Which of the following is not included in the United Nations Development Program's human development index (HDI)? happiness longevity income knowledge The US national debt is nearing 20 trillion 14 trillion 14 billion 5.5 trillion According to the property-rights principle: local communities should have a property right over flora and fauna within their borders. all users of environmental resoruces should be given property rights over those resoruces. all environmental policies should clearly define property rights. all resources should be used in a manner that respects the property rights of future generations.

Answers

The human development index (HDI) is a measure of a country's development based on indicators such as life expectancy, income, and education.

Happiness is not included in the HDI. According to the property-rights principle, local communities should have property rights over flora and fauna within their borders. The HDI is a composite index of the following three indicators: Resources - such as income and consumption, representing the economic dimension of human development;Education - as measured by years of schooling, representing the social dimension of human development;Longevity - as measured by life expectancy, representing the health dimension of human development.Happiness is not included in the HDI.

However, the United Nations has recognized the importance of happiness as an indicator of human development and well-being. The World Happiness Report is an annual publication that ranks countries based on their levels of happiness. The United States' national debt is approximately $28 trillion as of August 2021.According to the property-rights principle, local communities should have property rights over flora and fauna within their borders. This principle is based on the belief that local communities have a better understanding of the ecological balance and the resources that are available in their region.

By giving local communities property rights over these resources, they can manage them more effectively and sustainably. This principle has been used in various conservation projects around the world, such as the establishment of community-managed forests and protected areas.

To learn more about human development index:

https://brainly.com/question/14391428

#SPJ11

Related Questions

Explain,using PED,why a company might introduce a policy of raising travel fares at peak times and lowering travel fares at non peak time ?

Answers

Using Price Elasticity of demand or (PED) a company might introduce a policy of raising travel fares at peak times because :-

Understanding the 'elasticity of demand' that is pertinent in this situation. Applying price elasticity of demand demonstrates the relationship between the impact of raising fares during busy periods and changes in total revenue, as well as the impact of reducing fares during less busy periods and changes in total revenue.

The quantity demanded of a good or service divided by the percentage change in price is the price elasticity of demand. The percentage change in quantity supplied divided by the percentage change in price represents the price elasticity of supply.To learn more about Price Elasticity of demand, click the links

https://brainly.com/question/20630691

https://brainly.com/question/15010897

#SPJ9

Because susans standard deduction is greater than the amount she made, it turns out that Susan never owed taxes. How large of a refund should she expect from the Federal

government if she follows through on filing her 1040 form

Answers

Note that if Susan's standard deduction is greater than the amount she made, it means her taxable income is zero. If she had any taxes withheld from her paychecks throughout the year, she would be eligible for a full refund of those taxes.

What is the rationale for the above response?Assuming Susan is a single taxpayer under the age of 65 and not claimed as a dependent on anyone else's tax return, her standard deduction for tax year 2022 (filing in 2023) would be $12,950.

If Susan's total income for the year is less than or equal to $12,950, she would owe no federal income tax and would be eligible for a full refund of any federal income tax withheld from her paychecks or estimated tax payments she made throughout the year.

The exact amount of her refund would depend on how much federal income tax was withheld from her paychecks or paid in estimated tax payments throughout the year. Susan can determine the amount of her refund by completing her tax return using Form 1040 and any other applicable forms and schedules.

Learn more about deductions:

https://brainly.com/question/3158031

#SPJ1

A healthcare organization’s insurance coverage is:

the amount that the insurance company will pay for costs associated with risks

the amount that the healthcare organization pays to the insurance company

the amount that the healthcare organization pays for costs associated with risks

the amount that the healthcare organization will pay for a legal case

Answers

Answer:

A

Explanation:

the answer to this question is a

Answer:

A

Explanation:

- the amount that the insurance company will pay for costs associated with risks

correct on Edge

Unpredictable policies can result in conflict because employees may ______.

a.

Believe that there is a double standard

b.

Have to guess at what the policies actually are

c.

Give out information that is incorrect

d.

All of the above

Answers

Answer:

All of the above

Explanation:

D.

Answer:

D

Explanation:

Above

Question 9 of 20

A person earns $40,000 per year. She deducts $2,000 for charitable

donations. She also receives a $3,000 tax credit.

