Under the _____ concept, the company carefully integrates and coordinates its many communication channels to deliver a clear, consistent, and compelling message about the organization and its brands.

Answers

Under the Integrated Marketing Communucation concept, the company carefully integrates and coordinates its many communication channels to deliver message.

What is Integrated Marketing Communication?Integrated marketing communication is seen as the process employed by organisation to unify marketing communication means like public relations, social media, audience analytics, and advertising, into a brand identity that remains consistent in all media channels.

Therefore, the answer is Integrated Marketing Communication.

learn more about Integrated Marketing Communication: https://brainly.com/question/9696745

#SPJ1

Related Questions

GE Corporation has a put option selling for $2.90 and a call option selling for $1.95, both with a strike price of $29.00. What would the net value of a long straddle position be if the stock price at expiration is $35?

A) 7.15

B) $1.15

C) $1.15

D) $7.15

E) $36.15

Answers

Answer:

$1.15

Explanation:

Calculation for the net value of a long straddle position

Using this formula

Net value =(Stock price at expiration-Strike price)-Put option selling-Call option selling

Let plug in the formula

Net value = ($35-$29)-$2.90-$1.95

Net value=$6-$2.90-$1.95

Net value=$1.15

Therefore the net value of a long straddle position will be $1.15

With regard to suppliers, just-in time typically require: Group of answer choices buyer inspection of all goods and materials. delivery of large lots at regular intervals. the lowest price possible. multiple sources from which to purchase. long-term relationships and commitments.

Answers

Answer: long-term relationships and commitments.

Explanation:

Just in time typically implies long-term relationships and commitment. It requires a good understanding of the supplier and the manufacturer in terms of the quantity and the swiftness with material delivery. When there is a misunderstanding between the manufacturer and the supplier, delivery cones to a halt. This is why there's a need for a long lasting relationship and commitment.

-1 1. Which of the following budget terms mean the same thing?

a) surplus and deficit

c) surplus and break-even

b) break-even and balanced d) deficit and balanced

Answers

Answer:

b

Explanation:

none just trust me..............

Use Laplace transform to solve the following initial value problems:

(a) y'- 2y + 2y = cost, y(0) = 1, y'(0) = 0.

(b) y)-y=0, y(0)=2, (0) = -2, (0)=0, "(0) = 0.

(c) y + y(t) = '(0) = 0. 0 1≤t<5 otherwise, y(0) 0,

Answers

The given initial value problems involve differential equations that can be solved using Laplace transforms.

In problem (a), the Laplace transform will be used to find the solution for the given equation and initial conditions. In problem (b), the Laplace transform will be applied to solve a different equation with specific initial conditions. Lastly, problem (c) requires applying the Laplace transform to find the solution for a differential equation with a piecewise function and initial condition.

(a) To solve the initial value problem y' - 2y + 2y = cost, y(0) = 1, y'(0) = 0, we first take the Laplace transform of both sides of the equation, substitute the initial conditions, and then solve for Y(s). After finding Y(s), we take the inverse Laplace transform to obtain the solution y(t).

(b) For the initial value problem y" - y = 0, y(0) = 2, y'(0) = -2, y''(0) = 0, we again take the Laplace transform of the given equation and apply the initial conditions. This will give us the transformed equation in terms of the Laplace variables. By solving for Y(s), we can then use the inverse Laplace transform to find the solution y(t).

(c) In the initial value problem y' + y(t) = '(0) = 0, 0 ≤ t < 5, and y(0) = 0, we encounter a piecewise function. We will apply the Laplace transform to the equation, taking into account the different intervals. By considering the initial condition and solving for Y(s), we can obtain the inverse Laplace transform to find the solution y(t) for the given differential equation.

Using Laplace transforms allows us to solve these initial value problems and find the solutions to the respective differential equations with their specific initial conditions.

Learn more about Laplace transforms here:

https://brainly.com/question/30759963

#SPJ11

in the national income accounts, government purchases are goods and services purchased by: the state and local governments. the federal, state, and local governments. the federal and state governments. the federal government.

Answers

In the national income accounts, government purchases are goods and services purchased by the federal, state, and local governments.

National income accounts are a set of macroeconomic measures that provide information about a country's overall economic activity, including its production, income, expenditure, and savings.

