asgard farms, inc., has a number of divisions that produce jams and jellies, condiments and glassware. the glassware division manufactures a variety of bottles that can be sold externally (to soft-drink and juice bottlers) or internally to asgard farm's jams division. sales and cost data on a case of 24 basic 12-ounce bottles are as follows:

Answers

The price at which a company's subsidiaries sell to one another is known as a transfer price. When compiling the financial results of particular subsidiaries, transfer prices are essential.

1. Glassware Division would be willing to accept a minimum transfer price of $ 1.17 per unit.

The spare capacity for the Glassware Division is (530,000 units – 400,000 units) 130,000 units. As a result, the department's variable cost of production is the minimum transfer price when there is spare capacity.

Variable cost on external sales = $ 1.30 per unit

Less: Savings in selling costs = $ 0.13 per unit

Variable cost on Internal Sales = $ 1.17 per unit

The maximum transfer price that Jams and Jellies Division is willing to pay: $2.90 per unit.

The purchase price from the external seller would be the maximum price that Jams and Jellies Division would be willing to pay.

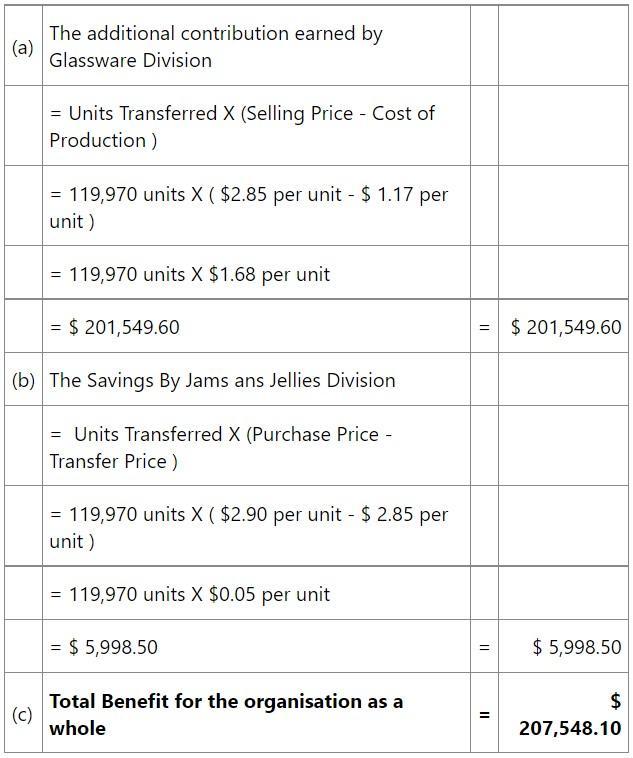

Yes. An internal Transfer should take place at the price of $2.85 per unit as it is profitable to both the departments and the business as a whole.

The Benefit to the business as a whole will be $ 207,548.10. The calculations for the same are attached in the form of an image.

2. No. If Paul knows that Glassware division has an idle capacity, he would not accept the transfer price of $2.85 per unit. The minimum transfer price when there is spare capacity, is the variable cost of production in the department.

Yes. If I am Bella, the offer of $2.40 per unit would be accepted as the department could still earn contribution.

Transfer Price = $ 2.40 per unit

Variable cost on Internal Sales = $ 1.17 per unit

Contribution per units on internal transfer = $ 1.23 per unit

3. Variable cost on Internal Sales = $ 1.17 per unit

Add: Fixed allocated costs per unit = $ 0.75 per unit

Transfer Price = $ 1.92 per unit

Yes. The transfer would still take palace as the transfer price be above the minimum acceptable transfer price by Glassware Division ($1.17 per unit) and lower than the maximum transfer price by Jams and Jellies Division ($2.90 per unit).

Learn more about Transfer Price here: https://brainly.com/question/26932515

#SPJ4

Disclaimer: Your question is incomplete. Please write the complete question by looking over the internet.