How much taxable income does the person have?

A. $37,000

B. $38,000

C. $43,000

D. $40,000

SUBMIT

Answers

The net amount of taxable income for a person who earns $40,000 per year and deducts $2,000 for charitable donations will be $38,000.

What is taxable income?The amount of income on which the payment of taxes is to be made to the federal or other such authorities for the time being in force, is known as taxable income.

Certain deductions are allowed in total income to compute the liability of the net taxable income. As per the given conditions, a deduction of $2000 can be claimed by the person on her total income of $40000.

Hence, option B holds true regarding the taxable income.

Learn more about taxable income here:

https://brainly.com/question/17961582

#SPJ2

What does the income approach to value rely on when valuing properties that are five or more units?

Gross rent multiplier

Monthly gross rent

Gross income multiplier

Sales comparison

Answers

The income approach to value rely on when valuing properties that are five or more units include the gross rent multiplier, the monthly gross rent, the gross income multiplier, and the sales comparison.

The gross rent multiplier is a ratio that takes the value of a property and divides it by its gross rental income. This gives a quick and easy estimate of a property's value based on its income.

The monthly gross rent is the total rent received from all units in a property before any expenses are subtracted. This is an important factor in the income approach because it is the foundation of the property's income.

The gross income multiplier takes into account all the expenses associated with owning and operating the property, including property taxes, insurance, and maintenance. This gives a more accurate estimate of the property's net income, which is used to determine its value.

Sales comparison is a method of valuing a property by comparing it to similar properties that have recently sold in the same area. This helps to confirm the value estimated using the income approach and ensures that the final estimate is accurate and in line with market conditions.

In conclusion, the income approach to value relies on several key factors to determine the value of properties that have five or more units.

Learn more about Income approach here;

https://brainly.com/question/29829961#

#SPJ11

The utility of a business plan for managing day-to-day operations depends on the accuracy of your assumptions.

a.True

b. False

Answers

True. The accuracy of assumptions plays a crucial role in determining the utility of a business plan for managing day-to-day operations.

Assumptions are the underlying predictions, forecasts, and estimates made about various aspects of a business, such as market conditions, customer behavior, costs, and revenues.

A business plan serves as a roadmap for the organization, outlining its goals, strategies, and expected outcomes. It provides a framework for decision-making and guides the allocation of resources. However, if the assumptions on which the business plan is based are inaccurate, it can lead to significant discrepancies between projected and actual results, impacting the effectiveness of day-to-day operations.

When assumptions are inaccurate, it can result in incorrect revenue projections, cost estimates, market demand forecasts, and other critical factors that influence business operations. This can lead to misalignment between planned activities and the reality of the business environment, hampering decision-making, resource allocation, and performance evaluation.

To maximize the utility of a business plan, it is important to regularly review and update the assumptions based on new information, market changes, and feedback. By ensuring the accuracy of assumptions, businesses can enhance the reliability and relevance of their business plans, facilitating better management of day-to-day operations.

The accuracy of assumptions directly impacts the utility of a business plan for managing day-to-day operations. Accurate assumptions enable businesses to make informed decisions, allocate resources effectively, and adapt their operations to changing circumstances. Regularly reviewing and updating assumptions is essential to ensure the ongoing relevance and usefulness of the business plan in guiding day-to-day activities.

To know more about business plan, visit

https://brainly.com/question/28303018

#SPJ11

Post-Assessment

Question 2 of 5

Why is buying a car considered "bad debt"?

It decreases in value over time

It increases your net worth as it build equity

It gives you transportation to and from your job

It is worth more than any other investment

Submit

Continue

E

Answers

The reason why buying a car considered "bad debt"is that It decreases in value over time. option A

What is bad debt?The term bad debt can be described as the amount of money that a creditor must write off as a result of a default on the part of the debtor in a case whereby the creditor has a bad debt on the books, then things turn to uncollectible and is recorded as a charge-off.

It should be noted that a case can be regarded as bad debt because the value of the asset you receive from the loan depreciates quickly however in some cases interest charges increase how the amount that is been paid for the vehicle. and in thius case cost is higher compare to what it would be if you'd purchased the car outright with cash.