In this framework, "government purchases" refer to the goods and services bought by the federal, state, and local governments, which are collectively referred to as the public sector.

This category of spending is an important component of the national income accounts because it represents the government's contribution to overall demand in the economy.

When the government buys goods and services, it injects money into the economy, which in turn stimulates demand and drives economic growth. Additionally, government purchases may also contribute to the provision of public goods and services, such as national defense, education, and infrastructure.

To know more about National income

https://brainly.com/question/23850586

#SPJ4

Raising animals in a CAFO has the benefit of keeping manure contained and away from farm fields where it would lead to erosion and loss of soil fertility Not yet answered Points out of 1.00. True or False?

Answers

True. Concentrated animal feeding operations (CAFOs) are large-scale facilities where animals are raised indoors in close confinement. CAFOs are often criticized for their environmental impact, including the production of large amounts of manure.

However, CAFOs can also have some benefits, such as keeping manure contained and away from farm fields where it could lead to erosion and loss of soil fertility. Manure is a valuable fertilizer, but it can also be a pollutant if it is not properly managed. When manure is spread on fields, it can contribute to nutrient runoff, which can pollute waterways and lead to algae blooms. CAFOs can help to reduce nutrient runoff by collecting and storing manure on-site. This allows the manure to be applied to fields in a controlled manner, which helps to prevent nutrient pollution. In addition to reducing nutrient runoff,.

CAFOs can also help to improve soil quality. Manure contains nutrients that are essential for plant growth, such as nitrogen, phosphorus, and potassium. When manure is applied to soil, it can help to improve the soil's ability to hold water and nutrients, which can lead to increased crop yields.

To know more about CAFO's, click here:-

https://brainly.com/question/32340167

#SPJ11

Consider the following account starting balances and transactions involving these accounts. use t-accounts to record the starting balances and the offsetting entries for the transactions.

the starting balance of accounts payable is $1,900

the starting balance of cash is $9,100

the starting balance of debt is $2,400

the starting balance of inventory is $4,800

1. buy $18 worth of manufacturing supplies on credit

2. borrow $53 from a bank

3. pay $8 owed to a supplier

what is the final amount in debt?

Answers

To answer this question, we first need to understand what a T-account is. A T-account is a visual representation of a general ledger account, with a "T" shape. The left side of the "T" represents debits, while the right side represents credits.

Now, let's consider the following account starting balances and transactions:

Starting balances:

Cash: $1,000

Accounts Receivable: $500

Accounts Payable: $200

Transactions:

1. Received $300 from a customer on account

2. Paid $100 to a vendor for supplies

3. Collected $50 cash from sales

To record these transactions in T-accounts, we would start with the following starting balances:

Cash | $1,000

|-------

|

Accounts Receivable | $500

|--------

|

Accounts Payable | $200

|-------

|

For transaction 1, we would debit Cash for $300 (increasing the balance) and credit Accounts Receivable for $300 (decreasing the balance):

Cash | $1,300

|-------

| $300

Accounts Receivable | $200

|--------

| $300

For transaction 2, we would debit Accounts Payable for $100 (decreasing the balance) and credit Cash for $100 (decreasing the balance):

Cash | $1,200

|-------

| $100

Accounts Receivable | $200

|--------

| $300

Accounts Payable | $100

|-------

| $100

For transaction 3, we would debit Cash for $50 (increasing the balance) and credit Sales for $50 (increasing the balance):

Cash | $1,250

|-------

| $50

Accounts Receivable | $200

|--------

| $300

Accounts Payable | $100

|-------

| $100

Sales | $50

|------

| $50

To calculate the final amount in debt, we need to look at the balance in the Accounts Payable account. At the end of the transactions, the balance in the Accounts Payable account is $100. Therefore, the final amount in debt is $100.

In conclusion, T-accounts are a useful tool to record and visualize transactions in accounting. By using T-accounts, we were able to record the starting balances and transactions for this example and determine the final amount in debt.

for more such questions on account

https://brainly.com/question/27968241

#SPJ11

write the answers down like this pleaseeeeee

''1)??''

Answers

The definition of the terms in the image is given below as they are correctly matched:

The Definition of the termsAsset: An asset is any resource or property that has value and can be owned by a person, business or organization. Examples of assets include cash, property, investments, inventory, and equipment.