Related Questions

When ethical breache occur in the workplace or organization, what are the effect on the company, the employee, and ociety? What afe guard hould be put in place to deal with thee ituation? The current SSL cae ( RE: Jamaica Re: Uain Bolt) can be ued a a reference point along with any other notable cae (pat or preent) in Guyana/ Caribbean in your anwer. Your anwer mut alo point to the relevant legilation covering the iue identified

Answers

When ethical breaches occur in the workplace or organization, they can have significant effects on the company, employees, and society as a whole. Some common effects include:

What is ethical breaches?Company Reputation: Ethical breaches can harm the reputation of a company, leading to a loss of customer trust and reduced profitability.Employee Morale: Ethical breaches can lead to a negative impact on employee morale, as employees may feel that the company does not value their well-being or integrity.Legal Liability: Ethical breaches can also result in legal liability for the company and individuals involved. Companies can face lawsuits and fines, while employees can face criminal charges and loss of employment.In order to deal with ethical breaches, it is important to put safeguards in place to prevent them from happening in the first place. Some recommended safeguards include:Establishing an Ethical Code of Conduct: Companies should have a clear and concise code of conduct that outlines ethical expectations for employees.Providing Ethics Training: Employees should be provided with regular ethics training to ensure they are aware of the company's ethical standards and their obligations under the law.Implementing a Reporting System: Companies should have a reporting system in place for employees to report any ethical breaches they witness, without fear of retaliation.Conducting Regular Audits: Companies should regularly audit their operations to identify any potential ethical breaches and take corrective action where necessary.In Guyana and the Caribbean, the relevant legislation covering ethical breaches may vary, but generally, companies are subject to laws and regulations that prohibit unethical practices and require them to operate in a responsible and transparent manner.For example, in the recent SSL case in Jamaica regarding Usain Bolt, it was revealed that the company engaged in unethical practices such as falsifying records and misusing customer information. This case highlights the need for companies to uphold ethical standards and the consequences that can result from ethical breaches.To learn more about ethical breaches refer:

brainly.com/question/30182429

#SPJ4

How much will you accumulate in an account where you deposit $1,100 a year at the beginning of the next 3 years if you can earn 5% annually?.

Answers

It will accumulate in an account where the deposit is $1,100 a year at the beginning of the next 3 years if you can earn 5% annually is $3,346.90.

An account with an APR of 8% compounded quarterly has an annual interest rate EAR of 8.243%. A regular annuity is an annuity with cash flows or payments at the end of the period. Interest added to the original investment earns itself interest for subsequent periods.

calculation.

principal amount = $ 1,100

rate of interest = 5% annually

time = 3 years

SI = (P × R× T)/100

putting all the value

Amount will be = $ 3,346.90.

A $500,000 annuity pays $1916 per month in interest. A $500,000 annuity would pay $23,491 annually if you allowed the annuity interest to be accumulated and withdrawn annually. Here you can compare today's highest fixed annuity rates. you calculate future value. You can use this formula to calculate the future value with compound interest.

Learn more about An account here:-https://brainly.com/question/2712644

#SPJ4

If you can earn $3,346.90 at 5% per year, you will accumulate $1,100 per year in your deposit account at the beginning of the next three years.

An account compounded quarterly with an APR of 8% has an annual EAR of 8.243%. A term annuity is an annuity with cash flows or payments at the end of the term. Interest added to the original investment earns itself interest for subsequent periods.

A $500,000 annuity pays $1916 per month in interest. A $500,000 annuity would pay $23,491 annually if you allowed the annuity interest to be accumulated and withdrawn each year. Here you can compare today's highest fixed annuity rates. They calculate future values. You can use this formula to calculate the future value with compound interest.$3,641.14

annual return

learn more about annual returns here:-https://brainly.com/question/17149546

#SPJ4

worker on worker workplace violence accounts for about 7 percent of cases, yet they receive the most press coverage. why is that?