Hence, option A is correct.

Learn more about bad debt at:

https://brainly.com/question/24871617

#SPJ1

________leads to better quality and lower prices?

A. Scarcity

B. Competition

C. Monopolies

D. Studying macroeconomics

Please help!!

Answers

Answer:

a

Explanation:

because it makes sense in the sentence

Speculative, or non-investment-grade, bonds have an S&P bond rating of

Select one:

a. BBB or less.

b. CCC or less.

c. C or less.

d. BB or less.

Answers

Speculative, or non-investment-grade, bonds have an S&P bond rating of **d. BB or less**.

S&P (Standard & Poor's) is a credit rating agency that assigns ratings to bonds based on their creditworthiness and risk of default. Bonds rated below the investment-grade category are considered speculative, meaning they carry higher risks for investors. The S&P bond ratings for speculative bonds typically start at BB and go lower, such as B, CCC, and C, indicating varying degrees of credit risk. A rating of BB or lower signifies that the bond is below investment grade and is more susceptible to default or adverse financial conditions. Higher-rated bonds, on the other hand, are considered investment-grade and have lower default risk, making them more attractive to investors seeking more stable returns.

To learn more about non-investment-grade

https://brainly.com/question/30207863

#SPJ11

When accountants are not independent, which of the following reports can they issue: Multiple Choice 1.examination report on a financlal forecast. 2.standard unmodifled audit report on historical financial statements. 3.examination of internal control over financial reporting for an issuer. 4.compilation report on historical financial statements.

Answers

When accountants are not independent, the report they issue is typically a compilation report on historical financial statements.

It is one of the four types of reports that auditors issue, along with the standard unmodified audit report, examination report on a financial forecast, and examination of internal control over financial reporting for an issuer.Audit reports are issued by independent auditors who have no ties to the company they're auditing. This is essential because it establishes credibility and objectivity in their reports.

Independence implies that the auditor is impartial and can provide a fair and honest opinion on the accuracy of the financial statements.However, if accountants aren't independent, the report they issue may be influenced by the connections they have with the company, which may make their report less reliable. Compilation reports on historical financial statements are typically issued by accountants who aren't independent.

A compilation report is a report that includes financial statements prepared by a company's management. The accountant's role in this scenario is to arrange the financial data into a format that complies with the generally accepted accounting principles (GAAP) or other accounting standards.The report itself doesn't have any assurance and doesn't give an opinion on the accuracy of the financial statements. It simply says that the financial statements have been compiled in accordance with GAAP.

The accountant's lack of independence means that their report doesn't have the same credibility as an independent auditor's report. It is critical to understand the importance of independence in the auditing process, as it ensures that the information provided in the report is trustworthy and unbiased.

For more information on GAAP visit:

brainly.com/question/20599005

#SPJ11

Which of these situations can be handled by using the Management Information Systems?

An organization needs different types of managements to achieve business goals smoothly. However, managers, executives, and employees face

problems and hurdles while running the organization. (Sometimes, there are problems in the inventory department. )(At times, the organization

faces problems with the performance of their products in the market.)(Decision makers of the organization are not able to take proper

decisions.)(Employees face technical Issues while feeding data into a database.)

Answers

Answer:

Which of these situations can be handled by using the Management Information Systems?

An organization needs different types of managements to achieve business goals smoothly. However, managers, executives, and employees face problems and hurdles while running the organization. Sometimes, there are problems in the inventory department. At times, the organization faces problems with the performance of their products in the market. Decision makers of the organization are not able to take proper decisions. Employees face technical issues while feeding data into a database.

Explanation:

The amount of a market that a producer controls is called market share. How is market share related to pure competition?

Answers

Answer:

pure competition ids defined as a market structure with many fully informed buyers and sellers in an identical producer and ease of entry. if there were more market shares, there would be more competition.

Explanation:

Which of the following is an example of an entrepreneur being influenced by

the economic principle of supply and demand?

A. Wendy has researched ways to maximize productivity in her new

business.

B. Lindsey notices that the only coffee shop in town is very popular,

so she opens her own coffee shop.