Debit: A debit is an accounting entry that represents an increase in assets or a decrease in liabilities or equity. In double-entry bookkeeping, a debit entry is recorded on the left-hand side of an account ledger.

Credit: A credit is an accounting entry that represents an increase in liabilities or equity or a decrease in assets. In double-entry bookkeeping, a credit entry is recorded on the right-hand side of an account ledger.

Capital: Capital refers to the money invested in a business by its owners or shareholders. It can also refer to the assets owned by a business that can be used to generate income.

Liabilities: Liabilities are debts or obligations owed by a business to other parties. Examples include loans, accounts payable, and taxes owed.

Cash payments: Cash payments refer to any money paid out by a business or individual for goods, services, or other expenses.

Profit: Profit is the amount of money that a business earns after subtracting all of its expenses from its revenue.

Cash receipts: Cash receipts refer to any money received by a business or individual for goods, services, or other income.

Owner's equity: Owner's equity represents the residual value of a business after all liabilities have been paid off. It is the value of the assets that the owner or owners of the business can claim as their own.

Transactions: Transactions refer to any exchange of goods or services that takes place between two or more parties.

Sole trader: A sole trader is a business owned and operated by a single person.

Income: Income refers to any money earned by a business or individual from the sale of goods or services.

Expenses: Expenses refer to any money spent by a business or individual in order to generate income or operate a business.

Accounting equation: The accounting equation is a fundamental principle of accounting that states that assets must always equal liabilities plus owner's equity.

Loss: A loss occurs when a business's expenses exceed its revenue, resulting in a negative net income.

Bank: A bank is a financial institution that accepts deposits from customers and provides loans and other financial services.

Subsidiary journal: A subsidiary journal is a book of accounts that records transactions for a specific type of transaction, such as purchases or sales. It is used to simplify the process of recording transactions in the general ledger.

Read more about assets here:

https://brainly.com/question/25746199

#SPJ1

The journal entry to record the proceeds of long-term debt in a governmental fund includes a credit to:A. RevenueB. CashC. A long-term liability accountD. Other financing sources

Answers

The journal entry to record the proceeds of long-term debt in a governmental fund includes a credit to Other financing sources. The correct answer is:D.

When recording the proceeds of long-term debt in a governmental fund, the journal entry typically includes a credit to "Other financing sources." This account represents the inflow of resources from external sources, such as borrowing or issuing bonds, to finance the operations or capital projects of the government.

The credit to "Other financing sources" reflects the increase in liabilities resulting from the long-term debt. It represents the source of funds that will be used to support the government's activities and is classified as a financing activity rather than revenue.

It is important to note that the specific account titles and classifications may vary based on the governmental accounting standards and the chart of accounts used by the specific government entity. However, the concept of crediting "Other financing sources" to record the proceeds of long-term debt remains consistent.

The correct answer is:D.

To know more about journal entry refer to-

https://brainly.com/question/20421012

#SPJ11

this year, jordan, a single taxpayer, gave $35,000 cash to alex. alex used the money to pay medical expenses. jordan also paid $16,000 in tuition expenses directly to alex's university on alex's behalf. assume the annual gift tax exclusion is $15,000, the gift tax rate is 20%, and jordan has not used any of the unified credit. what is jordan's taxable gift amount and the lowest possible gift tax owed for this year, if any?

Answers

Jordan's taxable gift amount is the amount of gifts that exceed the annual gift tax exclusion of $15,000 per recipient. In this case, the taxable gift amount is $36,000. Applying the 20% gift tax rate, the lowest possible gift tax owed is:

$36,000 x 20% = $7,200

Jordan's taxable gift amount is the amount of gifts that exceed the annual gift tax exclusion of $15,000 per recipient. In this case, Jordan gave a total of $51,000 ($35,000 in cash and $16,000 in tuition payments) to Alex. Since the annual gift tax exclusion is $15,000 per recipient, $36,000 of the gifts ($35,000 in cash + $1,000 of the tuition payment) exceeds the exclusion amount and is considered a taxable gift.

To calculate the lowest possible gift tax owed, we need to first determine the taxable gift amount and then apply the gift tax rate of 20%. In this case, the taxable gift amount is $36,000. Applying the 20% gift tax rate, the lowest possible gift tax owed is:

$36,000 x 20% = $7,200

However, it is important to note that Jordan has not used any of the unified credit, which is a credit against the gift and estate tax. The unified credit is currently set at $11.7 million for 2021, so Jordan has plenty of credit available to offset the gift tax owed. In this case, since the amount of the taxable gift is less than the unified credit, Jordan will not owe any gift tax.