Answers

It often makes news headlines because it happens so infrequently. Most acts of violence among workers involve injuries and beyond, and the media likes to cover that sort of thing.

Who commits the most violence in the workplace?Customers or clients are responsible for most incidents of workplace violence - about 40%. This group includes a wide range of people, including current and former customers, patients, customers, passengers, criminal suspects, inmates, and inmates. Their violent motives also vary widely.

What are the most common causes of workplace violence?Studies have identified factors that may increase the risk of violence for some workers in certain workplaces. These factors include exchanging money with the masses and working with fickle and insecure people. Working alone or in remote locations can also foster the potential for violence. Companies that do not conduct thorough background checks on potential employees are prone to violence or risk hiring someone with a history of violence.

Learn more about workplace violence :

brainly.com/question/21585647

#SPJ4

what are the advantages of interdependence in economics

Answers

Answer:

This affiliation allows specialist industries to thrive. And, the success can lead to job and wage/salary increases and an overall improvement to wealth and lifestyle

Which of the following describes the two different types of interest rates offered on home mortgages?

A: Fixed and variable

B: Timed and untimed

C: High and low

D: Year or decade

Answers

The two different types of interest rates offered on home mortgages is A) Fixed and variable.

A loan is a financing settlement between a lender and a borrower, where the latter borrows a positive amount of money and repays it over a period of time. A mortgage, or home mortgage, is a sort of mortgage used to shop for real estate, and secured with the aid of the purchased land or house.

Even along with the association charges, a loan continues to be probable to be less expensive than getting rid of a non-public loan. However, to be virtually certain of which would come up with the higher deal you want to evaluate the total value of borrowing - consisting of association charges for the mortgages - of the two styles of a mortgage.

A mortgage is an agreement between you and a lender that gives the lender the proper to take your private home if you fail to pay off the money you've borrowed plus interest. Loan loans are used to shop for a domestic or to borrow money towards the cost of a home you already personal.

Learn more about mortgages here https://brainly.com/question/1578286

#SPJ1

Determine the correct sequence of the following events from start to finish.

-The kitchen staff prepares the dishes.

-Fatima, the expediter,checks the order before the server picks them up.

-Lara then transmits the order to the kitchen

-Lara takes the order from the customer and notes down.

-Brian, the chef, estimates the time each dish will require for preparation

-Lara retrieves the order and delivers it to her customer

Answers

The correct sequence of the events from start to finish is:

-Lara takes the order from the customer and notes down.Lara then transmits the order to the kitchenBrian, the chef, estimates the time each dish will require for preparationThe kitchen staff prepares the dishes.Fatima, the expediter,checks the order before the server picks them up.Lara retrieves the order and delivers it to her customerWhat is the sequence of ordering food in a restaurant?The first thing that happens is that the waiter picks up the order from the customer and takes note of it. The order will then go to the kitchen where the chef will estimate how long the order will take to be prepared.

The expediter will then check the order when the meal is done but before the waiter picks it up. The waiter than delivers to the order.

Find out more on sequence of events at https://brainly.com/question/24613604

#SPJ1

The Everly Equipment Company's flange-lipping machine was purchased 5 years ago for $75,000. It had an expected life of 10 years when it was bought and its remaining depreciation is $7,500 per year for each year of its remaining life. As older flange-lippers are robust and useful machines, this one can be sold for $20,000 at the end of its useful life.

A new high-efficiency digital-controlled flange-lipper can be purchased for $110,000, including installation costs. During its 5-year life, it will reduce cash operating expenses by $40,000 per year, although it will not affect sales. At the end of its useful life, the high-efficiency machine is estimated to be worthless. MACRS depreciation will be used, and the machine will be depreciated over its 3-year class life rather than its 5-year economic life, so the applicable depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%.

The old machine can be sold today for $45,000. The firm's tax rate is 35%, and the appropriate cost of capital is 16%.