C. Saul has come up with an advertising budget for his new

business's marketing campaign.

D. At his new bike shop, Nick hires polite, friendly individuals to work

the registers.

Answers

Answer:

B. Lindsey notices that the only coffee shop in town is very popular, so she opens her own coffee shop.

Explanation:

According to the economic principle of supply and demand, the relationship between the two is directly proportional to each other. With the increase in the demand of any product, there arises an increase in the supply of the product and vice versa.

From the given options, option B. is representing the relationship between supply and demand. The popularity of coffee shop among the people in the town led Lindsey to open her own coffee shop. Increase in demand led to the increase in the supply of the product.

Answer:

Lindsey notices that the only coffee shop in town is very popular,

so she opens her own coffee shop.

Explanation:

The interest rate a company pays on loans depends in part on

A. its current ratio, debt-asset ratio, and operating profit as a percentage of global sales revenues.

B. its credit rating and the length of the term of the loan (1-year versus 5-year versus 10-year)--the longer the payback period, the higher the interest rate.

C. its debt-equity ratio and interest coverage ratio in the prior year.

D. whether its credit rating is above or below a B rating--all loans made to companies with a B or lower rating are made at prime plus 3.5%, while loans to companies with a credit rating of B+ or above are made at prime plus 1.5% [prime is defined as the "base" or "lowest" interest rate that creditors charge very low-risk customers who put up 200% or more collateral]

E. the extent to which its default risk ratio is above/below 3.0.

Answers

The interest rate a company pays on loans depends in part on credit rating and the length of the term of the loan the longer the payback period, the higher the interest rate.

Option B is correct.

What does the term "interest rate" mean?An interest rate tells you how much borrowing costs and how much saving pays off. As a result, if you're a borrower, the interest rate is the percentage of the total loan amount that you pay to borrow money.

What kinds of interest rates exist?The three main types of interest rates are as follows: the effective rate, the real interest rate, and the nominal interest rate. The stated rate at which interest payments are calculated is what is referred to as the nominal interest on an investment or loan.

Learn more about interest rate:

brainly.com/question/25816355

#SPJ1

angela, inc., holds a 90 percent interest in corby company. during 2020, corby sold inventory costing $123,500 to angela for $190,000. of this inventory, $45,800 worth was not sold to outsiders until 2021. during 2021, corby sold inventory costing $102,300 to angela for $186,000. a total of $57,000 of this inventory was not sold to outsiders until 2022. in 2021, angela reported separate net income of $182,000 while corby's net income was $103,500 after excess amortizations. what is the noncontrolling interest in the 2021 income of the subsidiary?

Answers

The first step in calculating the noncontrolling interest in the 2021 income of the subsidiary is to determine the total income of the subsidiary for the year. Since Angela holds a 90% interest in Corby, it means that the noncontrolling interest is 10%.

The total sales from Corby to Angela in 2021 were $186,000, and since $57,000 worth of inventory was not sold to outsiders until 2022, it means that $129,000 worth of inventory was sold to outsiders in 2021. Therefore, the cost of goods sold for 2021 is $102,300.

To calculate the net income of the subsidiary for 2021, we subtract the cost of goods sold from the total sales and then subtract any excess amortizations. This gives us $186,000 - $102,300 - $5,200 = $78,500.

Since Angela holds a 90% interest in Corby, it means that the noncontrolling interest is 10%, which is equal to $7,850 (10% of $78,500). Therefore, the noncontrolling interest in the 2021 income of the subsidiary is $7,850.

Learn more about noncontrolling interest

https://brainly.com/question/14186309

#SPJ4

Michael perez deposited a total of $2000 with two savings institutions. one pays interest at a rate of 6%/year, whereas the other pays interest at a rate of 7%/year. if michael earned a total of $136 in interest during a single year, how much did he deposit in each institution? (let x and y denote the amount of money, in dollars, invested at 6% and 7%, respectively.)

Answers

Answer:

He invested $400 in the account with interest at 6%, while investing $1600 in the account with interest at 7%.