For more such questions on taxable gift

https://brainly.com/question/28640464

#SPJ11

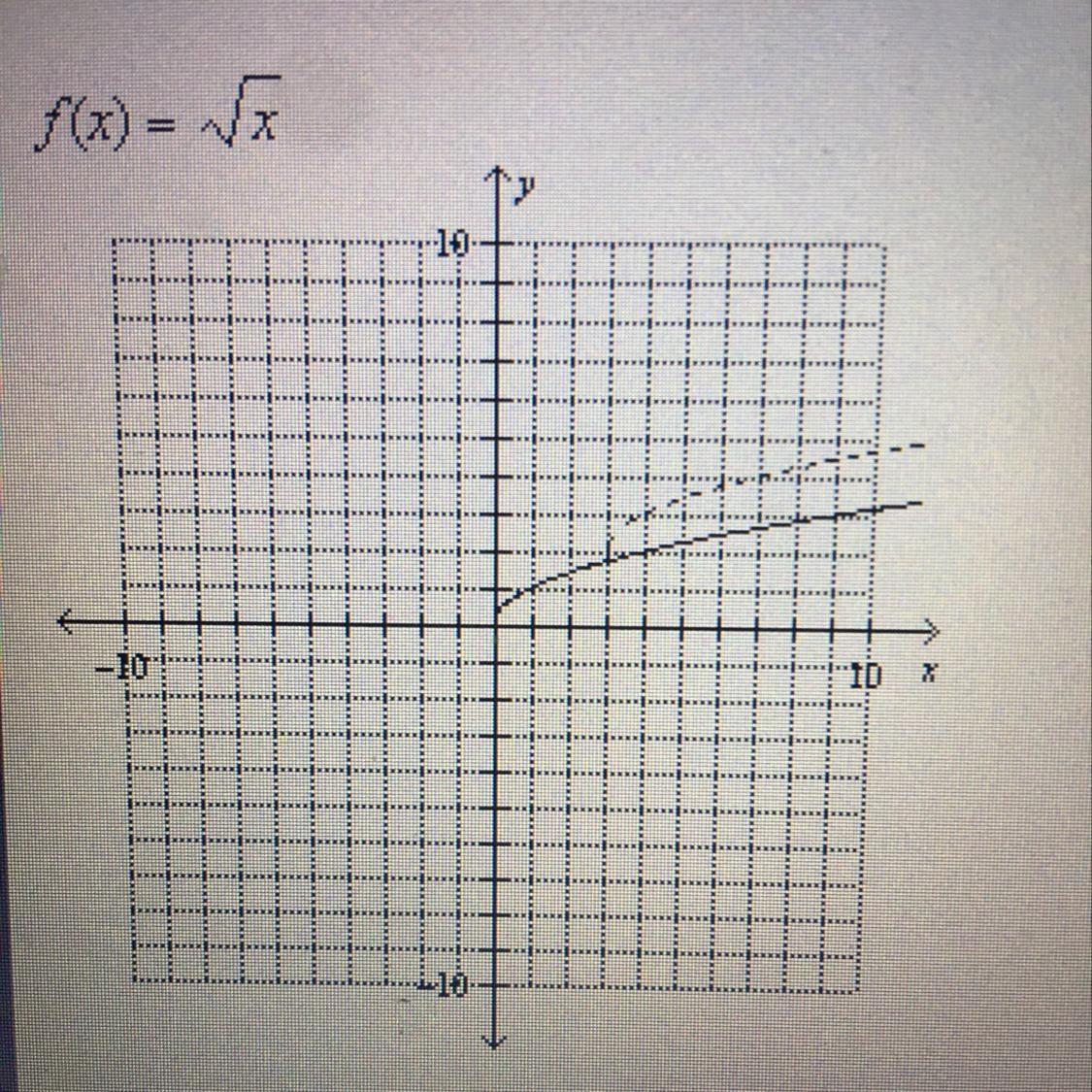

Identify the change in the parent function that will produce the related function shown as a dash line. f(x)= √ x

Answers

Answer:

\(g(x) = 2 + \sqrt x\)

Translate the parent function, 2 units upward

Step-by-step explanation:

Given

\(f(x) = \sqrt x\)

See attachment for the graph

Required

Determine the change in f(x) that gives the dashed line

Let the dash line be represented with g(x)

From the attachment, there is only one transformation from f(x) to the g(x).