If the new flange-lipper is purchased, what is the amount of the initial cash flow at Year 0? Round your answer to the nearest dollar. Cash outflow, if any, should be indicated by a minus sign.

$

What are the incremental net cash flows that will occur at the end of Years 1 through 5? Do not round intermediate calculations. Round your answers to the nearest dollar. Cash outflows, if any, should be indicated by a minus sign.

CF1 $

CF2 $

CF3 $

CF4 $

CF5 $

What is the NPV of this project? Do not round intermediate calculations. Round your answer to the nearest whole dollar. Negative value, if any, should be indicated by a minus sign.

$

Should Everly replace the flange-lipper?

-Select-YesNo

Answers

Incremental net cash flows refer to the change in a company's cash flows that result from a specific business decision or project.

a. The initial cash flow at Year 0 is calculated as follows:

Old machine salvage value = $45,000

Tax savings from depreciation of new machine = Depreciation x Tax rate

= ($110,000 x 0.3333) x 0.35

= $12,223.25

Initial cash flow = Cost of new machine - Salvage value of old machine + Tax savings from depreciation of new machine

= -$110,000 - $45,000 + $12,223.25

= -$142,776.75

Therefore, the initial cash flow at Year 0 is -$142,776.

b. The incremental net cash flows for Years 1 through 5 are calculated as follows:

Year 1: Savings in operating expenses = $40,000

Tax savings from depreciation = ($110,000 x 0.4445) x 0.35 = $17,325.13

Net cash flow = $40,000 + $17,325.13 = $57,325.13

Year 2: Savings in operating expenses = $40,000

Tax savings from depreciation = ($110,000 x 0.4445) x 0.35 = $17,325.13

Net cash flow = $40,000 + $17,325.13 = $57,325.13

Year 3: Savings in operating expenses = $40,000

Tax savings from depreciation = ($110,000 x 0.1481) x 0.35 = $5,803.68

Net cash flow = $40,000 + $5,803.68 = $45,803.68

Year 4: Savings in operating expenses = $40,000

Tax savings from depreciation = ($110,000 x 0.1481) x 0.35 = $5,803.68

Net cash flow = $40,000 + $5,803.68 = $45,803.68

Year 5: Savings in operating expenses = $40,000

Tax savings from depreciation = ($110,000 x 0.0741) x 0.35 = $2,901.95

Salvage value of new machine = $0

Net cash flow = $40,000 + $2,901.95 - $110,000 = -$67,098.05

c. The NPV of the project is calculated as the sum of the present value of the net cash flows. Using a discount rate of 16%, the NPV can be calculated as:

NPV = -$142,776 + ($57,325.13 / (1 + 0.16)^1) + ($57,325.13 / (1 + 0.16)^2) + ($45,803.68 / (1 + 0.16)^3) + ($45,803.68 / (1 + 0.16)^4) + (-$67,098.05 / (1 + 0.16)^5)

= -$142,776 + $49,547.35 + $42,740.34 + $30,294.43 + $26,143.12 - $31,505.43

= -$26,556.19

d. Since the NPV is negative, Everly should not replace the flange-lipper.

To know more about net present value (NPV) visit:

https://brainly.com/question/30404848

#SPJ11

Which one of the four factors of copyright is MOST important?

Answers

Answer:

the purpose and character of the use i think

Explanation:

Discuss whether or not consu,er benefit more from a market economic system or mixed economic system

Answers

Answer:

It just depends on which characteristics the mixed economy emphasizes. For example, if the market has too much freedom, it can leave the less competitive members of society without any government support. Central planning of government industries also creates problems.

Explain network topologies with 4 examples state where each might be used. Use diagrams to illustrate your answers

Answers

Network topologies refer to the physical or logical arrangement of network devices and connections. Four examples of network topologies are bus, star, ring, and mesh. Each topology has different characteristics and applications.

