $1,670

Office Supplies

Account Title Debit Credit

Cash $544

Office Equipment

Account Title Debit Credit

Accounts Payable $10,369

Common Stock

Account Title Debit Credit

Cash $18,750

Accounts Payable

Account Title Debit Credit

Office Equipment $10,369

Cash $10,369

Fees Earned

Account Title Debit Credit

Cash $2,212

Accounts Receivable 3,975

Rent Expense

Account Title Debit Credit

Cash $530

Dividends

Account Title Debit Credit

Cash $1,000

Explanation:

a) Data and Analysis:

a. Cash $18,750 Common stock $18,750

b. Office supplies $544 Cash $544

c. Office Equipment $10,369 Accounts Payable $10,369

d. Cash $2,212 Fees Earned $2,212

e. Accounts Payable $10,369 Cash $10,369

f. Accounts Receivable $3,975 Fees Earned $3,975

g. Rent Expense $530 Cash $530

h. Cash $1,670 Account receivable $1,670

i. Dividends $1,000 Cash $1,000

Casey Klemons' agreement (BELO plan) with his employer provides for a pay rate of $16.50 per hour with a maximum of 50 hour. How much would Klemons be paid for a week in which he worked 46 hours

Answers

Answer:

$907.50

Explanation:

Calculation for How much would Klemons be paid for a week in which he worked 46 hours

Amount to paid =(10 × 0.5 × $16.50)+(50× $16.50

Amount to paid=$82.50 + $825

Amount to paid=$907.50

Therefore the amount that Klemons should be paid for a week in which he worked 46 hours is $907.50