When f(x) is translated 2 units vertically upwards , it gives g(x); the dash line.

If

\(f(x) = \sqrt x\)

Then g(x) is:

\(g(x) = 2 + f(x)\)

\(g(x) = 2 + \sqrt x\)

influences of Business environment,

Answers

Factors that Influence the business environment are :

Economic environmentSocial environmentTechnological environmentPolitical environmentLegal environment

The business environment means the total of all the individuals, and institutions that could affect the working of the business firm.

Importance of business environment:

Business environments help the firm to prepare itself for every possible obstruction or hindrance that can affect the functioning of the firm.It also helps the firm to adjust to frequent changes.The economic environment is all the things that create an economic impact on the firm.

The social environment is all the traditions and customs of the society that creates an impact on the firm.

The technological environment is all the impact on the firm caused due to new technology and upgradations.

The political environment is the conditions and behavior that the elected representatives hold toward the business

The legal environment is entirely based on the rules and legislation of the authorities.

For more about Business Environment refer to the link : https://brainly.com/question/26589766

what would you expect to be the major product obtained from the following reaction?

Answers

In order to determine the major product obtained from a chemical reaction, we need to consider the reactivity and stability of the reactants and products. Without knowing the specific reaction being referred to, it is difficult to provide a definitive answer.

However, we can consider some general principles. For example, in a reaction between an acid and a base, the major product is typically a salt and water. In a reaction between an alkene and a halogen, the major product is typically a halogenated alkane. In a reaction between an alcohol and a carboxylic acid, the major product is typically an ester.

The type of reaction being referred to and the specific reactants involved will determine the major product obtained. It is also possible that multiple products can be formed, depending on the conditions of the reaction.

To know more about product click here:

https://brainly.com/question/31812224

#SPJ11

The complete Question is:

What Would You Expect To Be The Major Product Obtained From The Following Reaction? AICl ExcesS HN CH3CI HN HN HN.

Which of the following statements about cash flows are true? Check All That Apply The income statement reports cash flow information directly The income statement reports cash flow information indirectly. The statement of cash flows reports information about cash flows directly. The statement of cash flows reports information about cash flows indirectly Knowledge

Answers

The statement of cash flows reports information about cash flows directly about cash flows are true.

The income statement, on the other hand, reports information about revenue and expenses, which indirectly impact cash flows. The statement of cash flows is a financial statement that summarizes the sources and uses of cash during a given period. It shows the inflows and outflows of cash in operating, investing, and financing activities.

By contrast, the income statement shows the revenue earned and expenses incurred by a company during a specific period. Understanding the statement of cash flows is essential for assessing a company's liquidity, solvency, and financial performance.

For more about cash flows:

https://brainly.com/question/29768594

#SPJ11

Assume General Motors Corporation is planning to issue bonds with a face value of $250,000 and a coupon rate of 6 percent. The bonds mature in five years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided. Round your final answer to a whole dollar. ) Determine the issuance price of the bonds assuming an annual market rate of interest of 8 percent

Answers

The issuance price of the General Motors Corporation bonds is $219,226.

To determine the issuance price of General Motors Corporation's bonds with a face value of $250,000 and a coupon rate of 6 percent, maturing in five years and paying interest semiannually, given an annual market rate of interest of 8 percent, follow these steps:

1. Calculate the coupon payment: 6% of $250,000 divided by 2 (since it's semiannual) = $7,500 per period.

2. Determine the number of periods: 5 years multiplied by 2 (semiannual) = 10 periods.

3. Find the semiannual market rate: 8% divided by 2 = 4% or 0.04.

4. Determine the present value of the interest payments (PVA of annuity): Use the PVA of $1 table with 4% interest rate and 10 periods to find the appropriate factor (6.7101). Multiply this factor by the coupon payment: $7,500 x 6.7101 = $50,325.75.

5. Determine the present value of the face value (PV of lump sum): Use the PV of $1 table with 4% interest rate and 10 periods to find the appropriate factor (0.6756). Multiply this factor by the face value: $250,000 x 0.6756 = $168,900.