Bus Topology: In a bus topology, all devices are connected to a single cable. It is a simple and cost-effective topology suitable for small networks. It is commonly used in small office or home networks. However, if the main cable fails, the entire network can be affected.

Star Topology: In a star topology, each device is connected to a central hub or switch. It provides better performance and reliability compared to bus topology as the failure of one device does not affect others. It is commonly used in larger networks such as offices and schools.

Ring Topology: In a ring topology, devices are connected in a closed loop, where each device is connected to the next and the last device is connected back to the first. It provides equal access to the network resources and is suitable for networks with a small number of devices. It is commonly used in local area networks (LANs).

Mesh Topology: In a mesh topology, each device is connected to every other device in the network, creating multiple redundant paths. It offers high reliability and fault tolerance, as if one connection fails, traffic can be rerouted through alternate paths. It is commonly used in critical systems such as banking networks or data centers.

Each network topology has its advantages and disadvantages, and the choice depends on factors such as network size, scalability, reliability requirements, and budget.

Learn more about Network topologies here:

https://brainly.com/question/17036446

#SPJ11

Delara is opening a credit card because her budget is really tight right now and she’s struggling to pay all of her expenses based on her income.

Why might a card with a long grace period be in her best interest?

Answers

Answer:

Delara might benefit from a credit card with a long grace period because it would give her more time to pay off her expenses without accruing interest charges. A grace period is the amount of time between the end of a billing cycle and the due date for payment, during which no interest is charged on the balance. A longer grace period means more time for Delara to pay off her expenses without incurring additional interest charges, which could help her avoid falling further into debt. Additionally, if she needs to make a large purchase that she cannot afford to pay off immediately, a credit card with a long grace period would give her more time to pay off the balance without being charged interest. However, it's important for Delara to also consider other factors when choosing a credit card, such as the interest rate, annual fees, and rewards programs, to ensure she selects the best card for her financial situation.

Explanation:

Which of the following statements can correctly be made about illness?

Answers

there is no option can you tell option so I can help

If the economy is in an inflationary gap, Keynesian economists are likely to propose which variety of fiscal policy?a. the contractionary varietyb. the expansionary varietyc. the automatic varietyd. none of the above

Answers

If the economy is in an inflationary gap, Keynesian economists are likely to propose the contractionary variety of fiscal policy.

The correct answer is option a. the contractionary variety.

In an inflationary gap, the economy is producing more goods and services than it can sustain in the long run, leading to high levels of inflation. To reduce the level of economic activity and bring the economy back to its long-run potential, Keynesian economists would recommend contractionary fiscal policy. This includes measures such as reducing government spending, increasing taxes, or both. By reducing the amount of money in the economy, these policies can help reduce inflation and bring the economy back to a more sustainable level of output.

Read more about it: https://brainly.com/question/29803608

#SPJ11

_____ allows industries, organizations, and companies to approach business decisions from different perspectives. Arbitration Ergonomics Tolerance Workforce diversity

Answers

Answer:

Workforce diversity

Explanation:

Workforce diversity refers to similarities and differences between employers and employees in terms of their race, religion, gender, perspectives and opinions.

Diversity is important for every industry, organization, and company since people have different perspective and views, they approach business problems differently, leading to different solutions. Diversity leads to increase profits, creativity, wide range of skills e.t.c.

At the end of the fiscal period, Burton Company omitted the adjusting entry for depreciation

on equipment. The effect of this error on the financial statements is to

a. understate liabilities.

b. understate owner's equity.

c. overstate expenses.

d. overstate assets

Answers

The impact of the given error on the financial statement should be an overstatement of the assets.

Since the adjusting entry for depreciation is omitted i.e.Depreciation expense Dr XXXXX

To accumulate depreciation XXXXXX

(being depreciation expense is recorded)

Here depreciation expense is debited as it increased the assets and credited the accumulated depreciation as it decreased the assets.