Explanation:

Given that Michael Perez deposited $ 2000 in two different accounts that granted an interest of 6% and 7% per year respectively, and that at the end of the year he obtained $ 136 in interest, to determine how much money he invested in each account it is necessary to perform the following calculation:

2000 = 100

136 = X

((136 x 100) / 2000) = X

13600/2000 = X

6.8 = X

Thus, the benefits obtained were 6.8% per year. Thus, the annual 7% of the account with the highest interest rate must subtract a 0.2% yield, with which Michael Perez invested 2/10 parts of his money in the account with interest at 6% and 8/10 in the account with interest at 7%.

Thus, in the account with interest at 6% he invested $ 400, while in the account with interest at 7% he invested $ 1600.

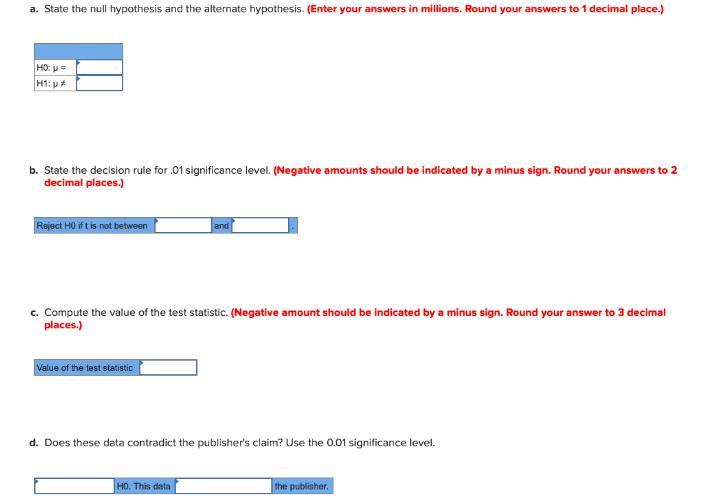

The publisher of Celebrity Living claims that the mean sales for personality magazines that feature people such as Megan Fox or Jennifer Lawrence are 1.5 million copies per week. A sample of 10 comparable titles shows a mean weekly sales last week of 1.3 million copies with a standard deviation of 0.9 million copies.

Answers

Answer and Explanation:

The computation is shown below:

For determining each part first we have to do the following calculations

Critical value of t = 3.250

Null hypothesis = 1.5

Alternative hypothesis ≠ 1.5

Population mean \(\mu\) = 1.5

Sample mean \(\bar X\)= 1.30

Sample size \(n\) = 10.00

Sample standard deviation \(s\) = 0.900

Standard error of mean is

\(s_x = \frac{s}{\sqrt{n} }\)

\(= \frac{0.900}{\sqrt{10.00}}\)

= 0.2846

Test static is

\(t = \frac{x - \mu}{s_x}\)

\(= \frac{1.30 - 1.5}{0.2846}\)

= -0.703

a. The null hypothesis is

μ = 1.5

Alternate Hypothesis is

μ ≠ 1.5

b. reject \(H_o\) if t is not between

-3.250 and 3.250

c. The value of the test statistic is

t = -0.703

(as we have computed above)

d. fail to reject \(H_o\) as this data does not contradict the publisher claim

Owners of coffee plantations in the country of Cantonica grow their own coffee beans and supply them to various stores and restaurants all over the country. There are many plantation owners supplying to a huge number of companies, and they are typically unable to differentiate their products from one another. They also do not have the power to fix their own prices in the industry. In addition, these suppliers can only achieve competitive parity and not a competitive advantage. Thus, the coffee bean industry in Cantonica best illustrates a(n) ________ structure.

Answers

Answer:

Perfectly competitive structure

Explanation:

Based on the information we can say that the coffee bean industry in Cantonica best illustrates a(n) PERFECTLY COMPETITIVE structure reason been that this type of competitive structure companies can easily produce their own products and as well supply this product to different stores which makes them to have many small firms .

Secondly PERFECTLY COMPETITIVE structure allow owners of plantation to easily supply their product to different companies which which makes it hard for people to easily differentiate these products from one another.

Thirdly in PERFECTLY COMPETITIVE structure the firm involve have little or no right to increase the price of the product.

Therefore the coffee bean industry in Cantonica best illustrates a(n) PERFECTLY COMPETITIVE structure .