6. Add the present values from steps 4 and 5 to find the issuance price of the bonds: $50,325.75 + $168,900 = $219,225.75. Round this value to the nearest whole dollar: $219,226.

In conclusion, the issuance price is $219,226.

To know more about bonds click here

brainly.com/question/29667007

#SPJ11

An Investor who brings _____ equity often will recelve a share of ownershlp in the company although she did not Invest capital, but effort Use this media to help you complete the question.

sweat

additional

bootstrapped

lingering

Answers

Answer:

additional equity I think

sam's employer matches a portion of his contributions to a 401k. this is essential for sam to consider when planning how to allocate his cash flow because

Answers

Sam's employer matching a portion of his contributions to a 401k is essential for him to consider when planning how to allocate his cash flow because it provides a valuable opportunity to maximize his retirement savings.

Employer matching contributions are essentially free money added to Sam's account, increasing the overall value of his retirement fund.

By taking advantage of the employer match, Sam can potentially double his 401k contributions, depending on the match percentage offered by his employer. This significantly accelerates his retirement savings growth and helps him reach his financial goals faster.

Moreover, contributions to a 401k are usually tax-deferred, meaning Sam's taxable income is reduced by the amount he contributes. This results in immediate tax savings, allowing him to allocate more of his cash flow towards his retirement goals.

In addition, the 401k plan provides a long-term investment horizon, allowing Sam's funds to grow through compound interest over time. As his account balance increases, so does the earning potential, which can lead to substantial growth in the long run.

In summary, Sam should prioritize maximizing his employer's 401k matching contributions when allocating his cash flow. Doing so will allow him to take advantage of free money from his employer, reduce his taxable income, and accelerate the growth of his retirement savings, ultimately helping him achieve a more secure financial future.

To know more about Employer matching contributions, refer to the link below:

https://brainly.com/question/29997233#

#SPJ11

One to two sentences, explain what happens to a production possibilities curve if a natural disaster creates a scarcity of a key resource needed to make a product. Explain why this happens.

Answers

A natural disaster causing a scarcity of a key resource necessary for production will result in a shift inward or to the left of the production possibilities curve.

This occurs because the reduced availability of the key resource limits the economy's ability to produce the affected product, leading to a decrease in overall production capacity.

As a result, the economy's production possibilities are constrained, and it is forced to operate at a suboptimal level.

The scarcity of the key resource disrupts the balance between the production of different goods, leading to a decrease in potential output.

The economy will need to allocate its limited resources and adjust its production mix accordingly, potentially focusing on alternative products or finding substitutes for the scarce resource in order to maximize production under the new constraints imposed by natural disaster-induced scarcity.

For more questions on: production possibilities curve.

https://brainly.com/question/26460726

#SPJ8

________ can be classified according to whether they are delivered by people or equipment, or by business firms or nonprofit organizations. Multiple choice question.

Answers

Services can be classified according to whether they are delivered by people or equipment, or by business firms or nonprofit organizations.

What are services?

Services serves as the task or activities that is been delivered to the client in exchange if rewards.

Services can be different based on the organization performing it such banking sector , and classified according to whether they are delivered by people or equipment, or by business firms.

Learn more about services at:

https://brainly.com/question/25605883

Which type of document typically includes contract contingencies?

Purchase and sale agreement.

O Assignment of contract.

Appraisal.

O Option contract.

Answers

Answer:

A.

Explanation:

For a Sailor with a Significant Problems (SP) evaluation, what information must be entered on a C-WAY application?

Answers

For an assessment of a Sailor with Significant Problems (SP), Information about being ineligible must be submitted on a C-WAY application.

The top-performing Sailors can be connected to job requirements in the people inventory using the Career Waypoints (C-WAY) system, a corporate IT system. It operates as a service continuum system and is recognised as a long-term force managed service, balancing manning across rates, ratings, Active Component (AC), Full Time Support (FTS), and Reserve Component. The Bureau of Naval Personnel (BUPERS) has control over the reenlistment and enlistment contract extension quotas (RC). applicable to Sailors E3 through E6 who request permission to reenlist or complete a STE when appropriate and who have less than 14 years of active duty between their Active Duty Service Date (ADSD) and Expiration of Active Obligated Service as Extended (SEAOS).