So if the above journal entry is omitted so it means the assets should be overstated.

Learn more about the depreciation here: brainly.com/question/15085226

Your annual income is $104,000. You have a spouse, two kids, a dog and a mortgage – a typical family. Using the easy method to determine your need for life insurance, your insurance should be in the amount of:

Answers

Your life insurance should be in the amount of: $1,040,000 to provide sufficient financial protection for your family.

Determine the amount of life insurance you should have based on the easy method. To calculate the recommended amount of life insurance using the easy method, follow these steps:

1. Calculate your annual income: Your annual income is $104,000.

2. Multiply your annual income by 10: $104,000 x 10 = $1,040,000.

The easy method suggests that, for a typical family with a spouse, two kids, a dog, and a mortgage, the recommended life insurance coverage should be 10 times your annual income. In your case, your life insurance should be in the amount of $1,040,000 to provide sufficient financial protection for your family.

Keep in mind that this method is a simplified approach and individual circumstances may vary. It's always a good idea to consult with a financial advisor to determine the best life insurance coverage for your specific needs.

To know more about insurance, refer here:

https://brainly.com/question/16267577#

#SPJ11

Last year, a company's gross income was $119,000, expenses (not including depreciation) were $25,000, and the depreciation allowance was $5,000. If federal income taxes are 21%, state income taxes are 6\%, and local income taxes are 1\%, what is the After Tax Cash Flow (ATCF) for that year? $89,000 $69,080 $64,080 $67,680 None of the above

Answers

The After Tax Cash Flow (ATCF) for the company is $64,080.

The company's taxable income is calculated as follows:

Taxable income = Gross income - expenses - depreciation

= $119,000 - $25,000 - $5,000

= $99,000

The company's federal income tax is calculated as follows:

Federal income tax = Taxable income * federal income tax rate

= $99,000 * 21%

= $20,890

The company's state income tax is calculated as follows:

State income tax = Taxable income * state income tax rate

= $99,000 * 6%

= $5,940

The company's local income tax is calculated as follows:

Local income tax = Taxable income * local income tax rate

= $99,000 * 1%

= $990

The company's total income tax is calculated as follows:

Total income tax = Federal income tax + State income tax + Local income tax

= $20,890 + $5,940 + $990

= $32,820

The company's After Tax Cash Flow (ATCF) is calculated as follows:

ATCF = Taxable income - Total income tax

= $99,000 - $32,820

= $64,080

To learn more about gross income, here

https://brainly.com/question/547727

#SPJ4

g xyz corp expects to earn $4.0 per share next year and plow back 37.5% of its earnings (i.e., it expects to pay out a dividend of $2.5 per share, representing 62.5% of its earnings). the dividends are expected to grow at a constant sustainable growth rate and the stocks are currently priced at $30 per share. how much of the stock's $30 price is reflected in present value of growth opportunities (pvgo) if the investors' required rate of return is 20%?

Answers

The present value of growth opportunities (PVGO) for g xyz corp's stock is $10.

To calculate the PVGO, we first need to find the stock's dividend discount model (DDM) value. Here's a step-by-step explanation:

1. Calculate the dividend in the next year (D1): Since the company expects to pay a dividend of $2.5 per share, D1 = $2.5.

2. Determine the required rate of return (r): The investors' required rate of return is given as 20% (0.2).

3. Calculate the sustainable growth rate (g): The company plows back 37.5% of its earnings. The payout ratio is 62.5% (1 - 37.5%). With earnings per share (EPS) of $4.0, the growth rate (g) = EPS × retention ratio = $4 × 37.5% = $1.5.

4. Find the DDM value (P0): Using the Gordon Growth Model, P0 = D1 / (r - g) = $2.5 / (0.2 - 0.0375) = $2.5 / 0.1625 = $15.385.

5. Calculate the PVGO: Subtract the DDM value from the stock's current price: PVGO = $30 - $15.385 ≈ $10.

Thus, $10 of the stock's $30 price is reflected in the present value of growth opportunities.