The marginal principle breaks quantity decisions into iterative decisions that use the...

A. cost-benefit principle

B. opportunity cost principle

C. interdependence principle

D. sunk cost evaluation

Answers

The marginal principle divides decisions about quantity into iterative ones that make use of Cost-benefit analysis. This is frequently applied in business and aids organizations in making choices that are best for all of their stakeholders, including shareholders, clients, and staff.

The idea is that a decision or investment should only be made if the advantages it offers outweigh the disadvantages. Businesses weigh the expected benefits against the costs of each option, including direct costs and indirect costs, when making decisions.

This aids companies in making decisions that are consistent with their overall goals and objectives and maximizing the value of their resources.

To learn more about business, click here: -

https://brainly.com/question/14579037

#SPJ4

For standing bear company, sales revenue is $200,000, sales returns and allowances are $5,000, sales discounts are $3,000, and cost of goods sold is $120,000. Net sales is?.

Answers

The net sale is $72,000.

What do you mean by net sales?Net sales are the total money that a company makes from sales after deducting discounts, client refunds, and other expenses. One of the top line KPIs for product-based organizations, it is often measured across weekly, monthly, or annual accounting periods and appears on the income statement.

What's the difference between gross sales and net sales?While net sales include all costs incurred during the sales process, gross sales do not account for deductions. Net sales are a better indicator of how much money a company is making from sales.

The Gross Sales:

Sales revenue: $200,000

Cost of goods sold: $120,000

Total = $200,000 - $120,000

=$80,000

Expenses:

Sales allowances and discounts: $5,000

Sales discounts: $3,000

Total= $5,000 + $3,000

= $8,000

Therefore, net sales = Gross Sales – Returns – Allowances – Discounts

$80,000- $8,000

=$72,000

To know more about net sales visit:

https://brainly.com/question/24161087

#SPJ4

Tuity fruity beverage company's operating activities for the year are listed below. purchases $140 comma 500 operating expenses 80 comma 600 beginning inventory 12 comma 900 ending inventory 18 comma 300 sales revenue 300 comma 700 what is the gross profit for the year?

Answers

Answer:

$135,100

Explanation:

Given :

Cost of purchasing: $140,500

Operating expenses :$80,600

beginning inventory:$12,900

Ending inventory:$18,300

sales revenue :$300,700

Gross profit of the year can be determined by

Cost of purchasing + beginning inventory - Ending inventory

=140,500 + 12,900 -18,300

=$153,400-$18,300

=$135,100

Jake Olsen has decided to put $1,000 in the bank. List several questions Jake might want to ask before ch whether to put the money in a checking or a savings account.

Answers

Answer:

look at my comment

Explanation:

Tom is the CEO of a jewelry business based in Boston. He needs to send a parcel of 200 diamonds as quickly as possible to a partner in Canada. What mode of transport should he use?

A.

road

B.

sea

C.

air

D.

rail

E.

rail and road

Answers

How important is money

Answers

Answer:

very important

Explanation:

money is a global income source for everyone. we all have different types but it is all still money. now say one country got rid of money and had people pay for stuff using other things. if china did that lots of different countries wouldn't be able to get stuff from there unless they had so much of that product they could just give it up.

When advertisers want to reach the same audience more than once, they are concerned with ______.a. humorb. targetc. frequency

Answers

When advertisers want to reach the same audience more than once, they are concerned with frequency.

What is frequency?

Frequency refers to the number of times an ad is exposed to the same audience during a certain period. It is a key concept in advertising because it allows marketers to ensure that their message reaches their target audience, and it is frequently used in the context of media planning and buying to maximize the impact of advertising campaigns.

How does frequency help advertisers?

Frequency helps advertisers by increasing the chances that their message will be noticed, remembered, and acted upon. By exposing their target audience to their message more than once, advertisers can reinforce their brand, build trust, and create a lasting impression that will drive sales and boost brand loyalty.

How to calculate frequency?

Frequency can be calculated by dividing the total number of impressions by the total number of people in the target audience. For example, if a campaign generated 10,000 impressions and reached 5,000 people, the frequency would be 2. This means that the average person in the target audience saw the ad twice during the campaign.