To learn more about CWAY application refer here:

https://brainly.com/question/14400492

#SPJ4

many companies provide office supplies for their employees use while on the job. imagine that you work for such a company. several of your co-workers take company supplies home for their personal use,such as pens,paper,and staplers.is this ethical? will it affect the company's profits?

Answers

Answer:

nyfdrferghhytejrhtgrsfeadS

Explanation:

fdgbhg

A) Mansfield Services Company provides its employees vacation benefits and a defined contribution pension plan. Employees earned vacation pay of $44,000 for the period. The pension plan requires a contribution to the plan administrator equal to 8% of employee salaries. Salaries were $450,000 during the period.

Provide the journal entry for the:

vacation pay and

pension benefit.

B) The payroll register of North Country Store Services indicates $1080 of social security withheld and $270 of Medicare tax withheld on total salaries of $18,000 for the period. Earnings of $6250 are subject to state and federal unemployment compensation taxes at the federal rate of 0.7% and the state rate of 3.8%.

Provide the journal entry to record the payroll tax expense for the period.

C) The payroll register of Classic Designs indicates $1,320 of social security withheld and $330 of Medicare tax withheld on total salaries of $22,000 for the period. Federal withholding for the period totaled $1,875.

Provide the journal entry for the period’s payroll. Indicate debits and credits.

Answers

A) For vacation pay, the journal entry would be a debit to Vacation Pay Expense for $44,000 and a credit to Vacation Pay Payable for $44,000.

For pension benefits, the journal entry would be a debit to Pension Expense for $36,000 ($450,000 x 8%) and a credit to Pension Payable for $36,000.

B) The journal entry to record payroll tax expense would be a debit to Payroll Tax Expense for $333.50 ($1080 + $270 + ($6250 x 0.7%) + ($6250 x 3.8%)) and a credit to Social Security Payable for $1080, Medicare Payable for $270, Federal Unemployment Tax Payable for $43.75 ($6250 x 0.7%), and State Unemployment Tax Payable for $21.88 ($6250 x 3.8%).

C) The journal entry for the period’s payroll would be a debit to Salaries Expense for $22,000 and a credit to Cash for $19,175 ($22,000 - $1,875 - $1,320 - $330).

The $1,875 federal withholding is a liability until it is remitted to the government, so it is credited to Federal Income Tax Payable. The $1,320 social security and $330 Medicare taxes withheld are liabilities until they are remitted to the government, so they are credited to Social Security Payable and Medicare Payable, respectively.

To know more about Federal Income Tax click on below link:

https://brainly.com/question/17092810#

#SPJ11

Which of the following is considered the heartbeat of an organization?

Management

Educators

Employees

O Customers

Answers

The heartbeat of an organization is Management.

ManagementManagement plays important role in shaping the culture of an organisation. The performance and survival of business organisation depends on its management.

Importance of ManagementManagement is the dynamic life-giving element in every organization. It is the activating force that gets things done through people. Without management, an organization is merely a collection of men, machines, money and material. In its absence, the resources of production remain resources and never become production.

Thus, the heartbeat of an organization is Management.

Learn more on organization here- brainly.com/question/14874943

#SPJ2

2. (1pt) what is the value of an infinite series of $50 semiannual payments growing at a rate of 4% every six months and with a discount rate of 10% apr compounded semiannually? how would your answer change if the growth rate was 5% every six months?

Answers

It usually multiplies by 100 to show the difference in GDP between one period and the next. This difference is expressed as a percentage of GDP from the previous period.

The value of the infinite series of payments is calculated as follows: Value = PMT/(r - g) Value = 50/(0.10 - 0.05) Value = 50/0.05 Value = $1,000 The value of the infinite series of payments with a growth rate of 5% Growth rate every six months, g = 5% = 0.05 APR = 20% compounded semiannually s = Number of semi-annual periods per year = 2

How is the perpetuity growth rate calculated?g is the increase in cash flows over time. The terminal value in year n (for instance, year 5) is the product of the growth rate and the free cash flow from year 5 multiplied by 1 divided by the WACC (w) – growth rate (g).