Learn more about growth here:

https://brainly.com/question/29455664

#SPJ11

if you we're running a company, describe at least two things you would do to improve its productivity

Answers

Answer:

I would provide training in order to boost the product quality and make the workers more advanced and productive. I would also give more paid time off so that the workers have a chance to recharge and come back to work refreshed.

Explanation:

Membership in the Future Business Leaders of America (FBLA) has nearly limitless benefits, including scholarships.

True

False

Answers

Answer:

True.

Explanation:

I think this will be the answer.

A stock has a correlation with the market of 0.56. The standard deviation of the market is 29%, and the standard deviation of the stock is 37%. What is the stock's beta?

1.40

0.71

0.44

0.29

Answers

To calculate the stock's beta, we can use the formula:

Beta = Correlation * (Stock's Standard Deviation / Market's Standard Deviation)

Given:

Correlation with the market = 0.56

Stock's Standard Deviation = 37%

Market's Standard Deviation = 29%

Substituting the values into the formula:

Beta = 0.56 * (0.37 / 0.29)

Beta ≈ 0.7138 (rounded to two decimal places)

Therefore, the stock's beta is approximately 0.71.

To know more about beta, visit:

https://brainly.com/question/12962467

#SPJ11

mary torres owns and operates a bakery. during the past week, she sold 500 loaves of bread at $2.25 per loaf. the raw materials for each loaf coast mrs. torres $1.80

what type of business does ms. torres operate?

what was the profit on bread sales for the week?

Answers

Answer:

b

Explanation:

Mary Torres runs a bakery business and her profit was 225 dollars for the past week.

What is business profit?Any kind of benefit produced when the gain produced by a business is more than the money spent on the business is called a business profit. Any profit that is earned from the business can be used by the business owners for themselves, to spend on the employees or to spend on the business.

In this case, the business run by Mary Torres is a bakery business where she bakes bread and sells them.

Over the past week, she has sold 500 loaves of bread.

The raw material for the 500 loaves of bread is priced at 1.80 dollars per loaf.

She sold each loaf of bread for 2.25 dollars.

Therefore, the total cost of raw materials for 500 loaves of bread is,

1.80 × 500 = 900 dollars.

Total money earned,

2.25 × 500 = 1125 dollars

So her profit was,

1125 - 900 = 225 dollars.

Therefore, Mary Torres has a bakery business where she made a profit of 225 dollars over the past week.

Read more about profits, here

https://brainly.com/question/15573174

#SPJ2

Based on the information given, do you think Teasha made the right economic choice in opening her own business? Explain?

Answers

yes because he can't be poor he/she must gets a profit everyday to cover the bills that is needed to be payed

1 point

10. In reviewing your account statement, you see a Balance Transfer Fee.

Based on the information you see in the statement, what would be the fee

if you transferred $3,000 from another credit card? *

Answers

Answer:

Find attached statement and the question which question number 10.

The correct option is C,$90

Explanation:

In the statement you would notice that the balance transfer from another credit card was $785,upon which balance transfer levy of $23.55 was charged(Section 7)

Intuitively, the percentage of balance transfer charge is $23.55 divided by the amount of balance transfer i.e $785

balance transfer charge(%)=$23.55/$785=3%

However, if the balance transfer were $3000,the charge is 3% of $3000 i.e $90 ($3000*3%).

The correct option then is C,$90

What is the world's largest free trade area?

Answers

Answer: free market

Explanation:

The free market is where all the stocks are shared, The answer is free market!

Answer:

The world's largest free trade area, encompassing 54 countries and 1.2 billion people, the African Continental Free Trade Area will bring the promise of trade-led economic growth closer to reality for Africa's entrepreneurs, industrialists, investors, innovators and service suppliers.

sorry if it wrong

Which is the most important decision factor in transportation?