What are the benefits of frequency?

There are many benefits to using frequency in advertising campaigns. For one, it helps to reinforce the message and create a lasting impression. It also helps to build trust and credibility with the target audience, as well as increase brand loyalty. Additionally, it can help to drive sales and generate more revenue for the business. All of these factors contribute to the overall success of an advertising campaign, and make frequency an essential component of any marketing strategy.

For more questions on frequency

https://brainly.com/question/16148316

#SPJ11

The price of a ranchette estate is $260,000. The bank requires a 15% down payment and 3 points at the time of closing. The cost of the ranchette is financed with a 30-year fixed-rate mortgage at 7.45%. What is the mortgage amount? *

Answers

Answer:

Missing word "and the cost of one point at the time of closing"

Down payment = $260,000*15%

Down payment = $260,000*0.15

Down payment = $39,000

Amount of mortgage = $260,000 - $39,000

Amount of mortgage = $221,000

Cost of 3 point at the time of closing = 3% of amount of mortgage

Cost of 3 point at the time of closing = 3% * $221,000

Cost of 3 point at the time of closing = $6,630

A stock has a required return of 11%, the risk-free rate is 7,5%, and the market risk premium is 2%. a. What is the stock's beta? Round your answer to two decimal places. b. If the market risk premium increased to 476 , what would happen to the stock's required rate of return? Assume that the risk-free rate and the beta remain unchanged. Do not round intermediate calculations. Round your answer to two decimal places. 1. If the stock's beta is equal to 1.0, then the change in required rate of return will be greater than the change in the market risk premium. I1. If the stock's beta is equal to 1.0, then the change in required rate of return will be less than the change in the market risk premium. 111. If the stock's beta is greater than 1,0 , then the change in required rate of return will be greater than the change in the market riak premium. IV. If the stock's beto is less than 1,0 , then the change in required rate of return will be greater than the change in the market risk premium. V. If the stock's beta is greater than 1.0, then the change in required rate of return will be less than the change in the market risk premium. stock's required rate of return will be

Answers

a. Required return=risk free rate+Beta*market risk premium 11=7.5+(Beta*2) Beta=(11-7.5)/2 =1.75 b.

Regulators require a bank to hold some of its assets as reserves mainly to address:

a. liquidity risk.

b. trading risk.

c. credit risk.

d. operational risk.

Answers

Liquidity risk: Regulators require a bank to hold some of its assets as reserves in order to ensure that the bank has sufficient liquid assets to meet its financial obligations if a large number of customers come demanding their money at once. This helps to mitigate the risk of the bank running out of funds and not being able to meet its obligations.

What is financial?Financial management is the process of managing money and other financial resources in order to achieve personal and organizational goals. It can involve budgeting, accounting, investing, forecasting, and protecting assets. Financial management includes making decisions related to the acquisition, investment, and distribution of resources in order to maximize their potential return.

Therefore the correct answer is A.

To learn more about financial

https://brainly.com/question/989344

#SPJ1

you buy a vacant lot in 2024 for $2,400,000. the market gets weaker exactly three years later you sell it for $1,750,000. what is your annual return? g

Answers

The annual return on this investment for the compnay was -9.02%.

What is annual return?Annual return refers to the percentage increase or decrease in an investment’s value over the course of one year. It is a measure of the investment's performance and is usually expressed as a percentage. The annual return is calculated by dividing the total return of an investment over a period of one year by its initial cost or value. The total return takes into account any appreciation of the investment, as well as any income generated from dividends, interest or rental payments. Annual return is an important factor in determining the overall performance of an investment and is commonly used by investors and fund managers to compare the performance of different investments. It is also used to evaluate the success of a long-term investment strategy, as well as to help make decisions about future investments.

The total return on the investment = $1,750,000 (selling price) - $2,400,000 (purchase price) = -$650,000

Next, let's divide total return by number of years, investment was held:

$650,000 ÷ 3 years = -$216,666.67

Annual return by original investment= $216,666.67 ÷ $2,400,000 = -0.0902 or -9.02%

So, annual return on this investment was -9.02%.

To learn more about annual return, visit:

https://brainly.com/question/26409783

#SPJ4