Learn more about growth rate here:

https://brainly.com/question/25849702

#SPJ4

LO3- Guideline P5+P6 1-Explain the benefits of international Accounting Standards (IAS) and International Financial Reporting Standards (IFRS) and distingish between them. -IAS: Definition and benefit

Answers

IAS and IFRS provide a consistent and transparent way of presenting financial statements, which increases the credibility and reliability of financial information. International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS) are important guidelines used by accounting professionals. The benefits of International Accounting Standards (IAS) include: Increased transparency, Improved quality of financial statements, etc.

International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS) are important guidelines used by accounting professionals.IAS are standards that were issued by the International Accounting Standards Committee (IASC), which is now known as the International Accounting Standards Board (IASB).The benefits of International Accounting Standards (IAS) include: 1. Increased transparency: When companies follow IAS, it is easier to understand the financial statements and to make comparisons between companies. 2. Global acceptance: Since IAS are recognized internationally, it allows businesses to be able to present financial statements that will be acceptable to foreign investors. 3. Improved quality of financial statements: When companies follow IAS, it ensures that the financial statements are more accurate and consistent. 4. Reducing the cost of capital: When a company follows IAS, it is easier for investors to understand the company's financial position, reducing the perceived risk, thus reducing the cost of capital.IAS are used as a basis for the development of International Financial Reporting Standards (IFRS). IFRS are accounting standards issued by the IASB that are now accepted worldwide. IFRS are used by companies in over 100 countries, and they are designed to provide a common accounting language. They are intended to ensure consistency and comparability in financial statements, allowing companies to communicate financial information more effectively and clearly. The main difference between IAS and IFRS is that IFRS are more specific than IAS. While IAS provide a general framework for accounting, IFRS provide more detailed guidance on how to implement the accounting principles. This makes IFRS more useful for companies that need to comply with specific accounting requirements. In conclusion, IAS and IFRS provide a consistent and transparent way of presenting financial statements, which increases the credibility and reliability of financial information.For more such questions on IAS and IFRS , click on:

https://brainly.com/question/30246507

#SPJ11

on january 1 luring, incorporated, issues $2,000,000 of 10 percent, 5-year bonds that pay interest of $100,000 semiannually. the market rate is 12 percent at the time of issuance. the present value of 1 at 6% for 10 periods is 0.5584. the present value of an annuity at 6% for 10 periods is 7.3601. the issue price of the bonds is .

Answers

Answer:

see the answer

Explanation:

It's 2000000-100000=3000000

then you now calculate the percentage

by adding and the decimal fraction and add it to the $

Explain the importance of office for an organization long answer

Answers

Answer:

The answer to this question is given below in this explanation section.

Explanation:

" importance of office for an organization"

An office is the center point of organization.It is a place to perform different activities of a business organization.The office is the brain of the whole organization.The office performs a critical function such as information collection,collection,recording analyzing distribution of information and executive function such as planning,organization,policies formulation,decision making etc.

It is used by management for the purpose of planning,organizing,staffing,directing,and controlling.Office not only keep record of information but also pay the role of reliable channel of communication the information.It is required for smooth functioning of the organization.

Proper organisation facilities the intensive use of human capital.Organization stimulates creativity.By providing well defined areas of work and ensuring delegation of authority,Organization provides sufficient freedom to the managers and encourages their initiative,independent thinking and creativity.

You can best show a business your interest in their job position through:

A.)social media

b.) an application

c.) a resume

d.) a cover letter

Answers

Answer:

d.) a cover letter

Explanation:

The best way to show a company/business your interest in the job position is through the cover letter. This is a letter that goes in front of your resume when applying for a job and is where the applicant usually explains who they are and why they want the job. This cover letter is the first thing that the employer will see and should tell them why you want the job and why you are the best choice for that job in order to convince them into interviewing or hiring you.

write a number which is the product of two prime number

Answers

Answer:

2 x 3 = 6. ...............

A product of two primes can never be prime because the product of two primes p1 and p2 is always divisible by those two primes that are smaller than it and always bigger than 1 which is not prime by definition - and a prime is only divisible by 1 and itself.

The first 49 prime numbers are 2, 3, 5, 7, 11, 13, 17, 19, 23, 29, 31, 37, 41, 43, 47, 53, 59, 61, 67, 71, 73, 79, 83, 89, 97, 101, 103, 107, 109, 113, 127, 131, 137, 139, 149, 151, 157, 163, 167, 173, 179, 181, 191, 193, 197, 199, 211, 223, and 227.

No, the product of two (or more) prime numbers cannot result in another prime number.