A.capacity

B. Cost

C.capability

D.reliability

Answers

a bank promises to pay 5.5% pa compound interest on deposits of £2337 if saved for 3 years. how much will the savings be worth at the end of the period mentioned? write your answer correct to 2 decimal places.

Answers

Answer:

£2,744.20

Explanation:

savings amounts after 3 years can be calculated using the formula below.

A = P x ( 1 + r) ^ n

Where A is the amount after three years

P = principal amounts: £2337

r: interest rate: 5.5% or 0.055

n is the number of periods: 3 years

A =£2337 x( 1 + 0.055)^3

A =£2337 x(1.055) ^3

A=£2337 x 1.174241

£2,744.20

Amount after 3 years will be £2744.20

Question 11 Interest Payable Type of Account Appears on Which Financial Statement Normal Balance Is the Account Closed? A. Liability Balance Sheet Debit No B. Liability Balance Sheet Debit Yes C. Liability Balance Sheet Credit No D. Liability Balance Sheet Credit Yes

Answers

Interest Payable type of account appears on Liability Balance Sheet. The normal balance is credit and the account is closed. The correct option is (C) Liability Balance Sheet Credit No.

Interest payable is the money that a company owes in the form of interest on any outstanding loans. Interest payable arises out of a company's debt, such as bonds, loans, and other forms of debt. It's a liability account that shows how much interest is owed but hasn't yet been paid.

The Interest Payable type of account is classified as a liability account on the balance sheet. This account represents an amount of money owed to an external party. The interest payable account is frequently used in businesses that have borrowed funds and must pay periodic interest payments.

The balance sheet is one of the company's financial statements, showing its financial position at a given point in time. The balance sheet is a summary of all the company's assets, liabilities, and equity at a certain point in time.

To learn more about "Interest Payable" visit: https://brainly.com/question/16134508

#SPJ11

urgent

Purpose: Assessment 1 is a report critically analysing a nominated website. Students must identify all the good interface design principles used in the website design. The report should point out the

Answers

The key interface design principles employed in the nominated website, highlighting their effectiveness and contribution to the overall user experience.

In addition, the report should also identify any potential areas for improvement or design flaws that may hinder the user experience. Finally, the report should conclude with recommendations for enhancing the website's interface design based on the identified strengths and weaknesses.

>Title: Critical Analysis of [Nominated Website] Interface Design

>Introduction

>Briefly introduce the nominated website and its purpose.

>Provide an overview of the importance of interface design in creating a positive user experience.

>Outline the objectives and structure of the report.

>Evaluation Methodology

>.Explain the criteria and framework used for evaluating interface design principles.

>Describe the process of analyzing the nominated website.

Interface Design Principles

>Identify and discuss the interface design principles effectively utilized in the website design.

a. Consistency and Visual Hierarchy

b. Simplicity and Minimalism

c. Responsiveness and Mobile Optimization

d. Intuitive Navigation

e. Clear Call-to-Action Elements

f. Effective Use of Color, Typography, and Imagery

g. Accessibility and Inclusivity

h. Feedback and Error Prevention

i. Loading Time Optimization

Learn more about website here : brainly.com/question/32113821

#SPJ11

According to Tesla's 10-K, how many Model S cars did the company deliver in 2013?

35,164

22,477

23,477

23,000

Answers

According to Tesla's 10-K, the company delivered 22,477 Model S cars in 2013. This information can be found on page 47 of the 2013 Tesla 10-K filing. It is important to note that this is just one year's delivery numbers and Tesla's sales have grown significantly since then.

Model S is a line of electric cars produced by Tesla, Inc. As of my knowledge cutoff in September 2021, the Model S is one of the flagship models of Tesla and has gained significant popularity in the electric vehicle market.

So, according to Tesla's 10-K, the company delivered 22,477 Model S cars in 2013.

To know more about Model S cars, refer

https://brainly.com/question/29852970

#SPJ11